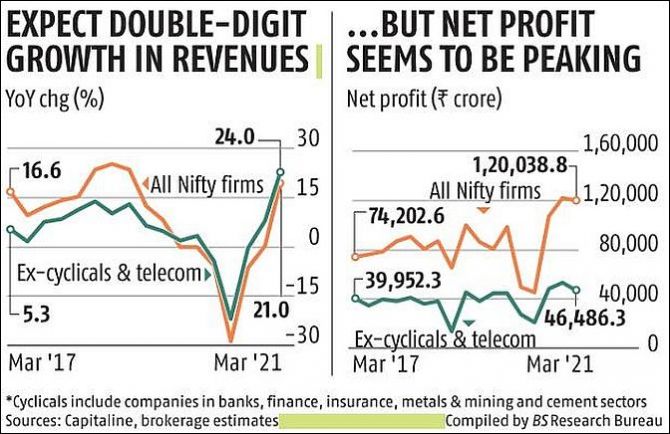

The earnings are, however, expected to be down around 2 per cent on a sequential basis due to pent-up demand getting exhausted and the adverse impact of rising metals and energy prices on consumer goods and manufacturing companies.

Led by a surge in prices of metals and energy and a continued better show by lenders, India Inc is expected to report high double-digit growth in revenue and one of the highest quarterly profits in the fourth quarter of 2020-21.

Year-on-year growth, however, will be amplified by the low base in Q4FY20 due to Covid-19 lockdown.

The country’s top brokerages expect Nifty50 companies to report a combined net profit of Rs 1.2 trillion in Q4FY21, translating into year-on-year growth of 142 per cent from Rs 49,645 crore a year ago.

The earnings are, however, expected to be down around 2 per cent on a sequential basis due to pent-up demand getting exhausted and the adverse impact of rising metals and energy prices on consumer goods and manufacturing companies (see the charts).

The analysis is based on earnings estimates for Q4FY21 by equity brokerages including Motilal Oswal Financial Services, Kotak Institutional Equity, and Edelweiss Securities.

For banks and non-banking financial companies, net sales are net interest income, while for others their total income is from sales of goods and services (net of indirect taxes).

Net sales and net profit after tax for Q3FY21 are based on brokerage estimates while its reported numbers are for the earlier quarters.

The surge in profits is expected to be led by top companies in cyclical sectors such as metals and mining, oil and gas, banks, non-banking financial companies, and cement companies.

Metals and mining companies are expected to report their highest ever quarterly net profits in Q4FY21, up nearly four times on a y-o-y basis and nearly 60 per cent higher than the previous high in Q4FY19.

Similarly, oil and gas companies are expected to report all-time high profits in Q4FY21.

The companies in these cyclical sectors, along with telecom major Bharti Airtel, will account for nearly three-fourths of incremental growth in index earnings in Q4FY21 on a year-on-year basis.

The combined net profit of index companies, excluding cyclicals and telecom, is expected to be down 12.8 per cent on a sequential basis, hinting at a plateauing of corporate earnings in the near term.

“On a reported basis, profit growth is likely to be very strong in cyclicals — commodities, banks, industrials, and consumer discretionary ex-auto.

"However, some softening in the earnings momentum is likely in FMCG, cement and domestic auto owing to rising input price pressures,” write Prateek Parekh, Aditya Narain and Padmavati Udecha of Edelweiss Securities on their earnings preview for the fourth quarter.

With this the index companies are expected to end FY21 with net profits of Rs 3.94 trillion, up 25 per cent year-on-year.

However, accounting for a low base in FY20, the two-year compound annual growth rate in Nifty earnings is expected to be around 9 per cent.

“After two consecutive quarters of solid earnings beats and upgrades, we expect another strong quarter, aided by a deflated base of 4QFY20 and healthy demand recovery for the large part of 4QFY21 – as attested by high-frequency indicators.

"Performance is expected to be healthy despite headwinds of commodity cost inflation in various sectors,” write analysts at Motilal Oswal Financial Services on their earnings preview for Q4FY21.

The index companies are expected to report net sales (net interest income in the case of lenders) of Rs 10.83 trillion in Q4FY21, up 21 per cent on a year-on-year basis.

Growth in the top line is, however, expected to be a moderate 6 per cent over Q4FY19 quarter.

Sequentially, the combined net sales of the Nifty 50 companies are expected to be higher by 7.6 per cent over the Q3FY21 quarter.

Revenue growth will be led by non-cyclicals sector such as automobiles, FMCG, consumer durables, and power utilities, largely due to the base effect.

The revenue in these sectors was adversely impacted by the lockdown announced on March 24, 2020.

“Robust revenue growth rides on a low base of the corresponding quarter a year ago, besides higher government capital expenditure, and higher realisations amid a commodity upcycle, among others.

"A closer look at the revenue breakup indicates 50 per cent of the recovery is contributed by three key verticals – automobiles, IT services and construction,” said Hetal Gandhi, director, CRISIL Research.

Among index companies, Indian Oil Corporation is expected to top the charts with nearly Rs 10,200-crore y-o-y swing in its profits, accounting for 13.5 per cent of incremental profit growth of all Nifty 50 companies.

It is expected to be followed by Tata Steel with a profit swing of nearly Rs 8,600 crore.

Other companies likely to report big profit swings include Bharti Airtel (Rs 6,500 crore), Reliance Industries (Rs 5,500 crore), and Bharat Petroleum Corp (Rs 3,900 crore).

At the other end of the spectrum, five index companies are expected to report a year-on-year fall in their net profit.

They are SBI Life Insurance, HCL Technologies, Dr Reddy's Lab, ITC, and Ultratech Cement.

© 2025

© 2025