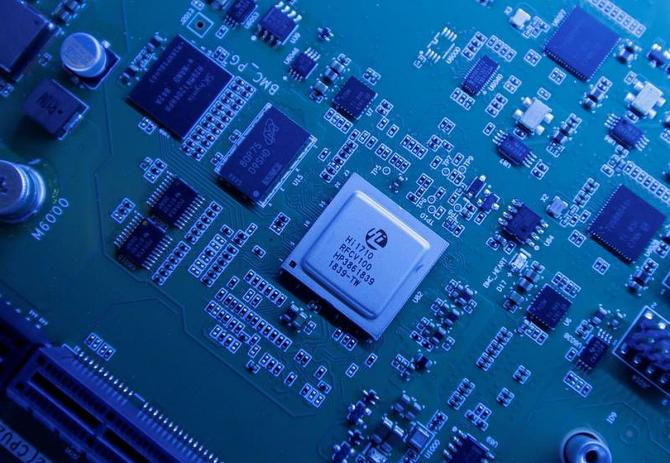

The Indian government is keen to woo major semiconductor players, but a global race to attract them to countries where there is already an ecosystem is making it difficult for India to attract the biggies in the business.

On Wednesday the government decided to throw open the doors to more players to participate in its semiconductor scheme.

It is now looking at not only 28 nanometre (nm) chips and below, but higher nodes like 40 nm.

It is also open to existing participants in the scheme applying again.

Meanwhile, the US, the EU, South Korea, Japan, among others, are spending an estimated $200 billion on subsidies to encourage companies to set up fab plants and other semiconductor downstreams in their countries.

And they already have a vibrant semiconductor ecosystem and supply chain in place.

India is new to the business, and is entering the space at a time when countries that faced a huge shortage of chips during the pandemic are racing to reduce their dependence on foreign countries.

India is also one of them, and its offer of subsidies is to the tune of $10 billion, which is for fab plants, chip designing, outsourced semiconductor assembly and test (OSAT) and display fabs, among others.

But other countries are also ramping up their chip manufacturing plans.

The US Chips Act signed in August 2022 offers $53 billion as subsidy for five years in chipmaking, research and development and collaboration and coordination with friendly countries.

This has attracted the attention of all the big players in the game — TSMC, Samsung, Intel, and Micron are working to build gigafactories in the US.

In the EU, the European Chips Act aims to increase their global share of chip making from 10 per cent to 20 per cent in 5 years, and the legislation is expected to spur overall investments of €43 billion, out of which €30 billion ($32.04 billion) will be through public investments by member states.

Intel has already announced that it is setting up a plant in Germany and talks are on with TSMC as well.

Even South Korea is upping the ante. Its policies are expected to generate investments of $450 billion by 2030, and these include an incentive of 20 per cent on building facilities.

Samsung has plans to invest $230 billion to build five new plants in the country.

In Taiwan, which is the world’s largest chip maker, the government is offering a host of incentives: A 25 per cent tax credit for expenditure on cutting-edge technology for seven years till 2029.

There is also a 5 per cent tax credit for new machinery and equipment purchased for advanced manufacturing for a similar period.

In India, so far, the big players have kept away.

That is because TSMC, Samsung and Intel have already put together mega plants in other countries.

And Taiwanese OSAT companies have voiced their reservations about coming to India due to the lack of policy stability, especially on revenue matters.

Recently, communications minister Ashwani Vaishnaw went to the US and met top executives of companies like Intel, Micron, and Western Digital.

Applied Materials, among others, in order to woo them to come to the country to set up semiconductor plants.

Betting big

US: Offers $53-bn subsidy under the US Chips Act

EU: Will invest €€43 bn to raise global share in chipmaking from 10% to 20% in 5 years

South Korea: Policies expected to generate $450-bn investments by 2030

Taiwan: 25% tax credit for expenditure on cutting-edge technology for 7 years

© 2025

© 2025