Check out some of the stocks that will react on the basis of their numbers in the near term.

Emami: More gains ahead for the stock?

Yash Upadhyaya reports.

A sustainable volume-led recovery driven by healthy rural demand, focus on expanding distribution reach, new product launches and commitment to bring down pledge on promoter shareholding has turned the Street bullish on consumer goods firm, Emami.

In the December 2020 quarter (Q3), Emami reported a second successive quarter of double-digit volume growth -- a first since Q1FY19 -- led by robust traction in the rural markets.

Emami derives close to 55 per cent of its overall revenues from the hinterland.

The figure is considerably higher than the industry average of 35 to 40 per cent, according to analysts' estimates.

Rural areas and small towns have been relatively less impacted because of the Covid-19 pandemic as reflected in the pace of recovery in the region.

Moreover, strong cropping season aided by healthy monsoons, the government's efforts to support farmers by increasing the minimum support price (MSP) for rabi crops, and improving availability of finance have boosted income of rural households.

And the trend is expected to continue.

The company is also focused on expanding its rural distribution reach and has started a pilot project in top four states in Phase 1 and a further 12 states in phase-2.

Emami also has a large presence in the ayurvedic products segment under its Zandu brand.

It has capitalised on the recent shift in consumer preference to Ayurvedic products following the COVID-19 outbreak and has launched a slew of new products.

Additionally, the company has launched a new brand 'Emasol', which offers a complete range for home hygiene products.

Notably, operating profit margin, too, expanded by nearly 400 basis points to an all-time high of 36.4 per cent in Q3, aided by overall cost efficiencies.

However, some moderation can be expected in the margins due to rising raw material prices (particularly liquid light paraffin) and normalising advertising spends from FY22 onwards, say experts.

Going ahead, the management is confident of extending the strong growth momentum for a third consecutive quarter and hopes to end the financial year with a high-single digit growth.

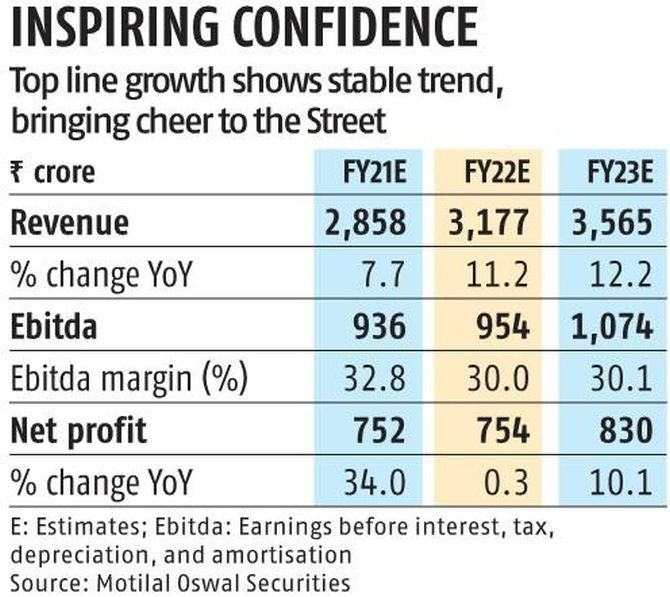

In this context, analysts have upped their forward estimates and target prices for the stock.

Motilal Oswal Securities has increased its earnings per share (EPS) estimates by 9.8 per cent, 12.1 per cent and 11.7 per cent for FY21, FY22 and FY23, respectively, while increasing their 12-month price target from Rs 1,310 to Rs 1,425 per share.

Troubles at the group level due to high debt and promoters pledging their shares have been a key overhang on the stock in recent years.

However, the group has been focused on reducing its overall debt and to that extent has managed to sell its cement and solar power assets.

With these divestments, promoter debt taken against pledged Emami shares has more than halved and the group plans to further reduce debt by selling other non-core assets.

This has helped bring down the proportion of promoter pledged holding from its peak of 90 per cent in June 2020 to 39 per cent as of December.

With the worst of the promoter issues largely behind and pick-up in the company's core business, analysts at Jefferies believe that Emami -- trading at 32 times its FY22 estimated earnings -- makes for an attractive bet in the FMCG space.

Other FMCG peers trade at a premium of 20-25 per cent.

The stock, which hit a multi-year low of Rs 140.85 on 30 March 2020, has risen 3.4 times since then.

On Friday, January 29, even as leading indices fell, it was up 1.9 per cent at Rs 484.10.

Given this, there could be more gains ahead.

Key risks include the seasonality of Emami's winter/ summer portfolio, dependence on rural markets and the wholesale channel, sharp increase in input prices and delay in further resolution of debt issues at the promoter and group level.

Shriram Transport: Business bounce back at full throttle in Q3

Hamsini Karthik reports.

