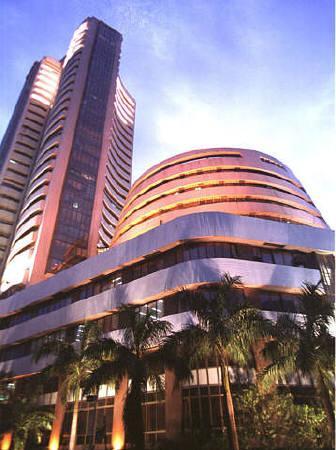

Markets ended flat amid a volatile trading session on Monday weighed down by banks and capital goods shares as investors turned cautious ahead of RBI's second quarter monetray policy review on Tuesday.

Markets ended flat amid a volatile trading session on Monday weighed down by banks and capital goods shares as investors turned cautious ahead of RBI's second quarter monetray policy review on Tuesday. Weakness in Europe also dampened market sentiment. The Sensex ended higher by 10 points at 18,636 and the 50-share Nifty advanced 1 point to 5,666.

For the most part of the day the markets traded in a tight range with Sensex trading in a range of 160 points and the Nifty moved in a range of 53 points.

Meanwhile, the Asian markets eased today as investors switched their focus away from solid US economic growth in the third quarter to the weak state of global corporate earnings.

But activity everywhere was expected to be thin as a massive hurricane closed in on the U.S. East Coast causing regulators to close stock and options trading on Wall Street.

The Hang Seng slipped 34 points to end at 31,511, Shanghai Composite fell 7 points to 2,059, Nikkei ended weaker by 4 points at 2,058 and the Starits Times slipped 23 points to 3,034.

The European shares fell on Monday as uncertainty over any rescue deal for Spain and worries over weak results from the region's top companies pushed stock markets lower. FTSE, DAX and CAC 40 indices were down 0.4-0.8% each.

Back home, capital goods stocks were amongst the worst hit in trades today after the sectoral heavyweight BHEL dipped 6.7% to Rs 226 on reporting a lower-than-expected net profit of Rs 1,274 crore as compared to analyst estimates of around Rs 1,418 crore for the second quarter ended September 2012 (Q2).

Net sales also grew marginally at Rs 10,400 crore from Rs 10,299 crore during the recently quarter. Analysts on an average had forecast net sales at Rs 11,464 crore from the state-owned capital goods company.

Tata Motors, Sterlite Industries, Larsen & Toubro, Coal India, GAIL India, ICICI Bank, NTPC, TCS, HUL, SBI, Maruti Suzuki, ONGC and HDFC were also among the losers, down 0.4-2.3% each.

On the other hand, Wipro was the top Sensex gainer. The stocks advanced 2.6% to end at Rs 345 after Credit Suisse upgraded stock to 'outperform' from 'neutral' and raised target price to Rs 415 from Rs 385.

Index heavyweight Reliance Industries also ended higher by 1.5% at Rs 811 as new Petroleum Minister M Veerappa Moily today promised expeditious decision-making and said India should look at tripling oil consumption to boost economic growth.

Wipro ended up 2.6% at Rs 345 after Credit Suisse upgraded stock to 'outperform' from 'neutral' and raised target price to Rs 415 from Rs 385.

Tata Power, Hero MotoCorp, Mahindra & Mahindra, Dr Reddy's Labs, Hindalco, Cipla, Bharti Airtel, Jindal Steel, ITC and HDFC Bank were also among the gainers.

On the sectoral front, BSE capital goods index was the top loser, the index fell 1.8% to close at 11,123. Realty, power, PSU, bankex, metal and auto indices also ended down 0.2-0.7% each. While, oil & gas, consumer durable, FMCG, healthcare and IT indices were among the notable gainers.

Shares of mid-and-small sized cement companies were in limelight on the bourses with many of them ending higher by up to 5% in an otherwise weak market.

Madras Cements, Prism Cement, JK Lakshmi Cement, India Cements, and Shree Cement are trading higher in the range of 2-5% on the Bombay Stock Exchange as compared to 0.18% or 33 points fall in benchmark Sensex at 1440 hours.

Bank of India slipped 6% to Rs 270 on reporting 38% year-on-year fall in net profit at Rs 302 crore for the second quarter ended September 2012, due to higher provisioning for bad loans. Analyst on an average had estimated profit of Rs 790 crore from the state-owned bank.

JSW Steel moved higher by 2% at Rs 748 after reporting a 547% year-on-year jump in standalone net profit at Rs 822 crore in September 2012 mainly on higher volumes and rupee appreciation impact. The company had a profit of Rs 127 crore in a year ago quarter. Net sales grew by 16% to Rs 8,834 crore during the quarter ended September against Rs 7,625 crore in the year-ago period.

Gujarat Flurochemicals dipped almost 8% to Rs 328 in trades after reporting a net profit of Rs 110 crore in September 2012 quarter against Rs 188 crore in the corresponding quarter of previous year.

The mid-cap and small-cap indices underperformed the benchmark indices. The BSE mid-cap and small-cap indices ended down 0.5% each compared to 0.09% gain in the Sensex.

The overall breadth was negative as 1,243 stocks advanced while 1,592 declined.

© 2025

© 2025