| « Back to article | Print this article |

Markets ended lower this Friday with 50-share Nifty closing below the crucial support level of 5,950 on back of profit-booking in rate sensitive sectors such as banks, real-estate after the central bank’s policy action.

Markets ended lower this Friday with 50-share Nifty closing below the crucial support level of 5,950 on back of profit-booking in rate sensitive sectors such as banks, real-estate after the central bank’s policy action.

The Reserve Bank of India in its monetary policy review reduced repo rates by much-anticipated 25basis points but hinted towards a little room for future policy easing.

“The hawkish statement by the Governor reaffirms our belief. We expect not more than 25 basis points incremental reduction in Repo till December 2013.,” said Amar Ambani, Head of Research, India Infoline.

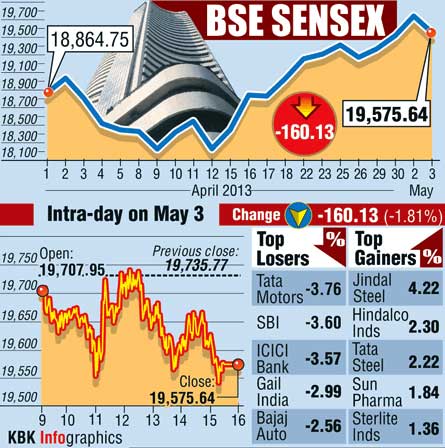

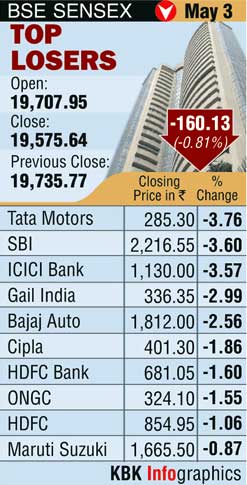

The Bombay Stock Exchange's 30-share index Sensex fell 160.13 points to end at 19,575.64 while the National Stock Exchange's 50-share Nifty declined 55.35 points to close at 5,944.

In the annual monetary policy for 2013-14, RBI also cut the ceiling on total SLR securities held under the HTM category to 23 per cent of Demand and Time Liabilities (DTL) from 25 per cent earlier.

Global risk appetite firm after a report that may show US employers hired more workers last month coupled with an interest rate cut by the European Central Bank added to hopes that more stimulus from yet another major central bank will help shore up the global economic recovery.

In US, payrolls increased by 140,000 workers following a gain of 88,000 in March, according to the median estimate in a Bloomberg survey of 90 economists.

Meanwhile, ECB President Mario Draghi on Thursday said the ECB stood ready to ease further if needed, dealing a blow to the euro currency as investors looked elsewhere for better returns.

Asian markets ended mixed with Hong Kong’s Hang Seng rose 0.1% to 22,689.83, China’s Shanghai Composite rose 1.2% to 2,205, Singapore’s Straits Times declined 0.3% to 3,373.

The laggards included counters such as Tata Motors falling 4%, SBI and ICICI Bank declined 3.6 % respectively, GAIL dropped 3%, Bajaj Auto shed nearly 2.5% on the BSE.

The laggards included counters such as Tata Motors falling 4%, SBI and ICICI Bank declined 3.6 % respectively, GAIL dropped 3%, Bajaj Auto shed nearly 2.5% on the BSE.