Shriram Transport's December quarter (Q3) results was the first in perhaps two years that the financier did not disappoint the Street on any aspect -- whether growth, asset quality or demand revival.

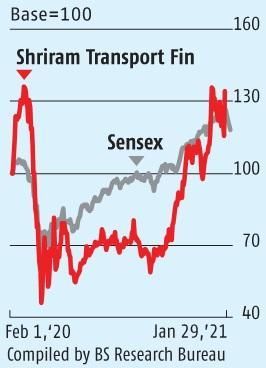

The Street rewarded the stock with over 16 per cent gains reacting to results announced after market hours on Thursday, January 28.

For a company that went into a slump even before Covid for reasons like high cost of funds, weak demand and consequently asset quality pressures, Q3's mere 1.6 per cent increase in net interest income, backed by 5.5 per cent increase in AUM (assets under management) growth was a good enough to cheer.

This has led brokerages to revise their earnings expectation upwards by 15-36 per cent for FY22-23 and CLSA upgraded the stock from 'outperform' to 'buy'.

Upgrades come after 12-18 months of break and Shriram Transport's earnings revision is the highest so far in the financial services space.

Collection efficiency touching 104 per cent in December is a key indicator of business normalisation.

Commentary on tightening the lending practices such as no top-up loans to customers until they meet their existing obligations and on boarding 30-35 per cent of new to Shriram Transport's customers through the referral practice (a custom once popular among banks which helped in tracing the customer in case of default) also suggests that the management is prudent on its growth in the near-term.

As for Q3's AUM growth, the rebound is growth is backed by its mainstay business -- used vehicles -- up nine per cent year-on-year.

The dependence on some of the newly introduced segments such as working capital loans and business loans, to beat the slowdown in the recent period, reduced by down 350 basis points (bps) in Q3.

Within the used vehicles segment, heavy commercial vehicles posted 10 per cent year-on-year growth and medium and light commercial vehicles up nine per cent year-on-year.

In short, Shriram Transport's Q3 numbers reiterate that the market leaders rebound faster than peers.

Yet, Shriram Transport stock may possibly see some correction from current levels mainly due to its asset quality.

While on a sequential and year-on-year basis, numbers improved in Q3, about three per cent of its book is likely to be restructured in the coming months.

The run-rate so far is 0.3 per cent of total AUM or Rs 310 crore.

As more accounts come for recast, the picture may change, and as analysts at Emkay Global Financial Services say the proportion of restructured loans will remain a concern.

For investors, despite Friday (January 29)'s rally, Shriram Transport stock continues to trade at undemanding valuations of 1.1x FY22 estimated book.

However, buying into correction could be more rewarding.

Lupin: Regulatory clearances, US growth near term key triggers

Ram Prasad Sahu reports.

Lupin's December quarter results were a tad below expectations.

Its two biggest markets, India and the US accounting for 70 per cent of the revenues, registered a growth of 5 per cent each over the year ago quarter.

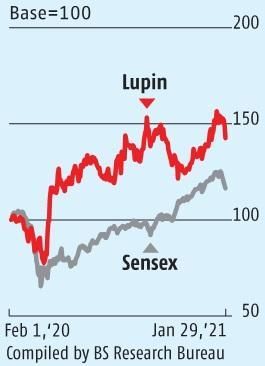

In a weak market, the stock was down 4 per cent.

While the India revenues were broadly in line with expectations, the US market growth was lower than estimates.

Revenue momentum in the market was impacted by the pandemic and weakness in seasonal portfolio (flu medications).

Growth going ahead, however, is expected to improve driven by sharp market share gains in inhaler albuterol, specialty portfolio and biosimilar launches in the US and Europe.

The US abbreviated new drug application (ANDA) pipeline includes 152 pending approval with 16 of them being exclusive first to file drugs.

From its lows last year, the India business continues to see a sequential recovery for the fourth consecutive quarter, with the company outperforming the domestic market with a 8.8 per cent growth in branded formulation sales.

Growth was led by the chronic portfolio with anti-diabetic, cardiac and central nervous system therapies posting double digit uptick.

In addition to the growth outlook, the street would also look at the margin movement in the coming quarters.

Margins in the quarter were up on a sequential and year ago basis to 20.4 per cent.

The company highlighted that R&D spends are being optimised and would be capped at 9 per cent of sales.

The key trigger for the stock would be clearance of its facilities by the US drug regulator (USFDA).

The company had received 13 observations for its US-based Somerset facility which has 40 pending ANDAs recently.

With the USFDA resuming its physical inspections, there could be more clarity on the issue as compared to delays earlier.

While the stock is up 13 per cent since the start of December and has outperformed its pharma peers, the consensus target price of Rs 1,014, indicates hardly any upside from the current levels.

Investors should await growth traction in the US market as well as regulatory clearances for multiple sites which are under US FDA scanner.

© 2025

© 2025