Markets continued to struggle for direction on Tuesday as the Sensex cracked below 28,000 to close at a one-week low as investors stayed cautious ahead of Goods and Services Tax debate in the Rajya Sabha on Wednesday amid weak European cues.

Broader markets did not show enough appetite either, with the BSE small-cap and mid-cap indices ending lower by 0.83 per cent and 0.62 per cent, respectively.

Earlier, the market opened in the green on the back of pick-up in eight core industries in June, an uptick in manufacturing PMI along with rising hopes of GST Bill passage this week.

The government on Monday listed the constitutional amendment Bill for GST for consideration and passage in the Upper House on Wednesday amid strong indications that the most far-reaching tax reform in independent India would be backed by the Congress and other major parties.

Infrastructure sector grew at 5.2 per cent in June, fastest in two months, mainly helped by a double-digit growth in coal and cement sectors.

India's weather office IMD keeping its above-average forecast for June to September too gave some cheer.

But that was short-lived as sentiment turned negative after European shares slipped to their two-week low in early session, mirroring a weak trend in Asia and falling crude prices, dealers said.

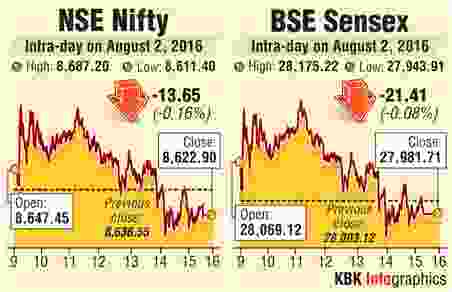

On the day, the Sensex resumed higher, but settled 21.41 points, or 0.08 per cent, down at 27,981.71, a level last seen on July 26. The gauge had lost 205.48 points in the past two sessions.

The NSE Nifty too took some blows as it dropped by 13.65 points, or 0.16 per cent, to close at 8,622.90. It moved between 8,687.20 and 8,611.40.

Tata Motors, with a loss of 2.80 per cent, was the worst hit from the Sensex pack followed by HDFC at 2.37 per cent.

Tata Motors, with a loss of 2.80 per cent, was the worst hit from the Sensex pack followed by HDFC at 2.37 per cent.

Others that came under selling pressure included Adani Ports, Bharti Airtel, ICICI Bank, GAIL, Wipro, Cipla, Lupin, Coal India, Sun Pharma, M&M and Tata Steel.

However, ITC rose 3.73 per cent followed by Maruti Suzuki (2.49 per cent) after the company raised prices by up to Rs 20,000 across various models.

Out of the 30-share Sensex pack, 18 fell while 12 gained.

State-run Indian Bank soared almost 20 per cent to Rs 186.20 after the company reported rise of about 43 per cent in net profit for the April-June quarter.

Talking of sectoral indices, metal dropped the most by 1.78 per cent, followed by realty 1.18 per cent, infrastructure 0.87 per cent, power 0.84 per cent and healthcare 0.80 per cent.

Foreign portfolio investors (FPIs) bought shares worth a net Rs 726.22 yesterday, as per provisional data released by the stock exchanges.

Key regional markets hit a soft patch as indices in Japan and Singapore fell by up to 1.47 per cent while financial markets in Hong Kong were shut due to Nida typhoon.

In Europe, France, Germany and the UK-based indices fell by up to 1.42 per cent.

Image: Stock traders. Photograph: Reuters

© 2025

© 2025