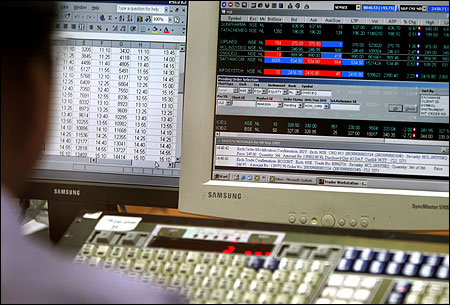

Benchmark shares indices ended marginally higher on Tuesday, amid a volatile trading session, led by oil exploration major ONGC.

Benchmark shares indices ended marginally higher on Tuesday, amid a volatile trading session, led by oil exploration major ONGC.

The 30-share Sensex ended up 31 points at 19,722 and the 50-share Nifty was up 15 points at 5,995.

Markets had firmed up after better-than-expected April WPI but pared gains in late trades after profit taking was seen at higher levels.

India's wholesale price inflation slowed for a third straight month in April to 4.89 per cent against 5.96% in the previous month, official release showed today.

This is the lowest level in 41 months last seen in November 2009.

The Nikkei share average edged down on Tuesday, after two gaining days, as interest rate-sensitive sectors such as real estate and financials succumbed to signs of rising long-term interest rates.

The Nikkei ended down 0.2%, Hang Seng was down 0.3%, Shanghai Composite fell 1.1%while Straits Times ended up 0.1%.

European shares were trading lower on Tuesday as investors remained cautious ahead of data on German investor confidence and industrial production in the euro-zone.

The CAC-40, DAX and FTSE-100 were down 0.1-0.3% each.

The sectoral indices on the BSE were led by Healthcare index up 0.7% followed by Power, Oil & Gas, IT indices.

Select oil and gas shares were up after a report in the The Financial Express said that ONGC and Oil India have requested the government to reduce the discounts they must offer PSU refiners on crude purchases because of declining crude oil prices.

ONGC was among the top Sensex gainers up 1.8% at Rs 326 while GAIL India was up 1.6% at Rs 337. Among other oil shares, Oil India was up nearly 2% at Rs 560.

HDFC ended up 0.7% at Rs 869. Motilal Oswal in a results review said current valuations are reasonable, considering company's growth potential, sound business fundamentals and substantially improved subsidiaries' performance (life insurance business has turned profitable).

The brokerage has Buy rating with a SOTP-based target price of Rs 970.

Tata Motors gained 1% to end at Rs 301 after its UK-owned Jaguar Land Rover reported 12% growth in April to 28,503 vehicles compared to the same month last year. For the first four months of 2013 sales grew 16%.

Software

Other Sensex gainers include Sun Pharma, Bharti Airtel and SBI.

HDFC Bank was among top Sensex losers down 0.6% after television news channel reports citing unnamed sources that the central bank has discovered violations by private banking majors related to Know Your Customer rules.

ICICI Bank was down 0.2%.

Drug firm Dr Reddy's Laboratories today reported a 66.58% rise in its net profit to Rs 570.89 crore for the quarter ended March 31, 2013 mainly on account of robust sales across all segments.

The stock ended down 2.7% at Rs 2,026.

Other Sensex losers include, Bajaj Auto, Mah & Mah and Reliance Ind.

Among other shares, Ranbaxy Laboratories ended 3.6% higher at Rs 456, bouncing back 8% from day’s low after the pharmaceutical company has agreed to pay $500 million (approximately Rs 2,743crore) to resolve fraud allegations that the company sold adulterated drugs and lied about it to US regulators.

In December 2011, the company had set aside $500 million to resolve potential criminal and civil liabilities.

Muthoot Finance has slipped 5% to Rs 150, falling almost 10% from intra-day high, after reporting 6.4% year-on-year (yoy) drop in net profit at Rs 220 crore for the quarter ended March 31, 2013 (Q4) due to higher provisioning. Analyst on an average had expected profit of Rs 278 crore from gold financing company.

Elder Pharmaceuticals is locked in upper circuit of 10% at Rs 248, bouncing back of 22% from day’s low, on back of heavy volumes.

The stock had opened at Rs 203, its lowest level since May 2009 on BSE has seen huge trading activities on the counter.

Aptech has surged 8.6% to end at Rs 63.40 after its board approved the buyback of company’s equity shares at maximum price of Rs 82 per share from the open market.

Zydus Wellness has rallied 12% to Rs 556, extending its previous day’s 6% gain, on reporting a healthy 59% year-on-year (yoy) jump in its consolidated net profit at Rs 37 crore for the fourth quarter ended March 31, 2013 on the back of strong revenue growth.

The BSE Mid-cap ended up 0.3% and Small-cap indices ended flat with positive bias.

Market breadth was negative with 1,201 losers and 1,134 gainers on the BSE.

© 2025

© 2025