Companies are introducing kids-only versions of popular brands as the line between adult and children’s categories begins to blur

Children have, for long, been an important demographic for marketeers.

For several reasons; apart from their individual purchasing power (which is considerable), they influence their parents’ purchases and are potential adult consumers.

But read between the lines above, and there is a noticeable shift in the way the demographic is being pursued by companies and advertisers in the country.

Children seem to have gone up a notch in the consumption hierarchy, as companies are now targeting them as direct consumers of goods that were hitherto meant for their parents.

Check out the stores (online and physical) and it is impossible to miss the rows of ‘kids only’ sunscreen lotions, body mists, deos, face and hand washes and perfumes staring back.

Some examples: Lotus Herbals has kids-only sunscreen lotions, there are Chota Bheem and Barbie lines of face and hand washes (marketed by their licensees), Kolkata based Emami has launched Zandu Balm Junior.

Not only are children wearing what their parents wear early on, there are also a larger number of parents, across income groups, encouraging them to do so.

According to a Dabur spokesperson, “Despite a growing demand for baby care products in India, the market is today starved of quality baby care products, While a number of overseas players are offering their international baby care products in India, what they lack is the traditional knowledge, we plan to expand our presence in the baby care market with newer introductions.”

There are two reasons why the market is excited about the infant-young adult category.

One, increasing brand awareness among children in the metros has led to the blurring of lines between adult and children-only product categories.

And two, changing aspirational levels among parents (especially mothers) in tier 2 and 3 towns is leading them to buy branded products.

Their shopping lists have a larger kids section say experts.

“The FMCG sector has always looked to carve a niche category from existing segments. In the metros, kids have become decision makers; similarly with rising affordability and exposure, those in the smaller towns have become equally aspirational (and are) driving this segment,” said Pinaki Ranjan Mishra, partner and national leader, EY.

Consider sunscreen lotions, for instance.

It was a product bought mostly by adult women and now, men. But companies are launching special lines for children too.

Industry experts say that kids-only sunscreen lotions and perfumes have a relatively small market size now, sub-Rs 50 crore (Rs 500 million), but annual growth is between 15-20 per cent.

These traditional adult products customised for children will soon claim a bigger share of the Rs 2,000-crore (Rs 20-billion) childcare market of India, they predict.

A similar story is unfolding in other product categories too. Kolkata-based Emami launched a balm under its Zandu brand exclusively for kids.

“We have received a very encouraging consumer response for Zandu Gel Balm Junior. The segment has potential for growth and we are watching it closely,” said an Emami spokesperson.

While the metros are seeing increased spending on branded products, in tier two and three towns, the amount spent on children is increasing as is the quantum spent on baby care, soaps and oils categories.

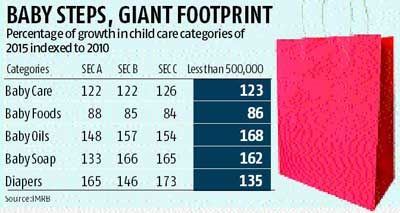

A recent report from market research firm, IMRB says that as compared to 2010, the spending on kids has grown faster among SEC C towns as compared to SEC A towns in 2015 (89 per cent and 73 per cent respectively).

“This trend can be attributed to the fact that with increasing education, more women are now taking decisions in the family, leading to more active parenting,” says Deepa Mathew, group business director at IMRB International.

Pradeep Kashyap, CEO of MART -- a consulting firm on emerging markets offers an interesting perspective.

“The rate of growth of sign-ins on social media platforms like Facebook is greater in rural India than in urban areas, this depicts change in rural consumer mindsets,” says Kashyap.

While this is true, it also offers us a clue as to why more and more companies are building a robust digital footprint for their baby care products.

While this is true, it also offers us a clue as to why more and more companies are building a robust digital footprint for their baby care products.

Take Mahindra and Mahindra for instance, it has integrated its Mom & Me brand with its online portal Babyoye, indicating perhaps that the marketing thrust for its baby care lines will be online.

Supam Maheshwari, founder of Firstcry.com says that the portal has seen a huge surge in interest for bay care products from Tier B and C towns.

“Parents, regardless of the level of wealth, always want to give the best to their children. We see a huge scope in the online segment in India,” says Maheshwari.

- Kolkata based Emami group has launched a kids-only variant of its popular Zandu Balm

- Last month, Mahindra & Mahindra integrated its Mom & Me brand with its online baby products’ portal Babyoye; M&M acquired the portal early this year

- In May this year, FMCG major Dabur created a sub-brand Dabur Baby saying that there was an increasing number of parents looking for branded quality baby care products in India

- According to a recent study by IMRB, spending on children has grown faster in Sec C towns as compared to Sec A towns, especially the baby care category

- Technavio Research estimates that the baby care segment in India will grow at the rate of 17 per cent between the years 2014-1

Image: Children are dressed as Santa Claus. Photograph: Reuters

© 2025

© 2025