The enforcement agency is looking to ensure that no big deals or transactions, such as the one Mallya struck with Diageo for Rs 500 crore, take place.

The Enforcement Directorate (ED) is working on ways to ensure that transactions such as the one industrialist Vijay Mallya struck with Diageo for Rs 500 crore (Rs 5 billion) don't take place in future.

It will shortly ask national depositories to freeze the shares owned by Mallya in listed companies, two persons familiar with the plan told Business Standard.

At present, Mallya holds stakes in United Breweries (Holdings) Ltd (UBHL), United Spirits (USL), and Mangalore Chemicals and Fertilizers Ltd (MCFL).

The ED has informed market regulator Securities and Exchange Board of India about the share freeze. It will write to the National Securities Depository Limited and Central Depository Service Limited, the two national depositories, said an ED official on condition of anonymity.

Confirming the development, another ED official, who also did not wish to be named, told Business Standard that the agency wants to ensure that no third-party rights are created by Mallya or a group company owned by him.

By taking such a step, the ED is looking to ensure that no big deals or transactions, such as the USL-Diageo one, takes place.

In February, Mallya had reached a Rs 500-crore deal with Diageo, to whom he had sold controlling stake in USL in a multi-billion dollar deal, to step down from the chairman’s post of the liquor company.

Mallya’s holding company UB Holdings now has a four per cent stake in United Spirits. He is no longer the largest shareholder in United Breweries, and has lost management control of MCFL.

Although the entities controlled by Mallya still own 32.4 per cent of United Breweries (Heineken, which acquired S&N owns more, around 37.5 per cent), four per cent of United Spirits and 22 per cent of Mangalore Chemicals.

However, more than half the shares in United Breweries and United Spirits are pledged to UB Group lenders.

It is learnt that the board of MCFL, which Zuari Fertilizer & Chemicals took over last year after wresting control from Mallya, had appointed Ernst & Young LLP to do a forensic investigation into the Rs 200-crore investment MCFL had made in Bangalore Beverages Ltd.

The audit was also asked to look into various advances made by MCFL to Mallya's flagship UBHL, of which a sum of Rs 16.68 crore was outstanding as of March 31, 2016.

Bangalore Beverages is a step-down subsidiary of UBHL and is facing liquidity crunch.

The audit found that these “transactions may have involved irregularities and elements of mismanagement in the company.”

MCFL has made provision of Rs 200 crore for potential diminution in the value of investments in Bangalore Beverages Ltd.

It has also provided for Rs 16.68 crore advances receivable from UBHL in its books of account for 2015-16.

Earlier, alleged financial irregularities had come to fore at United Spirits relating to loans advanced to UB Group firms including for the now-defunct Kingfisher Airlines.

Mallya, who left India for the UK following the deal with Diageo, has resigned from the Rajya Sabha ahead of a hearing by a Parliamentary ethics panel.

The ED is also investigating Mallya for suspected money laundering on suspicion of siphoning part of a 2010 IDBI Bank loan of Rs 950 crore to Kingfisher Airlines.

BELEAGUERED BARON

At present, Mallya holds stakes in United Breweries (Holdings) Ltd, United Spirits, and Mangalore Chemicals and Fertilizers Ltd.

Mallya’s holding company UB Holdings now has a four per cent stake in United Spirits.

Although the entities controlled by Mallya still own 32.4 per cent of United Breweries (Heineken, which acquired S&N owns more, around 37.5 per cent), four per cent of United Spirits and 22 per cent of Mangalore Chemicals. However, more than half the shares in United Breweries and United Spirits are pledged to UB Group lenders.

ED is looking to ensure that no big deals or transactions, such as the USL-Diageo one, takes place.

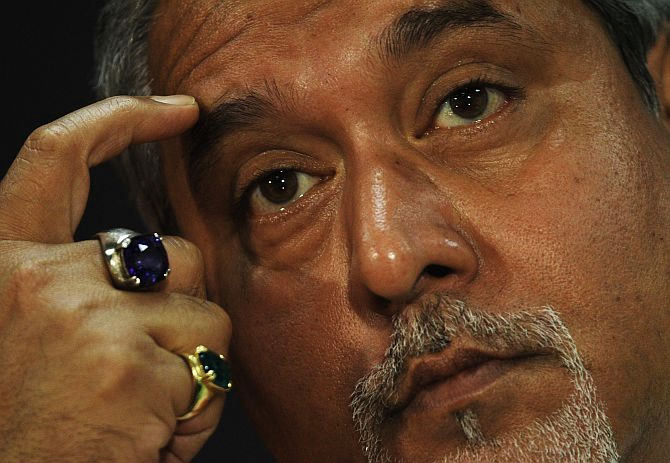

Photograph: Reuters

© 2025

© 2025