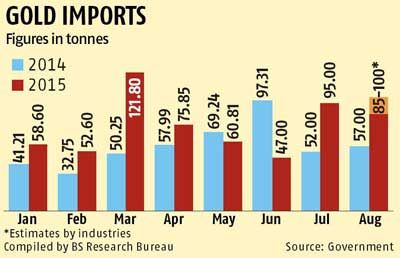

Gold imports in the first eight months of the calendar year are estimated to be 40 per cent higher at 587 tonnes year-on-year.

Gold imports in the first eight months of the calendar year are estimated to be 40 per cent higher at 587 tonnes year-on-year.

Imports in August remained elevated, even as the yellow metal prices rebounded from multi-year lows.

By December 2015, the total imports will touch 1000 tonnes.

Import bill for the first eight months is estimated at $23 billion, up 42 per cent year-on-year.

Sudheesh Nambiath, senior analyst- precious metals, GFMS Thomson Reuters, said, “In the next four months, import of another 300 tonnes is likely to happen for domestic market use.”

Imports in August are estimated at 85-100 tonnes compared to 67 tonnes in August 2014, a rise of around 50 per cent. In this July, 97 tonnes of gold were imported. If the final figure for August comes near to 100 tonnes as estimated, it will be perhaps highest August import.

In August 2011, gold imports had touched 91.8 tonnes.

Trade sources said lower prices since the last week of July generated sudden demand for gold.

Gold was trading below $1,100 per ounce since the last week of July. In Mumbai also, gold prices fell to aroundRs 25,000 per 10g in the same period.

Traders also placed higher orders a few days before the announcement of fortnightly revision of tariff value for gold.

Tariff value is that price on which import duty is to be paid and this value is revised every fortnight in middle and end of the month as part of routine exercise.

From mid-August, tariff value has increased from $354 per 10g to $363 per 10g. Tariff value for certain commodities such as edible oil, precious metals, areca nuts, brass scrap and poppy seeds is revised every fortnight.

Since tariff value is revised on average price of the commodity and in the first half of August, prices suddenly rebounded.

Traders calculated tariff value and found an arbitrage if imported gold arrives a day before the new value comes into effect, there was marginal duty benefit.

From September, the tariff for gold has been further revised upwards to $369, considering weak rupee and rise in gold prices.

While the increase in tariff value was not much, the difference was used to increase margins in a rising gold market.

Rise in August gold imports would also mean that total imports in the first five months of the current financial year has risen 19 per cent to 370 tonnes.

This may not be a cause of concern yet as prices are lower compared to the last year and lower crude prices are keeping the current account deficit in check.

But as gold imports are usually higher in the last quarter, total imports this fiscal may cross 1,000 tonne, according to experts.

© 2025

© 2025