| « Back to article | Print this article |

Economists vary in their projection of gross domestic product growth for the first quarter (April-June) of 2015-16 by a huge margin, probably reflecting the newly complicated method of calculating national accounts numbers.

Economists vary in their projection of gross domestic product growth for the first quarter (April-June) of 2015-16 by a huge margin, probably reflecting the newly complicated method of calculating national accounts numbers.

The economic growth data would be officially out on Monday.

The level has been pegged at 6.8-8 per cent by various economists, as compared to 6.7 per cent in the first three months of 2014-15.

Many believe it is all value addition that is now counted in the industrial growth component of GDP numbers these days but that is not entirely true for the first three quarters.

Value addition would not form part of this segment for most unlisted companies in this period.

It means that if an unlisted company produces the same amount of goods this year compared to earlier year, its production growth would be taken as zero in most cases.

If it spends higher amounts in advertising, marketing or innovating the product compared to earlier years, that might be reflected in higher growth in the fourth quarter and annual GDP data but not in the first three quarters. .

Let us first understand the new methodology on GDP numbers, changed to reflect the new base year of 2011-12 against the earlier one of 2004-05.

The revised methodology, announced in January this year, changed the way GDP numbers have been calculated.

So, the numbers for 2012-13 and 2013-14 were also changed and the new method was used to calculate the figures for 2014-15.

The new numbers changed GDP growth to 5.1 per cent from the earlier 4.5 per cent for 2012-13 and 6.9 per cent from the earlier 4.7 per cent for 2013-14.

For 2014-15, the growth came at 7.3 per cent.

Now, GDP is taken at market prices.

This includes indirect taxes and excludes subsidies, quite different from what had been calculated so far.

Which was GDP at factor cost, which included subsidies and excluded indirect taxes.

So, at the outset, GDP should grow a bit faster, since service tax was raised from 12.36 per cent to 14 per cent with effect from June this year and subsidies are lower, due to softening crude oil and other commodity prices.

For the fourth quarter and annual numbers, industrial growth as reflected by the Index of Industrial Production has less weight -- 24-26 per cent of the industrial growth component in GDP.

The rest is all taken from the filings of MCA21 (the corporate affairs ministry's e-governance initiative) and the Securities and Exchange Board of India for listed companies.

Industrial production accounts for 30 per cent of India's gross value added.

Also, the revised numbers largely take into account an enterprise-based approach for industrial growth and uses the establishment one for only small and unregistered companies, for Q4 and annual numbers.

In the former approach, activities at the headquarters' level is taken into account.

In the latter, performance of manufacturing units is. At the headquarters' level, expenses such as advertising, marketing and whole value addition is used, not done in the case of plant-based calculations.

The picture changes drastically in the case of calculating GDP numbers for the first three quarters of a financial year.

This is because MCA21 filing does not come by that time.

For the first quarter, what is available is advance filing of numbers for the first three months by companies listed with Sebi.

The rest is all based on IIP, explained Pronab Sen, chairman of the National Statistical Commission.

As to how much would be the weight of IIP in the industrial growth numbers of GDP, Sen said it would be higher than 24-26 per cent, the case with the annual and the fourth quarter number.

To give a rough gauge, he said, while there are 130,000 companies that would be taken for industrial growth numbers, only 18,000 give advance filings to Sebi.

So, this headquarters' approach would be taken only for 18,000 companies.

For the rest, which might include large companies, as well as unregistered proprietary or partnership firms, a plant approach would be taken, Sen explained.

On IIP, industrial growth slowed down to 3.2 per cent in Q1 of 2015-16, compared to 4.5 per cent in the corresponding period the previous year.

To that extent, industrial growth might show a slightly reduced growth in Q1, compared to the year-before period.

When the first quarter's indirect tax numbers were officially announced, of 37.5 per cent growth over a year, chief economic adviser Arvind Subramanian had said this reflected a healthy rise in nominal GDP numbers.

For, collections rose 14.5 per cent even if one took out the effect of additional measures such as a rise in excise duty in four phases since October last year, and removing excise sops for the automobile and capital goods industries.

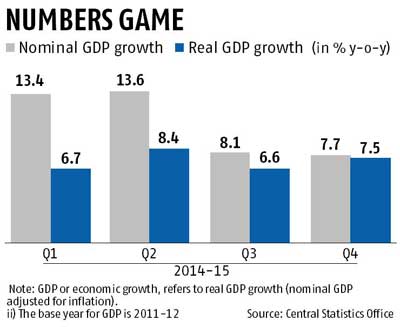

However, if nominal GDP is high, real GDP (adjusting with inflation) will have to be robust, as inflation is now quite low. This is also evident from the accompanying chart, as the gap between nominal and real GDP growth rates had narrowed in Q3 and Q4 of 2014-15.

In terms of wholesale prices, deflation continued for an eighth month in June.

However, Consumer Price Index inflation stood at 5.3 per cent on an average in the first quarter of this financial year, compared to 7.9 per cent in this financial year.

The Central Statistics Office uses price deflators to convert nominal GDP into real GDP, which is a mix of WPI, CPI and other price indices.

In contrast to Subramanian, State Bank of India chief economic adviser Soumya Kanti Ghosh said nominal GDP would be quite lower, while real GDP would be higher, due to probable negative price deflators.

He pegged real GDP growth to be as high as eight per cent in the first quarter, with lower nominal GDP.

For the entire financial year, he projected GDP growth to be 7.9 per cent, with an upward bias.

For the entire financial year, he projected GDP growth to be 7.9 per cent, with an upward bias.

CARE Ratings' chief economist, Madan Sabnavis, said first quarter GDP growth would likely be 6.8 per cent, with agriculture in the period representing residual production of the rabi crop.

Beside, net sales of 1,461 companies studied by CARE declined 10.4 per cent in the first quarter of 2015-16, against an increase of 11.9 per cent in the first three months the previous year.

Services also appeared to be not doing well, except for those supported by the government's expenditure, he said.

Sabnavis acknowledged that gauging GDP was a tricky issue due to the new methodology.

D K Joshi, chief economist with CRISIL, estimated economic growth to be 7.4 per cent in the first quarter and the same for the entire financial year.

However, he said, he would be a bit cautious on drawing conclusions on GDP growth from only indirect tax numbers.

The high tax numbers, he said, would come from better compliance and improved economic activity.

He believed it would be a mix of the two.

Refusing to gauge the numbers, India Ratings' chief economist Devendra Pant said while indirect tax numbers give a sign of high GDP, the IIP does not indicate robust numbers.

The image is used for representational purpose only. Photograph: Reuters