UK-based Cairn Energy PLC on Wednesday said it has agreed to drop litigations to seize Indian properties in countries ranging from France to the UK as it has accepted the Indian government's offer to settle tax dispute relating to the levy of taxes retrospectively.

Meeting the requirements of new legislation that scraps levy of retrospective taxation, the company has given required undertakings indemnifying the Indian government against future claims as well as agreeing to drop any legal proceedings anywhere in the world.

The government now has to accept this and issue Cairn a so-called Form-II, that will commit it to refund the tax collected to enforce the retrospective tax demand.

Following the issue of Form-II, Cairn will withdraw legal proceedings and will get a refund of Rs 7,900 crore.

Cairn said its undertaking shall be treated as having never been furnished if the Principal Commissioner for Income Tax either rejects the undertaking given by it in Form No.1 under rule 11UE(1) or the intimation of withdrawal given under rule 11UF(3), or declines to grant the refund.

Only after the refund is issued will the new legislation will be seen as working in the eyes of foreign investors.

In a statement, Cairn said it has "entered into undertakings with the Government of India in order to participate in the scheme introduced by recent Indian legislation, the Taxation Laws (Amendment) Bill 2021, allowing the refund of taxes previously collected from Cairn in India."

"Subject to certain conditions, the Taxation Amendment Act nullifies the tax assessment originally levied against Cairn in January 2016 and orders the refund of Rs 7,900 crore which was collected from Cairn in respect of that assessment," it said.

Seeking to repair India's damaged reputation as an investment destination, the government in August enacted new legislation to drop Rs 1.1 lakh crore in outstanding claims against multinationals such as telecom group Vodafone, pharmaceuticals company Sanofi and brewer SABMiller, now owned by AB InBev, and Cairn.

About Rs 8,100 crore collected from companies under the scrapped tax provision are to be refunded if the firms agreed to drop outstanding litigation, including claims for interest and penalties. Of this, Rs 7,900 crore is due only to Cairn.

Subsequent to this, the government last month notified rules that when adhered to will lead to the government withdrawing tax demands raised using the 2012 retrospective tax law and any tax collected in the enforcement of such demand is paid back.

For this, companies are required to indemnify the Indian government against future claims and withdraw any pending legal proceedings.

"In order to satisfy those conditions, Cairn will commence the filing of the necessary documentation under rule 11UF(3) of the Indian Income Tax Rules 1962(Rules) intimating the withdrawal, termination and/or discontinuance of various enforcement actions," the firm said in the statement.

Cairn said it is working collaboratively with the Government of India towards expediting the refund within the process of the Tax Amendment Act Rules.

From the refund it gets from the Indian government, Cairn will pay a previously announced special dividend in early 2022.

"Pursuant to the undertakings issued under clause (a) of Rule 11UE of the Indian Income Tax Rules, 1962, Cairn UK Holdings (together with its parent company Cairn Energy PLC as an 'Interested Party') hereby confirms that any claims arising out of or relating to the relevant order(s) (as defined in the Rules) or any related award, judgment or court order, no longer subsist," it said.

The two have given an undertaking to "forever irrevocably forgo any reliance on any right and provisions under the awards, judgments and court orders."

Also, "given a complete release of the Republic of India and any Indian Affiliates with respect to the awards, judgement and court orders and with respect to any claims pertaining to the relevant order(s), as well as an indemnity in respect of any claims brought against the Republic of India or any India affiliate, including by related parties or interested parties," it said.

Cairn said the undertaking "confirmed that they will treat any such awards, judgement and court orders as null and void and without legal effect to the same extent as if they had been set aside by a competent court and will not take any action or initiate any proceeding or bring any claim based on that."

The August legislation canceled a 2012 policy that gave the tax department power to go back 50 years and slap capital gains levies wherever ownership had changed hands overseas but business assets were in India.

The 2012 legislation was used to levy a cumulative of Rs 1.10 lakh crore of tax on 17 entities including UK telecom giant Vodafone but nearly 98 per cent of the Rs 8,100 crore recovered in enforcing such a demand was only from Cairn.

An international arbitration tribunal in December overturned a levy of Rs 10,247 crore in taxes on a 2006 reorganisation of Cairn's India prior to its listing, and asked the Indian government to return the value of shares seized and sold, dividend confiscated and tax refund withheld.

This totaled $1.2 billion-plus interest and penalty.

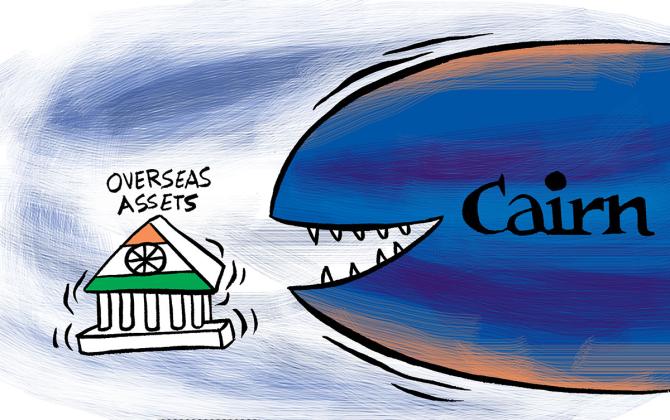

The government initially refused to honour the award, forcing Cairn to identify $70 billion of Indian assets from the US to Singapore to enforce the ruling, including taking flag carrier Air India Ltd to a US court in May.

A French court in July paved the way for Cairn to seize real estate belonging to the Indian government in Paris.

All these litigations will be dropped.

© 2025

© 2025