Are you always at a loss while planning your finances?

Are you always at a loss while planning your finances? Are you aware of the investment options available in the market? How best can you plan your finances?

What are the crieria for evaluating an investment option?

Are mutual funds profitable investment options? When and how should one buy mutual funds?

In an hour-long chat on rediff.com on Thursday, financial planning expert Sailesh Multani offered some valuable tips. Here is the transcript:

Sailesh says, Hi, good evening and welcome to this chat session

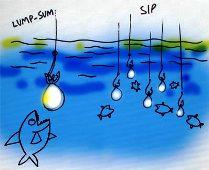

Sailesh says, For the benefit of all the participants who are planning to start SIP or invest lumpsum in equity or balanced funds, I recommend the following equity funds among others: HDFC Top 200, DSP BR Equity Fund, Fidelity Equity Fund. In the balanced fund category I recommend HDFC Prudence Fund. In the ELSS category, my personal favourite is Fidelity Tax Advantage Fund. The fund's performance across the time frame has been consistent

Neeraj asked, which is the right product to invest in?

Sailesh answers, at 2011-01-27 15:59:54hi, the answer to your question will depend on your investment objective, risk taking ability and investment horizon. Once you are crystal clear about these 3 parameters, you can choose the right product for your portfolio. e.g if you are long term investor with time horizon of 5 years and more, willing to take high risk with an objective to grow your money, then the ideal investment option fr you is equity funds.

gj asked, is SIP in Equity MFs is a good option in long term

Sailesh answers, Hi, equity investments need time to grow, typically 3-5 years. Therefore, one needs to have a long term view when it comes to investing in stocks and equity funds. SIP or Systematic Investment Plan is one of the simpler ways of investing in equity funds. Because the units are bought on a particular day of every month irrespective of the market level, it does away with the risk of timing the market. To benefit from SIP, the process should continue for 3-5 years. This helps in averaging the purchase price over the long term as the units are bought over the entire market cycle i.e. bear phase and bull phase.

doctochat asked, leveraging and investing ??

Sailesh answers, Hi, by leveraging and investing I assume you want to know whether you should borrow money and invest. My answer is very simple -NO. This is the most dangerous approach to investing and sure shot recipe for financial disaster. Please never ever invest your borrowed money especially in high risk instruments like equity funds

np asked, Hello sir, which is the right product to invest in? Keep in mind for the long term perspective, Is it the right to invest in GOLD?

Sailesh answers, hi, i just answered a similar question regarding the right investment. You can refer to the reply for that question. coming to Gold - in my view every investor, irrespective of age and risk-profile, should have atleast 10% allocation to gold. Gold is a precious metal and will always remain in short supply. It is the most sought after asset class in times of financial distress like the one we witnessed in the year 2008. Moreover, it is a store of value. The value of gold in terms of goods and services it can buy has remained constant over the centuries. Therefore, investment in gold also serves as a hedge against inflation. Gold as an asset class is less volatile compared to other asset classes like equity, debt and real estate. It can be used to diversify one's portfolio to bring in more stability in returns. For investors who are planning to invest in gold, it makes sense to invest in gold today. However, don't buy all the gold you want to add to your portfolio in one shot. Rather spread your investment over a six months time frame. I would advise investors to invest in Gold Exchange Traded Funds (ETFs) as against physical gold. ETFs are easier to buy and sell. Please keep in mind that you will need to open a demat account compulsorily if you want to invest in Gold ETFs.

Shivam asked, which sector is better, SIPs, mutual funds or stock market? expect descriptive answer with ratio and scripts to invest.

Sailesh answers, hi, would request you to please elaborate your question a bit and write to me separately at : sailesh.multani@gmail.com

prakd asked, i have 20 lakh..dont know how to get 25 to 30 pc return

Sailesh answers, hi, I wish I had an answer to your question. The only asset class that has the potential to deliver higher returns compared to fixed income instuements are equity and real estate. Going by the history, equity funds can deliver average 15-18% returns p.a. over a 5 year period. I would advise you to tone down your expectation from 25% to 15% if you dont want to be disappointed.

Jiten asked, Hi I have stared the SIP 6 month back HDFC top 200 4k ,HDFC Tax Saver 2k, Birla Midcap 2K,HDFC Prudence 5k, Fidielity Equity 5k.Please let me know shall i continue the SIP in current market

Sailesh answers, hi, all the funds are goood. You can continue your SIPS in them.

anmol asked, I am beginer in investment. has a pakage of 5LPA and want to invest 1lakh/yr for good return. Pls advice

Sailesh answers, hi,ideally you should invest 70% in equity funds via the SIP route, 20% in Gold ETF and 10% in Debt instruments.

rampa asked, is silver good investment and how can one go about in india for that?

