| « Back to article | Print this article |

Indian cos' valuations too high: Havells

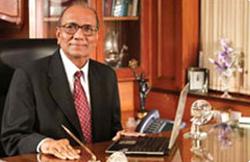

Havells India recently commissioned India's largest lighting fixtures factory, part of a larger growth strategy of the company. Having built a Rs 6,500-crore (Rs 65 billion) business empire from the scratch single-handedly, Qimat Rai Gupta, founder-chairman of Havells India, is a case study in entrepreneurial economics.

Having built a Rs 6,500-crore (Rs 65 billion) business empire from the scratch single-handedly, Qimat Rai Gupta, founder-chairman of Havells India, is a case study in entrepreneurial economics.

In 1958, Gupta began as an electrical goods trader in Delhi, with practically no capital. Today, his company is India's largest electrical products manufacturer, with facilities across India, Europe, Latin America and Africa.

In an interview with Sudheer Pal Singh, he shares his mantra of success - the ability to take calculated risks and strategise objectives. Edited excerpts:

How did you expand your business?

In 1958, I came from Punjab to Delhi and started selling electrical goods. In 1971, I acquired the brand of switchgear manufacturer Havells to rebuild a business around that brand.

Through the next 20 years, I set up factories and dealer channels and launched more products. By 1990, the company's revenue had increased to about Rs 25 crore (Rs 250 million).

From 1990, we went for foreign collaborations and joint ventures and added more products. While we were still a small player, by the turn of the century, the business had grown to Rs 130 crore (Rs 1.3 billion).

In the 90s, as the economy opened up, many multinational companies (MNCs) came into the market, including Schneider, ABB and Siemens.

A bulk of the company's size is attributed to the Sylvania business. Why did you acquire Sylvania for $300 million in 2007?

We realised to beat competition from China, not only did we need economies of scale, we also had to maintain quality to beat MNCs, not only in India but in their markets as well.

This paid off and from 2004, our exports increased in the European market, where no other company was selling premium quality products.

However, to expand into developed markets, we needed to make an acquisition to possess an established distribution channel. This was why we acquired Sylvania in 2007.

We wanted to capitalise

We saw some success in West Asia and Africa, where it was easy to create a distribution channel. In Europe, which was a difficult market, we started manufacturing for other brands.

But we also held discussions with investment bankers for acquisitions to sell under our own brand. By 2006, our balance sheet had become debt-free.

Immediately after the acquisition, Sylvania ran into losses. What was the lesson learnt from that?

We made certain mistakes. After an acquisition, the acquired entity must be integrated well into the existing business. We were overwhelmed by the size of the company.

And, because we had no experience in handling a large entity with a workforce of multiple cultures, we let Sylvania be on its own for some time.

To add to the problem, the global financial crisis broke out in 2008. As the company started making losses, we realised we needed to change the way we were managing Sylvania. Then, we spent a year integrating the company.

Is Havells considering another acquisition?

The logic behind our acquisitions has been to acquire not a company but a brand, along with its distribution channels. Apart from India, we have already achieved this in Europe and Latin America. The major markets are already covered.

We can grow the business in India 15-20 per cent over three to five years. The Sylvania business can grow at 10 per cent.

We might not want to make acquisitions in Europe, as our brand and channel is already established there. We want some acquisitions in markets where we are not present - such as Africa.

But through the next two years, we want to focus on making our cash flow heavier and then look at large acquisitions. In the meantime, we might be looking at small, opportunistic acquisitions.

Recently, we have looked at some small and medium-sized acquisition opportunities in India. But the valuations are high.

While currently, we are not in an acquisition mood, we are open to acquisitions. The next acquisition would probably take place in a market outside India.