| « Back to article | Print this article |

Key Indian benchmark indices surged this Thursday with 30-share Sensex closing above 19,000 levels while 50-share Nifty scaled upto 5,783 but fell short of 5,800 in today’s spectacular trading session.

Key Indian benchmark indices surged this Thursday with 30-share Sensex closing above 19,000 levels while 50-share Nifty scaled upto 5,783 but fell short of 5,800 in today’s spectacular trading session.

Investor’s risk-appetite was firm after prices of global commodities such as brent crude and gold slipped further, that will help bride the burgeoning current account deficit.

Brent Futures for June delivery traded at $98.01 per barrel after slipping to its 9-month low of below $97 a barrel intra-day . Likewise, Gold Futures for June contract eased by Rs 232, or 0.90%, to Rs 25,447 per 10 gm.

If this declining trend in commodity prices holds, CAD could come down to around three per cent in 2013-14 due to the lower import bill, said analysts.

Adding to the optimism was country’s trade data which showed that the exports grew for the third month in a row, rising by 6.97% in March though on annual basis it declined 1.76% to $300.6 billion in 2012-13.

Exports in March stood at $30.8 billion compared to $28.8 billion in the same month of previous year.

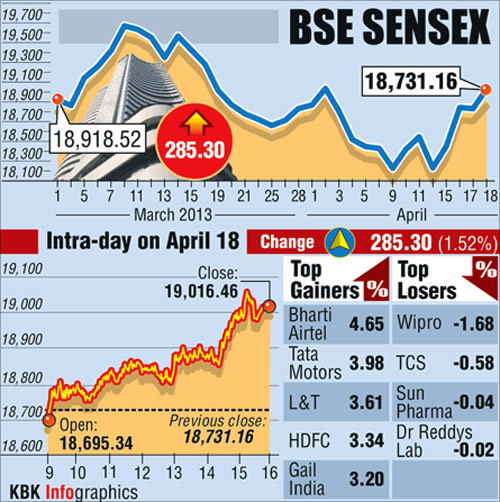

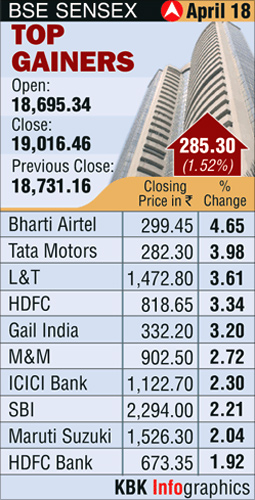

Reflecting the positive bias, the Bombay Stock Exchange's 30-share index Sensex gained 285.30 points to end at 19,016.46 while the National Stock Exchange's 50-share Nifty rose 94.40 points at 5,783.10.

Indian financial markets will remain shut tomorrow on account of Ram Navmi.

Rate-sensitive sectors such as banks, real-estate gained amid hopes that the central bank would ease monetary policy more aggressively next month to boost growth into the Asia’s third-biggest economy.

Meanhwile, global risk appetite was weak after disappointing corporate earnings of Bank of America coupled with weak revenue forecast for Apple Inc.

Apple Inc shares tumbled on worries about weakening demand for the iPhone and iPad.

Asian markets traded mixed with China’s Shanghai Composite Index up 0.17% to 2,197, Hong Kong’s Hang Seng declined 0.26 % to 21,512, Singapore’s Straits Times fell 0.06% to 3,289 while Japan’s Nikkei was down 1% to 13,220.

In Europe, France’s CAC rose 0.8% to 3,628, Germany’s DAX added 0.5% to 7,539 and UK’s FTSE was up 6,264.

Back

Shares of metal companies are trading lower by up to 3% in noon deals after the Supreme Court (SC) today cancelled all the mining leases for extraction of iron ore in 49 category C mines in Bellary, Tumkur and Chitradurga districts of Karnataka.

Shares of metal companies are trading lower by up to 3% in noon deals after the Supreme Court (SC) today cancelled all the mining leases for extraction of iron ore in 49 category C mines in Bellary, Tumkur and Chitradurga districts of Karnataka.