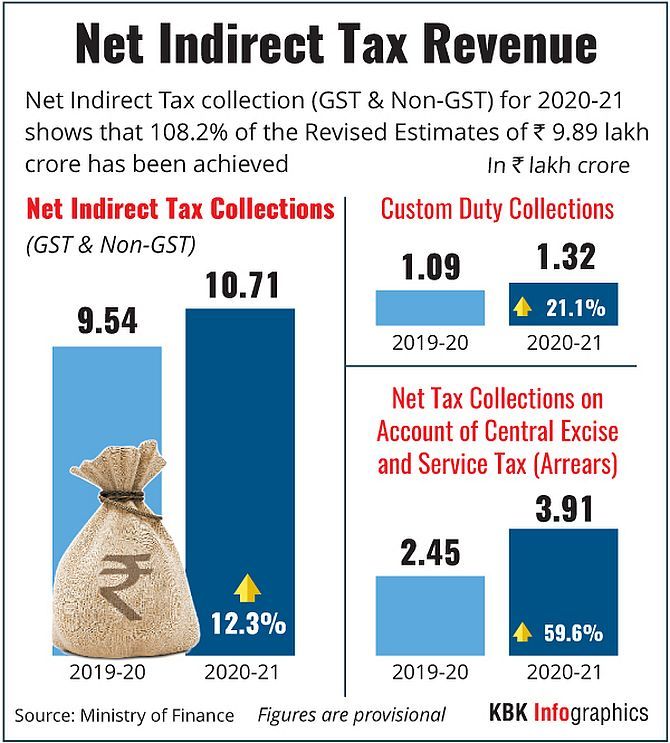

The net indirect tax collection in 2020-21 grew 12.3 per cent annually to Rs 10.71 lakh crore, thereby exceeding the target set in revised estimates, the Finance Ministry said on Tuesday.

The mop-up through indirect taxes, which include GST, Customs and excise duties, was Rs 9.54 lakh crore in 2019-20. In the Revised Estimates (RE) for 2020-21, the target was set at Rs 9.89 lakh crore.

Net collections from Goods and Services Tax (GST) stood at Rs 5.48 lakh crore during 2020-21, an eight per cent drop compared to Rs 5.99 lakh crore in the previous fiscal year.

This includes revenues from Central GST, Integrated GST and compensation cess.

Customs revenue during 2020-21 came in at Rs 1.32 lakh crore, a 21 per cent growth over Rs 1.09 lakh crore collected in 2019-20.

Net collections from central excise and service tax (arrears) stood at Rs 3.91 lakh crore, up 59.2 per cent over Rs 2.45 lakh crore mopped up in 2019-20.

"The provisional figures for indirect tax collections (GST and non-GST) for Financial Year 2020-21 show that net revenue collections are at Rs 10.71 lakh crore as compared to Rs 9.54 lakh crore for Financial Year 2019-20, thereby registering a growth of 12.3 per cent," a finance ministry statement said.

It said during the last fiscal year, GST collections were severely affected in the first half on account of COVID-19.

However, in the second half, GST collections registered a good growth and the mop-up exceeded Rs 1 lakh crore in each of the last six months.

March saw an all-time high of GST collection at Rs 1.24 lakh crore.

"Several measures taken by the central government helped in improving compliance in GST," the ministry added.

Asked about the impact of the second wave of COVID-19 on revenue collections in April, Central Board of Indirect Taxes and Customs (CBIC) chairman M Ajit Kumar said, "I am very sure we will see a very strong revenue bounce back even in the month of April.

“We should do very well, we may do even better than what we have done last month. We hope to do so."

In the Budget for 2021-22 fiscal year, which began on April 1, the government has pegged gross Customs collection at Rs 1.36 lakh crore and excise duties of Rs 3.35 lakh crore. Gross GST collection by Centre is budgeted at Rs 6.30 lakh crore.

Asked whether the targets for this fiscal year would be met, Kumar said, "I think the target has been fixed very moderately. I think they are achievable.

“For the past six months we have crossed the Rs 1 lakh crore (GST collection) target every month and I don't expect any change in that to happen this month."

He said imports, mainly of raw material and goods required by industry for manufacturing, have been showing very good trend.

On the next meeting of the GST Council, Kumar said a call will be taken by the GST Council secretariat.

"Elections are going on now, I am sure early decision (on meeting date) will be taken."

Deloitte India senior director M S Mani said, "The 12 per cent increase in the indirect tax collections comes on the back of a strong recovery in GST collections in the second half of FY21 together with the significant increase in the excise duty collections on petroleum products."

Nexdigm executive director (Indirect Tax) Saket Patawari said considering the economic and financial impact of the pandemic in the first half of the last financial year, a 12 per cent growth in the net indirect tax collections is a remarkable feat.

© 2025

© 2025