For the first eight months of the current financial year, reports Ishan Bakshi, the figure stood at Rs 7.17 trillion.

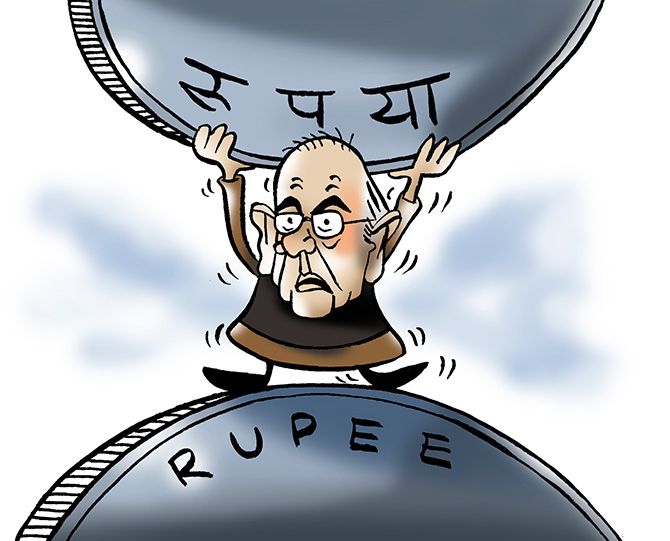

Illustration: Uttam Ghosh/Rediff.com

The central government's fiscal deficit widened further in November, after crossing the budgeted target last month, due to slower-than-expected growth in indirect tax collection.

The fiscal deficit stood at Rs 7.17 trillion at the end of November 2018, 114.8 per cent of the budgeted target of Rs 6.24 trillion, showed the latest data released by the Controller General of Accounts.

Slower revenue growth puts pressure on the Centre to meet the budgeted fiscal deficit target of 3.3 per cent of gross domestic product in 2018-19 (FY19), which may force it to cut capital expenditure (capex) this year and carry over some subsidies to the next year.

"Fears of fiscal slippage will persist, with the government's fiscal deficit having risen to 115 per cent of the Budget Estimate (BE) for FY19 in the first eight months of the year," said Aditi Nayar, principal economist, Icra.

"There are several risks to meeting the budgeted targets for revenue and expenditure, with one of the predominant concerns arising from a possible shortfall in indirect tax collection, despite the seasonal pickup in tax revenues in the last quarter of every fiscal year," Nayar added.

The pressure to meet the deficit target is already evident, with capex contracting in the last three months. In November alone, capex contracted 33%.

"It appears the course correction has already begun and the axe has once again fallen on capex," said Devendra Pant, chief economist, India Ratings and Research.

On the revenue side, while direct tax collection continued to witness robust growth, indirect tax collection remained sluggish.

Indirect tax collection (central goods and services tax, or GST, integrated GST, Union Territory GST, Customs, excise, and service) has contracted 3.5% during April-November year-on-year.

"In April-November 2018, CGST collections stood at a relatively moderate 49% of the FY19 BE of Rs 6 trillion, which suggests an impending shortfall relative to the level budgeted by the Government of India for this fiscal year. The provisional settlement of IGST, as well as residual GST compensation cess (after disbursal to states), will be key in augmenting the government's cashflow in the coming months," said Nayar.

Direct tax collection grew by a healthy 16.5%, with both corporation tax and income tax collection growing at around the same pace.

On the non-debt capital side, while disinvestment proceeds have more than doubled to Rs 340 billion in December, up from Rs 158 billion in November, economists remain concerned about meeting the Budget target.

"Divestment is way below the budgeted target of Rs 800 billion and may result in some slippage," said Pant.

"Although potential buybacks by some public sector undertakings and purchase of the government's stake in certain entities by other PSUs may help shore up the disinvestment proceeds, some concerns linger over the likelihood of achievement of the full-year target," said Nayar.

It is possible that in order to meet the fiscal deficit target, the government may roll over part of the subsidies due for the current year to the next financial year. It has already released 93% of its budgeted fuel subsidies in April to November.

"There could be deferment of some expenditure to the next year such as payments to other government entities like the Food Corporation of India," said Madan Sabnavis, chief economist at CARE Ratings.

"It will be interesting to see if the government will get interim dividend, surplus from the RBI. This will help shore up revenue," Sabnavis added.

The government has demanded Rs 100 billion of interim dividend from the RBI this financial year.

© 2025

© 2025