The broader markets ended weak in-line with the benchmark indices- BSE Midcap and Smallcap indices fell 0.9-1.2%.

Benchmark share indices ended over 1% lower on Monday weighed down by selling pressure in Infosys after four co-founders sold part of their stake in the IT major.

Benchmark share indices ended over 1% lower on Monday weighed down by selling pressure in Infosys after four co-founders sold part of their stake in the IT major.

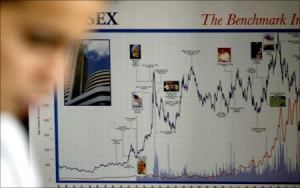

The 30-share Sensex ended down 339 points at 28,119 and the 50-share Nifty closed 100 points lower at 8,438. The Sensex and the Nifty touched an intra-day low of 28,097 mark and 8,432.

The broader markets ended weak in-line with the benchmark indices- BSE Midcap and Smallcap indices fell 0.9-1.2%.

The market breadth in BSE ended dismal with 1,790 shares declining and 1,157 shares declining.

Meanwhile, the foreign institutional investors were net sellers in Indian equities worth Rs 109.45 crore on Friday, as per provisional stock exchange data.

At 15:30PM, the rupee was trading weaker at 61.90 vs Friday's 61.77/78 close on the back of robust payrolls data.

Further, even as India was looking to it for a rating upgrade, Moody’s Investors Service on Monday restricted its talks to outlook on the economy’s grade, which is at the lowest investment level at present.

KEY EVENTS IN FOCUS

Traders will watch the proceedings of the winter session of parliament for cues. Some progress on reform-centric legislative proposals is expected.

Key macro-economic data, wholesale and consumer price inflation data for November 2014 and industrial output data for October 2014 is scheduled to be released on Friday.

ASIAN MARKETS

Japanese stocks edged up to a 7-1/2-year high on Monday as a downward revision in third quarter GDP figures was offset by the weak yen and optimism over the U.S. economy after it had strong jobs data.

The Nikkei benchmark ended 0.1% higher at 17,935.64, the highest closing price since July 2007. In early trade, the Nikkei touched 18,030.83. The broader Topix gained 0.1% to 1,447.58, while the JPX-Nikkei Index 400 also advanced 0.1% to 13,148.44.

SECTORS & STOCKS

BSE IT index slumped by over 3% followed by counters like Capital Goods, Realty, Auto, Banks, Consumer Durables and Metal, all dropping between 1-2%. Meanwhile, defensive counter FMCG ended higher by nearly 1%. Metal stocks ended lower tracking weak China data.

Shares of information technology (IT) companies ended weak on the bourses with the NSE CNX IT index down over 3% or 360 points at 11,176 dragged by Infosys after partial stake sale by promoters.

Infosys, TCS, HCL Technologies, KPIT Technologies, Hexaware Technologies, CMC and Mindtree were down 3-5% on NSE.

Infosys, the largest loser among IT pack, was down nearly 5% to Rs 1,971, its lowest level since October 31, on NSE after the company its founders, including Narayana Murthy, Nandan Nilekani, and their family members sold a combined nearly 33 million shares of the company through open market.

Sesa Sterlite was down nearly 4% after Brokerage house Bank of America Merrill has cut its earnings estimates and also the price target, citing falling crude and iron ore prices.

Other prominent losers were M&M, Dr Reddy’s Labs, Hindalco, BHEL and L&T, all dropping between 2-3%.

On the gaining side, Coal India was the top Sensex gainer, up over 2%. According to media reports, Coal India has requested the government to re-allot the two coal blocks in Odisha which it had lost following the Supreme Court's order to cancel allocation of 214 coal blocks.

ITC gained close to 1.5%. It has become the second-most valuable Indian company, surpassing refineries giants- Oil and Natural Gas Corporation (ONGC) and Reliance Industries - in overall market capitalization (m-cap) ranking.

Sun Pharma, Cipla, ONGC and Bharti Airtel were other notable gainers from the Sensex 30 pack.

Among other shares, Thangamayil Jewellery soared 16% to Rs 222 on the NSE, after SBI Mutual Fund bought stake in jewellery maker through open market purchase.

SpiceJet shares dropped 5% to Rs 15 on the BSE. The carrier cut its fleet by about a third in September and will operate 22-24 Boeing planes until at least the middle of next year, its CEO said Friday.

© 2025

© 2025