| « Back to article | Print this article |

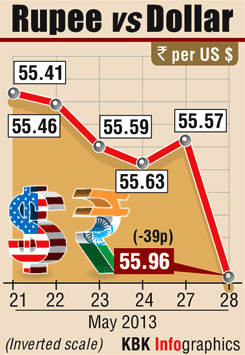

Falling to nearly nine-month lows, the rupee today closed just shy of 56-level against the dollar after it slumped by 39 paise to end at 55.96, weighed down by month-end demand for the US currency from importers and defence-related purchases.

Falling to nearly nine-month lows, the rupee today closed just shy of 56-level against the dollar after it slumped by 39 paise to end at 55.96, weighed down by month-end demand for the US currency from importers and defence-related purchases.

The dollar strengthening against major currencies overseas also put pressure on the rupee which struggled to recover despite over $125 million inflows coming into domestic stocks, forex dealers said.

At the Interbank Foreign Exchange market, the domestic currency commenced weak at 55.68 a dollar from Monday's close of 55.57 against the dollar.

However, it later recovered to a high of 55.64 but failed to sustain the momentum and dropped to a low of 55.99, on heavy dollar demand from importers, mainly oil refiners to meet their month end requirements, before concluding at 55.96, a fall of 0.39 paise, or 0.70