The government could look at providing deductions for expenses incurred by salaried employees while working from home in the upcoming Budget as it looks to boost demand, consulting firm PwC India said on Thursday.

Addressing a pre-Budget session, Pwc India senior tax partner Rahul Garg said demand creation is particularly focussed on money being given or left in the hands of the individuals.

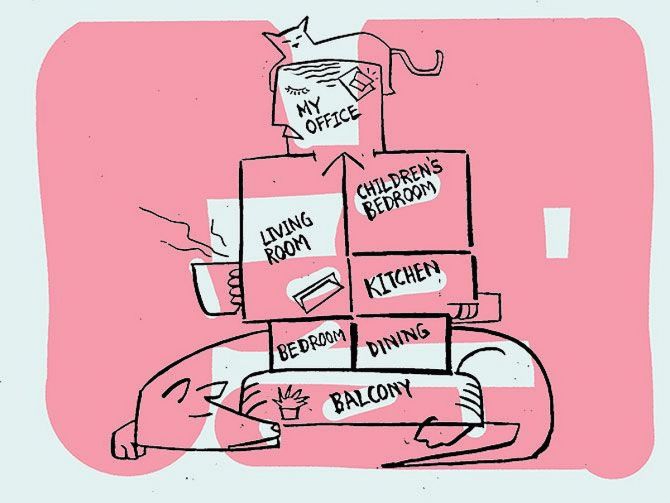

“One clear thinking is at the level of small to medium taxpayer can we look at, in view of the COVID, a deduction to them particularly for salaried employees when they work from home.

"So whatever expenditure they are incurring working from home, which expenditure in the typical case would have been incurred in office by their employers if they were using offices to work if you allow that to be treated as giving them an entitlement for deduction and that saves tax for them. It will leave more money in their hands," Garg said.

Following the outbreak of COVID pandemic early last year, many companies adopted a work from home policy for their employees.

Garg said such a measure would be "reasonably equitable" because if businesses were to incur that expense, that would have been a deductible expenditure in their books.

Today that deductible expenditure sits in the hand of the individual and therefore there is no tax base reduction or sacrifice of any revenue, he said.

“It creates a situation of shifting the money in the hands of individual by giving a concession or deduction in respect to COVID related expenses and they could look at few thousand rupees per month and every person who is employed can get deduction and tax relief in their hand and contribute to demand creation," Garg noted.

He said the Budget, to be unveiled on February 1, could also see amendments in the tax laws for entities who are facing unintended tax consequences for overstaying in India and has therefore become a resident in India, and therefore his global income becomes taxable in India or the income beyond what was intended to be taxable in India becomes taxable due to forced stay.

Pratik Jain, who leads the indirect tax practise at PwC India, said while there is not much scope for increase in customs duties, there is no possibility for a reduction in excise duty on petroleum products.

"There are two things which we are talking about - one is increasing customs duties on a lot of finished products particularly for items where the government has come out with Production Linked Incentive (PLI) scheme. It could be consumer electronics, auto components.

"There are discussions which I have heard there are plans to increase duties on cellphone, furniture and so on," Jain added.

He said in the last two years the government has come out with an amnesty scheme for excise and service tax followed by Vivad de Vishwas scheme for settling direct tax disputes.

"Customs was not touched earlier and maybe a right time to get a similar scheme under customs and allow the industry to pay of disputed tax and if you waive off penalty you may be able to garner Rs 15,000-20,000 crore," Jain said.

With regard to the imposition of COVID cess, Jain said, "My sense is that if they want to collect an additional amount of money and if they fund expenses for vaccines then it would be broad-based and not limited to few products and would be applied on base value and not on tax component".

© 2025

© 2025