Capital gains exemption benefits are available under Section 54 and 54F of the Income Tax Act.

Individuals need to be aware of the conditions attached to these provisions, suggests Archit Gupta, founder and CEO, ClearTax.

Property investments typically involve huge sums of money.

Buyers sometimes sell one residential property and reinvest the money so obtained in another.

In other cases, they liquidate some other assets to buy a property.

The Indian tax law grants exemption to individuals who sell their assets and invest in a house property.

Capital gains exemption benefits are available under Section 54 and 54F of the Income Tax Act.

Individuals, however, need to be aware of the conditions attached to these provisions.

Exit one property and reinvest in another

Individuals who have earned capital gains from the sale of one residential house and wish to reinvest it in another can claim exemption on capital gains under Section 54.

The key point to remember here is that this exemption is allowed on the lower of capital gains and the amount invested in a new house.

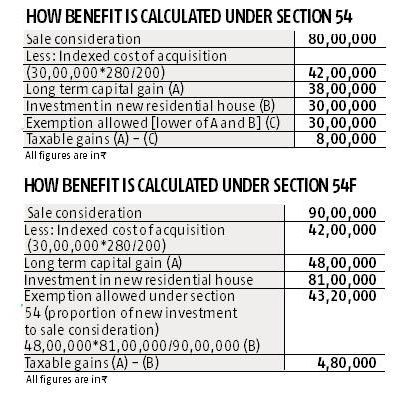

Let us take an example in order to understand this point well.

X sells his residential house on June 20, 2018 for Rs 8,000,000.

He had bought the house for Rs 3,000,000 on January 10, 2013.

With the proceeds of the house, X purchases a new residential house for Rs 3,000,000.

The calculation of the capital gains and the exemption is shown in the table (How benefit is calculated under Section 54).

Another conditions that must be fulfilled for claiming this exemption is that the property that is sold should have been held by the taxpayer for more than two years.

There has been a recent change in Section 54.

This exemption is now extended with effect from April 1, 2019 to investment in two residential properties (only once in a lifetime benefit), the one condition being that the gains are not above Rs 2 crore.

Investment in housing on sale of any other asset

The rules governing such a transaction fall under Section 54F of the Income Tax Act.

Many taxpayers tend to liquidate other assets to purchase a house property.

They may sell land, jewellery or other capital assets to invest in a house.

Such individuals, who have earned capital gains from the sale of another asset and want to invest in a residential house, can also avail of exemption from taxation of their gains.

Unlike the exemption discussed above, to claim exemption for capital gains on sale of assets other than house property, the benchmark is investment of sale proceeds.

Exemption is allowed in the proportion that the investment in the new house bears to the sale amount.

Therefore, exemption under Section 54F is different from that under Section 54.

The method of calculation differs in both the exemption provisions.

In Section 54F, the net proceeds from the sale of any other capital assets have to be reinvested in a residential house property, whereas Section 54 allows an exemption on the lower of LTCG earned and the amount reinvested.

Let's understand this better through an example.

Z sells a plot of land on June 20, 2018 for Rs 9,000,000.

He had bought the land for Rs 3,000,000 on January 10, 2013.

With the proceeds of the land, he purchases a new residential house for Rs 8,100,000.

The calculation of capital gains and the exemption will be as shown in the second table (How benefit is calculated under Section 54F).

In case the taxpayer wants to claim full exemption, he must invest the entire sales proceeds of Rs 90 lakh.

In addition, to claim this exemption the property that is sold should have been held by the taxpayer for more than two years.

Also, on the date of sale, the taxpayer should not own more than one house property.

This is apart from the new residential house.

Several other conditions have to be fulfilled to meet both the exemptions mentioned above.

Reinvest within stipulated time period

A taxpayer can acquire a residential house within a span of two years.

A residential property which has been purchased a year before the sale will also qualify for exemption.

In the case of an under-construction property, taxpayers have up to three years to complete the construction.

Also, the new property must be situated in India.

Deposit in capital gains account scheme

Taxpayers who are unable to invest the proceeds or capital gains have the benefit of depositing the amount of gain or sale consideration in a capital gains account scheme.

The deposits have to be made with any branch of a public sector bank on or before the due date for furnishing of income tax return for the year in which the property was sold.

Taxation of unutilised amount

Taxpayers have to utilise the amount deposited in the capital gains account scheme.

If they fail to utilise this amount within the specified time, they will have to pay tax on the gains which were earlier exempted at the end of three years from the date of sale of the property or asset.

© 2025

© 2025