Oil sank to the lowest level in a month after shedding all of its gains from the US-Iran clash as traders waited to see whether any further hostilities will disrupt exports from the East Asia.

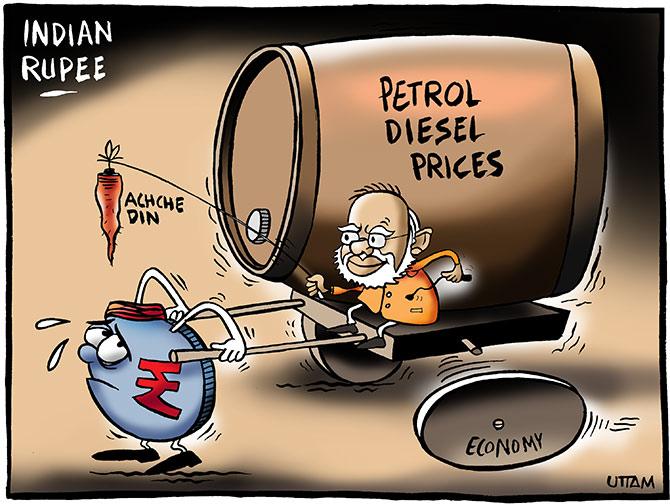

On top of the sustained economic slowdown that the Narendra Modi government has to factor in as it readies the 2020-21 Union Budget, there is also the uncertainty of further flashpoints in West Asia and the resultant impact on crude oil prices.

Analysts and economists, however, say that as long as crude prices stay below the $70 a barrel level, neither the Centre’s Budget maths nor inflation trends will be affected adversely.

And going by the recent statements from global leaders, including US President Donald Trump, a de-escalation is being sought, which is good news for Budget-makers.

“We would be okay if the budget-makers have assumed average crude price for the coming fiscal year between $65-70 a barrel for their fiscal arithmetic.

"The critical point is that the fiscal arithmetic needs to get more credible,” said Shubhada Rao, chief economist at YES Bank.

“The economy and the Centre’s Budget calculations are unlikely to be significantly impacted if crude stays below $70 for a sustained period.

"Even if it goes above that for a short period, there shouldn’t be a big impact.

"If crude prices are above that mark for more than two months or so, then there will be a problem,” said Devendra Kumar Pant, chief economist with India Ratings.

Oil sank to the lowest level in a month after shedding all of its gains from the US-Iran clash as traders waited to see whether any further hostilities will disrupt exports from the East Asia, according to Bloomberg.

Futures in New York declined as much as 1.6 per cent on Thursday after losing nearly 5 per cent the day before as President Trump downplayed the impact of missile attacks on American bases in Iraq.

That’s allayed concerns that Washington and Tehran were headed for military confrontation.

There’s been virtually no impact on the supply of oil to the market.

West Texas Intermediate for February delivery weakened 80 cents to $58.80 a barrel on the New York Mercantile Exchange, after climbing as much as 1.2 per cent earlier.

Brent futures for March settlement slipped 66 cents to $64.78 a barrel on the ICE Futures Europe exchange, after rising as much as 1 per cent earlier.

“OPEC region may not want a serious escalation of a war-like situation because their economies may also turn significantly vulnerable.

"Trump’s messaging in the run-up to the Presidential elections is an acknowledgement that he wants to de-escalate,” said Rao, adding it was in nobody’s interest to let oil prices rise.

“Global recovery is nascent and further flashpoints may also affect US recovery.

"The global economy is still not in a position to withstand another big oil shock,” she said.

Pant said any unexpected rise in crude prices in the coming months would not only upend Budget calculations by expanding the petroleum and fertiliser subsidy bills, but will also lead to a rise in inflation, which in turn will force a response on the monetary policy front.

© 2025

© 2025