Don't fret too much about the Rate of Interest (RoI) prevailing at the time of availing your home loan.

Don't fret too much about the Rate of Interest (RoI) prevailing at the time of availing your home loan.

Those of you who have been putting off buying a house in the hope that interest rates may fall are probably disappointed that the Reserve Bank of India did not cut interest rates in the latest monetary policy.

On the one hand you are ruing the fact that you waited for a rate cut, on the other hand you are wondering if you should wait till the next policy announcement.

After all, you don't want to be in a situation where you take a loan and within a week interest rates fall.

This brings us to the question: Is there a good time to buy a house? Should you wait for interest rates to fall or take the plunge now?

Don't fret too much about the Rate of Interest (RoI) prevailing at the time of availing your home loan.

Be aware and plan for variations in rates over the tenor of your loan. That will hold you in good stead to be able to meet your current obligations and even plan for a bigger home in future.

Affordability

The key question that you need to ask yourself while contemplating to buy your first home is what can you afford to buy comfortably.

Buy a house, even if it is smaller than you would ideally like, simply because it forces you to set aside money, take control of your expenses, own some space in a city you like living in and get used to paying your Equated Monthly Instalments (EMIs) on time.

You can always upgrade a couple of years later as and when your requirements increase, your financial situation improves or you have a better understanding of the entire home-buying cycle.

Affordability will come back to haunt you on the first of each month, as the home loan EMI hits your bank account.

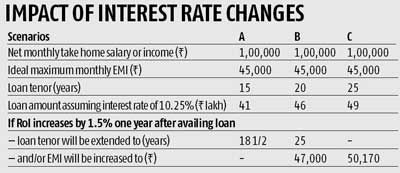

The EMI itself is derived from the loan amount, tenor and rate of interest at the time of availing the home loan.

The tenor that most people opt for is 15-20 years. Try and keep this manageable.

Preferably don't go for a tenor of 25 years, even if your bank offers you that option.

The EMI should necessarily leave enough cash flow for you to manage your monthly expenses.

Variable rate of interest

You have little control on the RoI prevailing. Most home loans come with a variable RoI.

That means, as the bank changes its Base Rate, the RoI on your home loan will go up or down to the extent of the change in base rate.

Remember that you availed of a 15-20 year home loan. The first few years are the ones to watch out for. Any sharp increase in the interest rate environment can cause a large swing in your EMI.

Given that you are already working on a tight monthly budget, this can be very disconcerting.

This is where the possible extra tenor (the advise not to opt for it) can come to your rescue.

Most banks allow you to continue paying the original EMI contracted and extend your loan tenor (within specified limits determined by your age or total tenor not exceeding 25 years) to take care of the higher RoI. You could opt for this facility, till such time that you are comfortable paying a larger EMI.

The challenge with interest rates is that they vary constantly. Fixed rate home loans are not available for 15-20 years. Both variable and semi-fixed home loans (which protect you from interest rate volatility only for a brief period and are more expensive) carry a significant risk.

In the example given in the table, if you had opted for 15 years' tenor and RoI increased by 1.5 per cent after a year, you are looking at having to pay the same EMI for an additional three and a half years.

If you had opted for the 20 years tenor, you would theoretically need to pay EMI for an additional 15 years.

However, your bank would probably not allow such an extension. So, assuming the bank wants the loan paid off in a maximum of 25 years, your EMI would go up to Rs 47,000.

If you had opted for a 25-year tenor, most banks would not agree to extend the tenor. In this case, your EMI would jump sharply to Rs 50,170 for the balance tenor, unless the RoI came off sharply over time.

Dealing with rate spikes

Over the past decade, home loan borrowers have had to face the ugly situation of multiple interest rates spikes.

Some of you have even faced rate hikes of 3 per cent or more, in the years following the global financial crisis in 2008.

Your EMIs have seen periodical upward revision and this has put considerable strain on your monthly budget.

You cannot afford to default on your obligation, as that will impact your credit history negatively.

Measures like short-term loans might provide some respite, but should be avoided as they will come back to haunt you.

If the situation does not seem to be improving, the best strategy is to raise funds by selling some assets and use the proceeds to part prepay your loan. This will help you fix a manageable EMI going forward.

Should you wait?

So, that brings us back to the question: Should you wait? If you are planning to buy your first home, don't be disheartened that the RBI didn't reduce interest rates in the recent policy announcement.

The important thing to remember is that we are in a downward interest rate cycle, and that is great for you.

You could reasonably expect rates to move to your advantage in the next couple of years. That will allow you to repay your loan quicker.

You should preferably not reduce your EMI, but cut the loan tenor instead.

The same will come to your rescue in case the interest rate environment suddenly takes a turn for the worse, as you will be able to opt for a tenor extension, instead of having to pay a higher EMI.

© 2025

© 2025