Sailesh answers, hi, you can invest in silver by buy in silver futures. you will have to contact a broking house that does commodity trading. They will be able to help you buy and sell silver futures. I would request you to take small step at a time. Also, take help of a commodity trader known to you before you decide on buying the silver futures.

sapna asked, Hi, iam sapna age 24 years and earn about 30Kpm. Could you please advise where can i park this investment without scare of losing principal amount You can write to me at sapna.s@rediff.com

Sailesh answers, hi, if you really want to play it safe then bank FDs are the only option left for you. BanK FD rates have been moving up for the past 2 months and are expected to move up marginally in the coming weeks. So make the most of it while the sun shines!!

sf asked, Please suggest some good FMP's considering Indian market. PS. i have no idea as of about FMP's but surely looking for investment. Thanks.

Sailesh answers, hi, FMPs are Fixed Matuirty Plans. These are issued by mutual funds. These are debt funds and compete with Bank Fds. FMPs are more tax efficient compared to bank FDs and therfore most sought after debt product after FD. Before you invest in any FMP you should check with your advisor about the tentative portfolio of the FMP. An all Bank Certificate of Deposit (CD) portfolio is considered to be the most safe portfolio. Please make sure that the FMP you will be investing in doesn have the mandate to invest in Real Estate company bonds and debentures.

VCS asked, I have ELSS of about 1.5 Lacs which is already matured, should i redeem it & invest it somewhere else? pls advise

Sailesh answers, hi, if your ELSS funds compare well with any of the non-ELSS diversified equity funds with respect to the performance, then there is no need to churn your portfolio. If the ELSS funds are underperforming, then it makes sense to shift to better performing funds.

spl asked, When market is declining can i put more money in my SIP's- Does the company has that option?

Sailesh answers, hi, you can make additional purchase in the same fund on any date. You can increase the amount of SIP as well.

mukesh asked, Which Equity SIP is best and how long.i want to invest for children in Life Insurance which company is best.

Sailesh answers, hi, if you are planing to build the education and marriage corpus for your children, then you should look towards equity funds. I would never recommend a Child Insurance Plan for planning your child's future. Insurance should be taken by the earning parent and not the child. So drop the idea of Child Insurance Plans for your children. You can start SIP in the funds recommended by me atthe begining of the chat. You can even invest in the New Fund launched by Fidelity known as the Fidelity India Children's Plan

Dharmesh asked, If I want to invest for long term ie.10-15 year where should I invest in Sharemarket or Real Estate ??

Sailesh answers, hi, both are good provided you have the necessary skill sets and information to invest in them. If you are going to invest only on what others are saying or by reading newspapers then you could be heading for a trouble especially when it comes to real estate. I would advise you to take the help of a honest and competnet investment advsor know to you who espcialised in the asset classes discussed above.

navgup asked, for NRI what are the best options

Sailesh answers, hi, NRIs

RAKESH asked, CURRENTLY I HAVE INVESTED RS 3 LACS IN ICICI LIFE STAGE PENSION FUND CAN I INVEST MORE IN THE FUND ?

Sailesh answers, hi, you should continue with your premium payment. What I would like to tell you and other participants is not to take any insurance plan except Term Plan. Term plan are compartiviely cheapest as far as premiums go and once can afford a higher sum assured. Avoid ULIPs at all cost.

Alok asked, Should I invest in fertilizer stocks before the budget to make gains in rally noticed in fertilizer stocks before the budget

Sailesh answers, hi, if you are guessing that the forthcoming budgt will have some sops for the agriculture or fertilizer sector and therefore wish to capitalise on them, then you are taking a big risk. If you are not a sector specalist then all the more reason to shun this approach to investments. Instead let the fund manager decide which sector will do well in the coming years. Your job is to invest in the well managed and diversified equity fund. Leave the rest to fund manager and his team.

ruma asked, EMI of a home loan gives you tax benefit? If yes then how much?

Sailesh answers, hi, the interest portion of the EMI qualifies for decuction under section 24(1) of the income tax. Interest payment upto Rs 150,000 qualifies for deduction from your Gross Total Income. The principal portion of your EMI qualified for deduction under section 80C. This deduction is capped at Rs 100,000

sonal asked, Dear sir, I already have 9Lakhs invested in MF. I am also having a SIP of 20K per month in the MF. Now I need half the money but not now, I need it after 4 months. What is your advice, shall i withdraw now or partial withdraw it after 4 months. Thanks in advance for your response

Sailesh answers, hi, you should first and foremost stop your SIP. Save your 4 installemtnts. the remaining amount should be immediately liquidated. Dont wait for the markets to go up. Please remember that markets can go down further.

sddss asked, I have sip in hdfc top 200 , dspr top 100,fidelity equity fund,& reliance growth of Rs.1000/-each & pay insurance of RS.65000/-P.a. my age is 40 year pls tells me that my investment is right or not

Sailesh answers, hi, overall good investment portfolio. I hope you have taken a Term Plan. Your minimum sum assured should be atleast Rs 50 lakhs.

vijs_v asked, Hi, Which are the top 3 Equity-Tax planning MF's that one can invest in now? Also what are the new tax saving options that I can relook into now?

