The broader NSE Nifty too dived by 101.65 points, or 0.97 per cent, to close at 10,350.15.

Illustration: Uttam Ghosh/Rediff.com

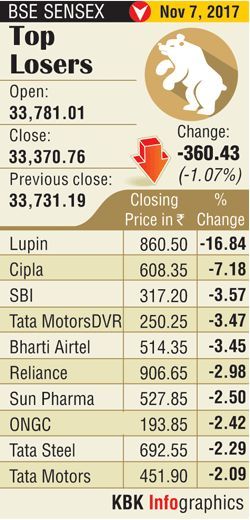

Surrendering early gains, benchmark Sensex tumbled 360 points to end at 33,370.76 on Tuesday as wary investors booked profits amid fears of a flare-up in crude oil prices following the shakedown in Saudi Arabia.

The 30-share index hit an all-time high of 33,865.95 intra-day, before slumping to 33,341.82 in late afternoon deals on across-the-board sell-off.

The index finally settled at 33,370.76 points, down by 360.43 points, or 1.07 per cent over its last close.

The index finally settled at 33,370.76 points, down by 360.43 points, or 1.07 per cent over its last close.

The broader NSE Nifty too dived by 101.65 points, or 0.97 per cent, to close at 10,350.15.

Both the key indices suffered their biggest single session fall since September 27.

Oil prices climbed 3.5 per cent overnight to quote above $64 a barrel, the highest since early July 2015, as Saudi Arabia's crown prince cemented his power with an anti-graft crackdown which sparked fears of fresh geopolitical tensions and disruption in crude supplies.

A spurt in oil prices can trigger a fresh bout of inflation and spoil the fiscal maths of net energy importers like India.

A weakening rupee, which depreciated by 39 paise to 65.07 against the dollar during the day, too dampened investor sentiment.

"Political disturbance in Saudi is triggering high volatility in the crude prices, which is negative for India leading to depreciation in INR.

"Additionally, continuous negative observations by USFDA on high quality Indian pharma companies are leading to a downgrade for the sector," said Vinod Nair, head of research, Geojit Financial Services Ltd.

Drug firm Lupin was the worst performer in the Sensex pack, crashing 16.84 per cent to close at its 52-week low after the company said it has received warning letter from the US health regulator for its manufacturing facilities in Goa and Indore.

Drug firm Lupin was the worst performer in the Sensex pack, crashing 16.84 per cent to close at its 52-week low after the company said it has received warning letter from the US health regulator for its manufacturing facilities in Goa and Indore.

Rival Cipla too faced selling pressure and slumped 7.18 per cent.

Other laggards included SBI, Bharti Airtel, RIL, Sun Pharma, ONGC, Tata Steel, Tata Motors, Bajaj Auto and Asian Paints.

However, gains in software exporters such as Infosys, TCS and Wipro on strengthening dollar cushioned the fall.

Foreign portfolio investors (FPIs) bought shares worth a net Rs 576.27 crore yesterday, as per provisional data released by stock exchanges. Domestic institutional investors (DIIs) sold shares worth a net Rs 263.84 crore.

Globally, other Asian markets led by Japan's Nikkei hit 25-year highs, tracking record closing on the US bourses amid strong corporate earnings.

Key indices in Hong Kong, Singapore, Japan, China, Singapore and Taiwan ended higher by 0.50 per cent to 1.73 per cent.

European markets were also trading in the positive zone.

Germany's Frankfurt and France's Paris CAC 40 moved up by 0.33 per cent in late morning deals.

The UK's FTSE too inched up by 0.07 per cent.

Back home, the BSE healthcare index emerged as the worst performer, losing 3.51 per cent, followed by realty 2.24 per cent, consumer durables 2.03 per cent, PSU 1.92 per cent, power 1.81 per cent, metal 1.64 per cent, oil & gas 1.32 per cent, bankex 1.26 per cent, infrastructure 1.26 per cent and capital goods 1.11 per cent.

A similar trend was witnessed in the broader markets as investors preferred to take away profits at record levels, pulling down the mid-cap index by 1.47 per cent and small-cap by 1.35 per cent.

Stocks of MMTC and STC ended higher by 10.18 per cent and 2.97 per cent after reports that the government is going ahead with the merger of its two trading firms.

© 2025

© 2025