| « Back to article | Print this article |

Markets ended higher this Thursday with 50-share Nifty closing near key resistance level of 6,000 on back of buying in rate-sensitive sectors such as banks, real-estate.

Markets ended higher this Thursday with 50-share Nifty closing near key resistance level of 6,000 on back of buying in rate-sensitive sectors such as banks, real-estate.

Risk appetite improved on hopes of aggressive policy action by the Reserve Bank of India in its credit policy tomorrow after headline inflation to over 3-year low in March.

The rate-cut optimism grew stronger after global commodity prices dropped. Lower crude oil prices have the potential to shave off 50 basis points (bps) from the headline inflation print during the year.

Barclays expects CAD to moderate to a little over three per cent of gross domestic product over the next three years, much worse than the long-term average of 1.5 per cent.

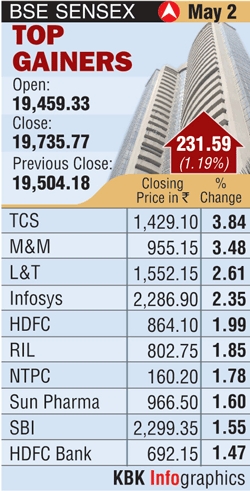

Mirroring the optimism, the Bombay Stock Exchange's 30-share index Sensex ended higher 231.59 points at 19,735.77, its highest level since Feb 4 while the National Stock Exchange's 50-share Nifty rose 69.15 points to close at 5,999.35, its highest level since February 1.

Global risk appetite was, however, frail after weak set of economic data from US and China, the two biggest economies of the world.

Reports on Wednesday showed U.S. companies added fewer workers than forecast in April and the Institute for Supply Management’s factory index fell to 50.7 in April from 51.3 in March.

Meanwhile, HSBC Purchasing Managers' Index (PMI) dropped to 50.4 in April from March's 51.6 and was largely in line with a flash reading last week of 50.5.

Asian markets ended mixed with Hong Kong’s Hang Seng falling 0.3% to 22,669.83, China’s Shanghai Composite shed 0.2% to 2,173, Singapore’s Straits Times added 1% to 3,402 while Japan’s Nikkei was down 0.7% to 13,694.

Meanwhile, European

Tata Motors dropped 1% after registering a 14.8% decline in total vehicle sold in the month of April 2013.

Tata Motors dropped 1% after registering a 14.8% decline in total vehicle sold in the month of April 2013.