The external sector remains vulnerable, and India cannot afford an overvalued rupee, says Jaimini Bhagwati.

The external sector remains vulnerable, and India cannot afford an overvalued rupee, says Jaimini Bhagwati.

It is widely accepted that for robust economic growth India needs to stay the course in reducing fiscal imbalances and inflation.

It appears that we do not have a similar degree of consensus about the extent of India's external-sector vulnerabilities. For instance, in the wake of Indian equity market gains and a mood of buoyancy, there may be a sense that the rupee's sharp downward correction and volatility last year is well behind us.

Further, recent media reports indicated that India's foreign exchange (forex) reserves have now reached record high - and, by extrapolation, comfortable - levels. But a review of critical elements in India's balance of payments suggests that we cannot afford an overvalued rupee, and need to aggressively build up forex reserves at every available opportunity.

India's external sector is often discussed with the same embarrassed obfuscation as is a family member who is slow on the uptake. India's trade and current-account deficits are still high, short-term external debt continues to rise and there is unhealthy dependence on non-resident Indian (NRI) remittances and foreign institutional investors' (or FIIs') portfolio investments.

It follows that, in the near term, India does not have room for further opening up of its capital account. Taking this as a given, there is need for greater clarity of purpose about how India manages the external value of the rupee.

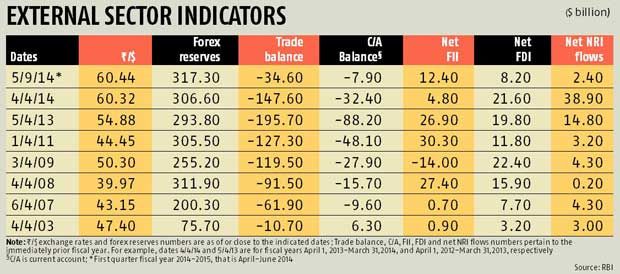

Table I provides simplistic yet revealing numbers on the changes over the last 10 years in the rupee-dollar nominal exchange rate, net forex flows and reserves. It can be seen that forex reserves had touched about $312 billion as far back as April 2008. In fact, the sharpest accumulation in one year was between April 2007 and April 2008, when reserves went up by about $112 billion.

Table I provides simplistic yet revealing numbers on the changes over the last 10 years in the rupee-dollar nominal exchange rate, net forex flows and reserves. It can be seen that forex reserves had touched about $312 billion as far back as April 2008. In fact, the sharpest accumulation in one year was between April 2007 and April 2008, when reserves went up by about $112 billion.

In the six years from April 2008 to April 2014, forex reserves decreased by 1.7 per cent, while India's negative trade balance rose by 61 per cent. Over the same period, net FII investments, foreign direct investment (FDI) and NRI remittances went up and down sharply, based on changing investor perceptions driven by developments in India and elsewhere.

India's short-term (defined as residual maturity of one year) hard-currency debt was uncomfortably high at 57.4 per cent of forex reserves, as of end-March 2014, according to Reserve Bank of India (RBI) estimates.

On the same date, NRI deposits amounted to $103 billion and external commercial borrowings to $143 billion, constituting 24 per cent and 33.3 per cent of total external debt respectively. The significant improvement in the current-account deficit in 2013-14 can be mostly attributed to a contraction in gold imports due to higher import duties and also softening of gold prices.

It can be legitimately argued that there is little that can be done directly by policymakers to raise forex reserves. Changes in forex reserves are a residual after current-account deficits are funded by net forex inflows.

Clearly, there are no short-term solutions to endemic trade deficits, since competitiveness cannot be achieved by flicking a switch. We come back to the same wide-ranging set of problem issues that need to be addressed, such as inadequate infrastructure, and tax and labour reforms.

Using Indian and United States Consumer Price Index numbers and 2004 as the base year, the rupee is at present overvalued in real terms by about 35 per cent against the dollar. Again, since 2004, according to the RBI's Annual Report for 2013-14, the rupee's six-currency real effective exchange rate (REER) is overvalued by 16.2 per cent - and even the 36-currency REER is overvalued by six per cent.

The inevitable conclusion is that the RBI's dollar purchases need to be much larger to address rupee overvaluation. And that the RBI should not be panicked into selling dollars to provide hard-currency liquidity for oil or other much-needed imports. At times of "excess" demand for dollars, the rupee should be allowed to drift lower to market-equilibrium levels.

Brent crude oil prices are currently lower at around $99 a barrel, and this could help ease inflationary pressures. Now is an opportune time to correct the rupee downward to levels consistent with little or no REER overvaluation.

It can be anticipated that there would be considerable pushback from interested domestic and FII quarters. One seemingly plausible argument could be that the rupee cannot be allowed to depreciate as the oil import bill and associated subsidies would go up in rupee terms and make the fiscal deficit look worse.

This is specious logic, since India's oil imports are paid for in hard currency and accounting for imports in rupees does not make this bill materially higher.

It has to be acknowledged, though, that it is difficult to keep the rupee exchange rate competitive, hold inflation down - plus deal with the uncertainty on net capital inflows. There are multiple uncertainties, and keeping the ship of India's balance of payments on an even keel is quite a balancing act.

Irrespective of the imponderables, the benchmark rupee exchange rate, to assess performance, has to be a target that reflects inflation differentials between India and developed countries in whose currencies international trade is invoiced.

To summarise, India could have managed the rupee REER much better. We should not have an episodic - at times active, and on other occasions less engaged - approach to managing the exchange rate.

It is high time to manoeuvre the rupee more effectively and predictably, even as it has to be recognised that such tweaking of the rupee needs to be accompanied by reforms to the real sector and factor markets.

The writer, a finance professional and former Indian High Commissioner to the United Kingdom, is currently RBI Chair professor at ICRIER.

© 2025

© 2025