Cigarettes, phone calls, eating out, branded garments and accessories, air travel are going to be more expensive post Budget.

Cars, cigarettes, branded garments, air travel will become more expensive, while footwear, solar lamps and routers are slated to be cheaper following a host of changes in the tax structure in the Budget for 2016-17.

As a result of additional levy of Krishi Kalyan and infrastructure cess on all services, activities including eating out and payment of bills will also become more expensive.

Continuing the trend set by his many predecessors, Finance Minister Arun Jaitley on Monday imposed up to 15 per cent excise duty on all tobacco products.

Following is a list of items that will turn costlier:

- Cars Cigarettes, cigar, tobacco, paper rolled beedis and gutaka

- All services like bill payments, eating out, air travel, trips to beauty parlours

- Computers

- Mobile phones

- Rail travel

- Readymade garments and branded apparel of more than Rs 1,000

- Gold and Silver; jewellery articles excluding silver

- Water, including mineral water, aerated water containing added sugar or sweetening matter

- Goods and services above Rs 200,000 in cash

- Aluminum foil

- Plastic bags and sacks

- Ropeway, cable car rides

- Imported imitation jewellery

- Industrial solar water heater

- Legal services

- Lottery tickets

- Travelling by hiring stage carriage

- Hiring of packers and movers

- E-reading devices

- Instruments for Voice over Internet Protocol

- Imported Golf Cars Gold bars

- Electricity bills

- Coal

The Finance Minister announced that a 1 per cent additional tax on cars costing above Rs 10 lakh (Rs 1 million). He even made small cars expensive.

“1% additional tax will be charged on luxury cars above Rs 10 lakh,” Jaitley announced.

The finance minister said that a 1 per cent infra cess will be levied on small petrol cars.

A 2.5 per cent infra cess will be imposed on diesel cars.

Four per cent additional levy will also be imposed on high-capacity passenger vehicles and SUVs, Jaitley said.

Following is a list items that will turn cheaper:

- Footwear

- Solar lamp

- Router, broadband modems and set top boxes,

- Digital video recorder and CCTV cameras

- Hybrid electric vehicles

- Sterilised dialyser

- Low cost houses with less than 60 sq mt carpet area

- Hiring of folk artists for performance

- Refrigerated containers

- Pension plans

- Microwave ovens

- Sanitary pads

- Braille paper.

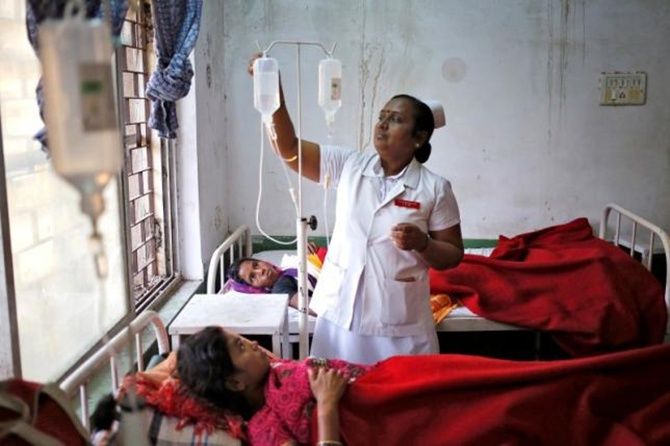

The Budget brought cheers for the insurance sector as service tax was exempted for General Insurance Schemes under Niramaya Swasthaya Bima Yojana.

The finance minister also announced that certain parts of dialysis machines to be exempted from all forms of customs duty.

It was announced that national dialysis service programme will be launched in all district hospitals.

© 2025

© 2025