It had declined by slightly over 4 per cent in December. The city contributes 37 per cent to the total direct tax revenues. If the trend continues, it could affect the Budget estimates of Rs 13 trillion for the current fiscal year.

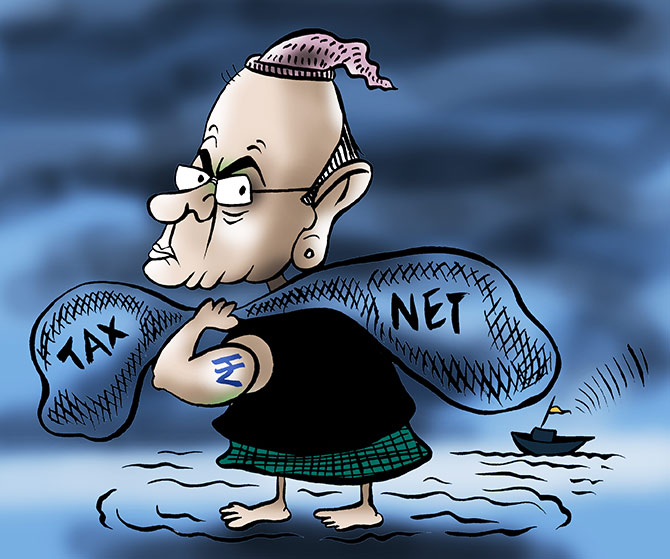

Direct tax collections from India’s commercial capital, Mumbai, slipped again after witnessing a decline in December, prompting tax officials to call the development rare as a double-digit fall has happened for the first time in the past decade.

Mumbai’s share in the collections fell by about 13 per cent by mid January.

It had declined by slightly over 4 per cent in December.

The city contributes 37 per cent to the total direct tax revenues.

Sources said the total direct tax collection figures have not even touched the Rs 9-trillion-mark, leaving a gap of Rs 5 trillion to be achieved in another two months if Budget targets are to be achieved for 2019-20.

If the trend continues, it could affect the Budget estimates of Rs 13 trillion for the current fiscal year, a tax official said.

Looking at the steep fall, the Central Board of Direct Taxes (CBDT) has called an urgent meeting on Tuesday.

It has asked all principal chief commissioners and officials of same rank to discuss strategies to achieve the target for the last quarter (January-March).

Sources said the finance ministry, too, has been apprised of the situation and an urgent review was sought in the Budget, which is to be tabled on February 1.

Total collections from Mumbai up to December stood at Rs 2.20 trillion - 4.3 per cent less compared to Rs 2.30 trillion in the same period last year.

The fall further grew to double digits after the department released refunds on December 31, an I-T official said.

“This is a matter of concern and there is no way we can reach even close to the target," said another senior tax official.

Meanwhile, the direct tax body is learnt to have ordered its field officials to step up efforts and put more focus on recovering tax arrears.

It has also asked international taxation wing and officials from Commissioner (Appeals) to reveal the status of certain important cases, which are expected to boost collection figures.

I-T officials have also been asked to verify payment of advance tax by property sellers in cases where tax deduction at source (TDS) has been made by the buyer but it has not been paid to the government.

The CBDT said officials could adopt other strategies depending on the nature of respective regions and jurisdictions.

Figures show tax collections lost steam in the September quarter.

Advance tax collection figures of third quarter also pressed the panic button within the department.

It fell to Rs 73,000 crore in the third quarter, compared with Rs 77,000 crore a year ago, while personal income tax paid in advance rose to Rs 33,000 crore against Rs 24,000 crore over this period in FY19.

Till December 15, gross direct tax collection has touched Rs 8.34 trillion compared with Rs 7.96 trillion in the same period last year.

Tax collection, net of refunds, was around Rs 6.75 trillion as compared with Rs 6.7 trillion in the same period last year.

© 2025

© 2025