Markets closed lower after rising for last two trading sessions as investors engaged in profit booking in the recent gainers at attractive and higher valuations.

Markets closed lower after rising for last two trading sessions as investors engaged in profit booking in the recent gainers at attractive and higher valuations.

Besides, investors are eyeing important events this week like July F&O expiry on Thursday, GST bill in ongoing monsoon session of parliament and the Federal Open Market Committee (FOMC) starting today.

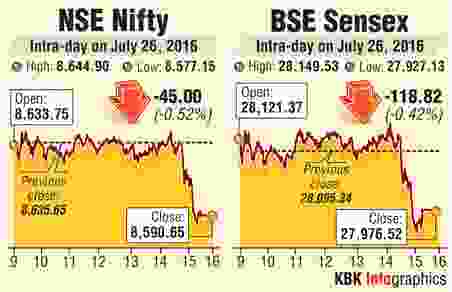

The S&P BSE Sensex shed 119 points to close at 27,977 and the Nifty50 dropped 45 points to finish at 8,591.

Broader markets ended mixed- BSE Midcap index inched up 0.2% whereas the Smallcap index fell 0.7%.

Going forward, all eyes are on the last monetary policy review for the current Reserve Bank of India Governor Raghuram Rajan, due on August 2, before he steps down a month later.

Caution was the watchword among investors on Tuesday, with equity markets mixed and the yen scampering higher ahead of central bank meetings in the United States and Japan.

The Federal Open Market Committee (FOMC) is widely expected to keep the benchmark fed funds rates unchanged after the conclusion of two-day monetary policy meeting on 26-27 July 2016.

Market participant will scrutinize the Fed statement for clues on policy direction.

MSCI's broadest index of Asia-Pacific shares outside Japan did edge up 0.7% to reach its highest in almost a year, aided by gains in China and South Korea.

Back home, Axis Bank rose by almost 3% after witnessing negative trend post the announcement of Q1 numbers.

The private lender reported 21% year on year (YoY) decline in net profit at Rs 1,556 crore for the quarter ended June 30, 2016 (Q1FY17), due to higher provisioning for bad loans.

Among other shares, Sobha increased 4% after the real estate company announced that it has bought back 1.76 million equity shares of the company from existing shareholders for Rs 58 crore.

Q1 EARNINGS IMPACT

Bajaj Finance surged over 10%, to hit fresh record high on the BSE, after the company reported a better than expected 54% year on year jump in net profit at Rs 424 crore for the quarter ended June 30, 2016 (Q1FY17).

Maruti Suzuki ended around 2% lower after reporting a 23% jump in its net profit for the quarter ended June 30, 2016. The net profit at Rs 1,486 crore was also the result of other factors like favourable Rupee-Yen rate and higher non-operating income.

Shares of Dr Reddy’s Labs dipped by 5% on the NSE after its quarterly profit slumped 75%, hurt by fierce competition in its largest market, the United States.

SBI associate State Bank of Mysore slipped into losses at Rs 471.88 crore in the first quarter on mounting bad loans, resulting into over sevenfold jump in provisions.

SBI associate State Bank of Mysore slipped into losses at Rs 471.88 crore in the first quarter on mounting bad loans, resulting into over sevenfold jump in provisions.

The stock fell over 1%.

Swaraj Engines gained 1% after hitting 52-week high in an intra-day trade, after the company reported its best ever quarterly performance in terms of volumes and financials, driven by growth in the tractor industry during the first quarter ended June 30, 2016 (Q1FY17).

TVS Motors ended 2% lower after reporting 21% rise in its net profit during the first quarter ended June 30, 2016 (Q1FY17).

Image: The Bombay Stock Exchange. Photograph: Reuters

© 2025

© 2025