Today, Vachani’s public-listed company, Dixon Technologies, has gone beyond manufacturing just television sets.

Armed with private equity funding from Motilal Oswal eight years ago, it has transformed itself into a Rs 4,400 crore electronic manufacturing services major, which now straddles lighting products, home appliances, feature phones, LED bulbs, amongst others.

A two-part series looks at how two home-grown manufacturers are leveraging the govt's production-linked incentive scheme.

In 1993 Sunil Vachani asked his father, the late Sunder T Vachani, for some capital to manufacture cathode ray tube TV sets for Lucky Goldstar (now LG), which had agreed to outsource the job to his company.

But Vachani Senior, who had built the Weston TV brand in India, wasn’t convinced that it was a good idea.

He felt companies would not be willing to give up their core area of business - manufacturing.

It turned out that he was wrong.

Sunil Vachani says that when he was studying for his management degree in the UK, he could see that global consumer brands were beginning to quietly outsource manufacturing to third party players while retaining control only of the design, marketing and brand building aspects of the business.

“We were one of the earliest players in this space.

"From the beginning, our core philosophy was that we would be a pure play EMS player and never build our own brands and compete with our clients. The rest is history,” says Vachani.

Today, Vachani’s public-listed company, Dixon Technologies, has gone beyond manufacturing just television sets.

Armed with private equity funding from Motilal Oswal eight years ago, it has transformed itself into a Rs 4,400 crore electronic manufacturing services (EMS) major, which now straddles lighting products, home appliances, feature phones, LED bulbs, amongst others.

And it has caught the fancy of the stock market as well, with its shares doubling in the last six months and its market cap hitting a valuation of $1.8 billion.

Vachani is now readying for the next big growth move by leveraging the new opportunities thrown open by the government’s production-linked incentive (PLI) schemes in various sectors.

He has identified three key areas where he wants to take the benefits of the PLI scheme –mobile devices (Dixon has already qualified under the scheme), laptops, desktops and tablets, and LED bulbs.

The PLI schemes have two objectives — first, to transform India into an export hub in certain products by offering incentives to companies, incentives that are primarily aimed at neutralising the cost disadvantage they face vis-a-vis countries like China and Vietnam.

Second, move towards “Atmanirbhar Bharat” by encouraging domestic production and reducing imports.

Vachani is clearly poised for both goals.

“I want to be amongst the top 10 EMS/ODM (original design manufacturer) players in the world,” he says.

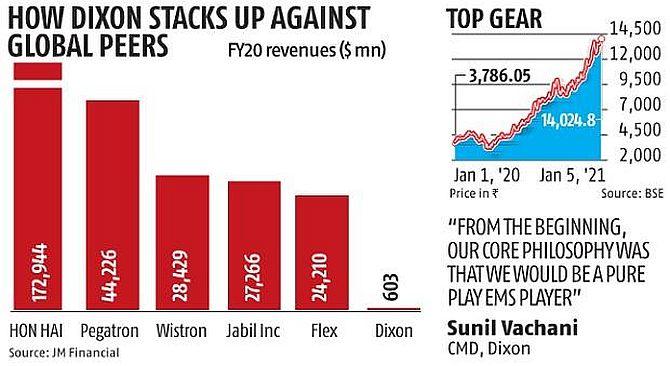

For that, his revenues have to go up by seven to eight fold (over $4.7 billion), based on data of global EMS players for FY 20.

His company is currently at the bottom end of the top 20 list.

He also wants to move from being primarily an EMS player (66 per cent of his revenues come from EMS products) to an ODM player in each segment.

This, he believes, would increase margins and allow more flexibility in launching new products.

To that end, the company plans to invest over Rs 300 crore in building or expanding capacities.

The big game is, of course, in mobile devices, where Vachani is already investing Rs 100 crore to set up a 20-million per annum smart phone unit under the PLI scheme.

This will be followed by another 30-million per annum unit.

Vachani says that he wants to export 60 per cent of the phones (priced below Rs 15,000), has already signed up with global players like Motorola (partly for export and the domestic market).

An elaborate plan is also being put in place to make phones with a localisation content starting with 15 per cent, and then taking it up slowly to 40 per cent.

The company will churn out both 4G as well as 5G phones, and while initially, it will depend on the customers for the design, it plans to develop that capability as well.

If Dixon gets its mobile device plan right, it would substantially change the company’s current over-dependence on consumer electronics or TV EMS business, which accounts for more than 48 per cent of its revenues.

However, it is also increasing its TV manufacturing capacity from 5.5 million to 7 million units, which accounts for 30 per cent of the total domestic requirement of the country annually. Its customers include Samsung, Xiaomi, Flipkart, to name a few.

But Vachani estimates that within two years, TV will account for only 15 per cent of Dixon’s revenues.

And mobile, which will have a large export component, will jump to over 50 per cent (currently, it is 12 per cent and that too, mostly feature phones) of its revenues.

Dixon’s other big gamble is in the laptop, desktop and tablet space, where the government has earmarked about Rs 5,000 crore as incentives under the PLI scheme.

“There are hardly any domestic manufacturers in this space and the majority of the devices are imported.

"So there is a large domestic market for tablets in the education sector and a major potential for exports of low cost tablets, too,” says Vachani.

But Dixon could face serious challenges in both these areas.

Top global EMS players like Foxconn, Wistron and Flextronics, and even Pegatron, are expanding their presence in the country, and they could easily snatch away large volume outsourcing deals from Dixon in the mobile devices or laptops and tablets space.

Also, with a mere 10 per cent localisation in laptops in India and 15 per cent in mobile devices, the company would always be vulnerable to global supply chain disruptions (as happened when Covid-19 hit) or even an unfavourable duty structure.

But Vachani is also banking on a third area — the LED lighting space where it already has scale.

Dixon produces 250 million LED bulbs per annum, or nearly 44 per cent of the country’s requirement, and is one amongst the top five players in the globe in terms of volumes (contributes 6-7 per cent of global volumes).

“In the LED bulbs space, there are only two countries — China and India — and no one else in the market.

"The global lighting market is $130 billion, and there is no reason why we cannot export $4-5 billion, once the PLI scheme takes care of the cost disabilities.” says Vachani.

He points out that top retailers in the US are already scouting for large volume deals from India.