'The correction could take two to three months and traders need to be careful.'

'For investors, this could be a good time to nibble in.'

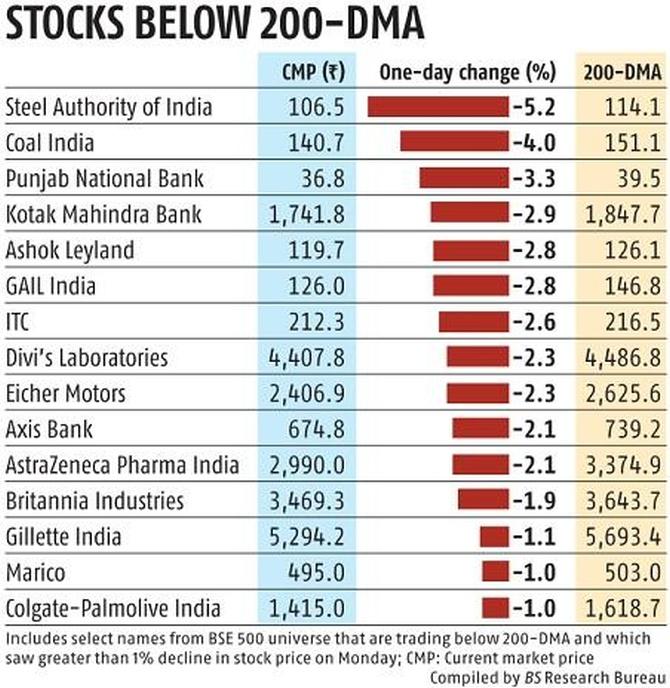

A majority of stocks from the BSE 500 universe are now quoting below their 200-day moving average (DMA).

As of Monday, 257 stocks were trading below their 200-DMA -- a significant negative indicator.

The general rule is if a stock is trading below its 200-DMA, the trend is largely downward, although there could be a short-term upward movement.

A number of consumer, pharmaceutical, and banking stocks are trading below their 200-DMA.

Some of the prominent stocks include Hindustan Unilever, Dr Reddy's Laboratories, Lupin, Colgate, Marico, Britannia Industries, Axis Bank, Eicher Motors, Kotak Mahindra Bank, ICICI Prudential Life Insurance, HDFC Bank, Mahindra & Mahindra, Coal India, Steel Authority of India, and Bharat Petroleum Corporation.

"Almost 50 per cent of the stocks below their 200-DMA implies there is an inherent weakness in the market and it will take time for the market to recover," says A K Prabhakar, head-research, IDBI Capital.

"The correction could take two to three months and traders need to be careful. For investors, this could be a good time to nibble in," Prabhakar cautions.

Markets have corrected by around 10 per cent from their peak, driven by consistent selling by foreign portfolio investors, tightening monetary policy by central banks globally, and concern over economic recovery due to rising Omicron cases.

"The overall market breadth remains negative and will require strong positive triggers for changing the current negative trend. Selling pressure is intact at higher levels and any recovery or bounce is being used by traders to go short on the market. Thus, we maintain our cautious view in the market for next few days,", says Siddhartha Khemka, head-retail research, Motilal Oswal Financial Services.

On Monday, the benchmark indices closed lower by more than 2 per cent.

Broader markets witnessed sharper selling pressure, with Nifty Midcap and Smallcap down around 4 per cent each.

All the sectoral indices ended in red with Media, PSU Bank, and Realty being the top losers -- down more than 4 per cent each.

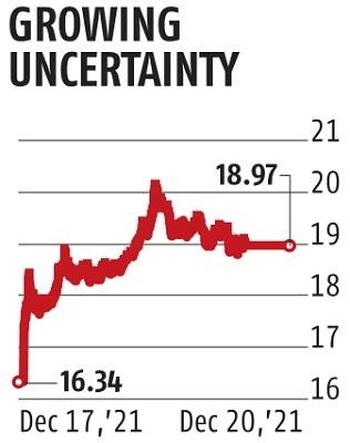

Volatility index, India VIX, climbed 16 per cent to 19 levels on Monday. The number of advances is at the lowest since April 12.

Nifty has a good support from the 15,860-16,245 band, where it may find durable support, while 16,896-16,966 could serve as a resistance on the upside, said analysts.

"A long bear candle was formed on the daily chart with gap down opening and with lower shadow. Technically, this pattern indicates a display of sharp downside momentum in the market with minor upside recovery," says Nagaraj Shetti, technical research analyst, HDFC Securities.

"Nifty has broken below the crucial support of 16,700 levels, according to the weekly time-frame chart. This is a negative indication and one may expect more weakness in the near term," adds Shetti.

He, however, believes there is a possibility of a pull-back from the lower levels and that could lead to a 'sell-on-rise' opportunity.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025