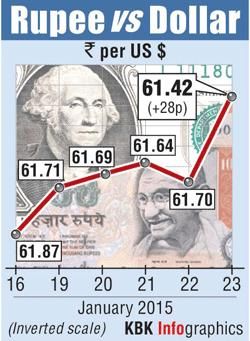

The rupee ended higher by 28 paise at 61.42 against the US currency on fresh selling of dollars by banks and exporters on persistent foreign capital inflows into equity market.

The rupee ended higher by 28 paise at 61.42 against the US currency on fresh selling of dollars by banks and exporters on persistent foreign capital inflows into equity market.

Banks and exporters preferred to reduce their dollar position on hopes of further capital inflows as foreign portfolio investors infused $107.22 million yesterday as per the record of Securities and Exchange Board of India.

The rupee opened higher at 61.45 per dollar as against the last closing level of 61.70 per dollar at the Interbank Foreign Exchange market and hovered in a range of 61.3650 and 61.6050 during the day.

It closed at 61.42 per dollar, showing a gain of 28 paise of 0.45 per cent.

The benchmark BSE Sensex rose further by 272.82 or 0.94 per cent to end at 29,278.84 on sustained buying in view of European Central Bank decision about keeping interest rates unchanged and announcement of bigger-than-expected stimulus programme.

The dollar index was up by 0.82 per cent against a basket of six major global rivals.

In the global market, the euro fell to the lowest in more than 11 years versus the dollar.

© 2025

© 2025