The Panama Paper leaks were originally revealed by the International Consortium of Investigative Journalists on April 4, 2016, following which, the government had set up the MAG to probe the matter.

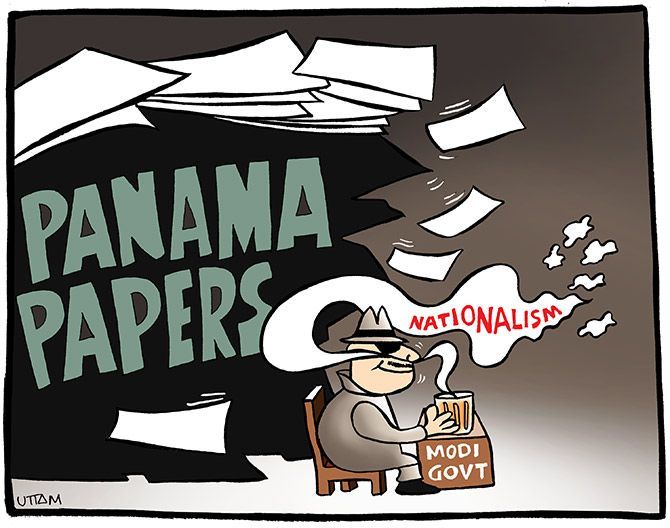

Illustration: Uttam Ghosh/Rediff.com

The government started its investigations into the fresh Panama Paper leaks, even as those named denied any wrongdoing.

The finance ministry on Thursday said the fresh revelations are being looked into by the Multi Agency Group (MAG), headed by the Central Board of Direct Taxes chairman as its convener and comprising representatives of the income-tax (I-T) department, Enforcement Directorate, Financial Intelligence Unit, and the Reserve Bank of India.

“The fresh release... under the Panama Paper leaks is being promptly looked into by the law enforcement agencies under the aegis of the MAG already constituted for facilitating coordinated and speedy investigation,” the ministry said in a release.

The Panama Paper leaks were originally revealed by the International Consortium of Investigative Journalists on April 4, 2016, following which, the government had set up the MAG to probe the matter.

Meanwhile, businessman Jalaj Ashwin Dani and KBM Global, named in the fresh leaks, refuted all allegations.

A company official on behalf of Kavin Bharti Mittal (KBM) said KBM is the sole beneficial shareholder of KBM Global.

He said the company was set up by KBM in 2008 for pursuing business activities and making investments in the tech sector.

“KBM is a British citizen by birth and an Overseas Citizen of India. He became a tax resident in India on account of his presence to manage tech start-up from the financial year 2011-12 and accordingly the tax returns filed with the tax authorities provide full disclosure and details about his ownership of KBM Global,” the official said.

Minerva Trust & Corporate Services, a reputed professional service provider, is the appointed administrator of KBM Global.

“They have informed us that they moved all their clients to Harney’s Corporate Services in 2016 for registered agency services,” the official said.

Kavin is founder and chief executive officer of Hike Messenger and son of Sunil Bharti Mittal.

The fresh leaks showed that six months after the earlier Panama Paper leaks, a notice was published by British Virgin Islands Financial Services Commission with the information that the registered agent of the company had been changed from Mossack Fonseca to Harney’s Corporate Services, both located in Tortola in the British Virgin Islands (BVI).

The other set of documents showed that how the shareholding pattern of these two companies changed in March 2106 and how 14 shares from Anten Resources, which was another shareholder of KBM Global, were transferred to Minerva Nominees.

These shares were held under declaration of trust for Kavin Bharti Mittal.

Dani said, “You will appreciate that your presumption, if any, that our investments are illegal, is ill-founded. Please note that this investment is legal and we have reported this investment in our returns to the I-T authorities as well.”

The fresh leaks showed that Dani, who resigned from Asian Paints in April 2017, and his wife Vita Dani were linked to a BVI entity called Poinsettia Group Holdings.

Naveen Wadhwa, tax experts at Taxmann, said all ordinary residents filing return of income (ITR) for the financial year 2011-2012 and subsequent years were required to disclose their foreign assets and income earned outside India.

“In case a taxpayer failed to disclose such details in ITR then the same shall be deemed to be an undisclosed income of taxpayer.

"Any undisclosed income detected by the I-T department, in case of person found during Panama Paper leak, would be taxed at a flat rate of 60 per cent plus a further penalty of 10 per cent of tax,” he said.

The finance ministry said the Panama Paper leaks involving 426 people have been already investigated by the I-T department and other member agencies of the MAG.

After thorough investigation, involving examination of the disclosures made in the ITRs, particularly the foreign assets (FA) schedule, residential status, responses to questionnaires issued, responses received from foreign jurisdictions and details of foreign remittances made, 352 cases were found to be non-actionable, the ministry said.

Among other 74 cases, it said “invasive actions” were taken in 62 cases, with searches conducted in 50 cases, and surveys in 12 cases leading to detection of undisclosed foreign investments of about Rs 1,140 crore.

In 16 cases, criminal prosecution complaints have been filed in jurisdictional courts which are at various stages of hearing. In 32 cases, notices under Section 10 of the Black Money Act have been issued.

“The investigations conducted in Panama Paper cases reflect the government’s continued focus in dealing with black money stashed abroad. The promptness in action is more than evident as most of the actionable cases have been effectively addressed,” the ministry said.

It further said that though the investigating agencies faced problems of incomplete data and absence of financial information as well as not very prompt cooperation from other countries, the overall outcome has been “very satisfactory”.

The government would like to assure that the fresh series of Panama Papers information would also be effectively addressed within a reasonable time frame, it said.

The ministry said that the standard operating procedures in place for investigating such cases will be followed.

The procedure involves examining the information revealed in the media release with the disclosures made by the alleged persons in the annual returns of income filed, particularly in the FA schedule, foreign remittance details will be undertaken expeditiously, followed by raising of relevant queries.

© 2025

© 2025