Sailesh answers, hi, I have given the name of one fund at the start of the chat. Other fund that I like and personally invest in is Franklin India Taxshield. two funds are more than sufficient for your portfolio. You can invest Rs 20000 in infrastrucuture bonds under section 80CCF.

spl asked, How are 1.HDFC Equity fund, 2. DSP blackrock equity fund, 3. IDFC premier equity, 4. Reliance equity opportunities for SIP's. I want to start with rs 5500 per month in these. IDFC premier equity is minimum 2500 per month(agent told). Wil it be a ideal portfolio?

Sailesh answers, hi, except for Reliance Equity Opportunities Fund, I like all the other funds.

Rinjal asked, suggest Best Gold Etf to invest thru SIP

Sailesh answers, hi, I like Benchmark Gold Bees.

a asked, is it right time to invest in ELSS fund ?

Sailesh answers, hi, I deifinitely think so. We are nearing the end of the tax planing season. You will have to invest by 31st March! coming to the market timing, in my view the equity market has corrected by more than 10% from the recent peak it touched. It definitely is a good level to invest.

neeraj_vikalp asked, I want to take one term plan for me (36 yrs age). I know ICICI's i-next is cheeper than LIC' Anmol Jeevan. Should I go with ICICI or not.

Sailesh answers, hi, yes you could go with that provided it is a pure term plan. Please dont buy any Term Plans with frills attached.

ABHIJIT asked, I HAVE INVESTED IN ICICI IN THE FOLLOWING POLICIES 1)LIFE STAGE RP-75000 2)LIFE TIME GOLD-1.20,00 3)SMART KID-30,000 4)HEALTH PLAN-25000 SHOULD I CONTINIUE ?

Sailesh answers, hi, you have no option but to continue. If you surrender your policy now you will end up making losses. threfore continue with the same. But dont buy an other insurance in future except a Term plan.

Sanj asked, Hello, I have invested 8 Lacs in JM Basic Fund? Shouls I stay to recover it or liquidate all amount and put into some other fund? Your suggesion pls?

Sailesh answers, hi, please redeem this fund first thing tomorrow morning. You can invest in better managed funds like the ones recommended by me at the start of this chat.

sapna asked, Hi Sir, Sorry to be troubling you again. Could you please answer my one last question for commodity market returns. I was told that i could get 20 to 30% on investments is it true

Sailesh answers, hi, according to me realistic return from any high risk investment like equity/real estate cannot be more than 12-15%. If some one has suggested you that, then please listent to it and forget it. Dont think too much about it. Keep your investment strategy simple. Why get into commodity markets unless you are a trader in that commodity and wish to hedge your risk.

satu asked, Hi, I hve Following as SIP Reliance Banking/Diversified Power/ Pharma/Growth, HDFC top 200, ICICI Technology. Any comments

Sailesh answers, hi, a very risk portfolio. Except for HDFC Top 200 fund, all other funds are sectoral funds. I will never ever recommend a sectoral fund to investors. Please redeem all the sectoral funds and invest in well managed DIVERSIFIED equity funds.

subhashsoni asked, Dear Mr Shailesh, I am retired and wish to invest so that the capital is not eroded and the returns are also good. I am little bit wavering between FMPs, SIPs, MIPs, Bank FDs, Direct participation in Equity. Pls suggest shall I consider all these options or some of them. I do have a requirement of about 20K each month. What is the total amount which should be invested in each of above or the best of above options.

Sailesh answers, hi, I would requst you to send me your query on email: mt email id is: sailesh.multani@gmail.com

spv asked, what is ur openion of annuity plans? which is the best annuity plan

Sailesh answers, hi, I am not in favour of buying any annity plans. I would rather advise investors to build a retirement corpus that can generate regular returns to take care of all possible post-retirement needs. Annuity plans are not at all suitable for reitrement planning.

all alone asked, Which is the best infrastucture bond to invest and will i get a rebate over and above 1 lac on this investment

Sailesh answers, hi, you could invest in the IDFC Infrastrcuture Bond that is currently open.

Cheguru asked, I have invested 70%in Mutual fund,10%in Gold,10%in debt fund and want to invest 10% in PPF,can you please let me when and how to invest in PPF,is it monthly or Lumpsum,in april or march etc....

Sailesh answers, hi, you will have to open a PPF account with SBI. you can invest a lumpsum or make monthly investments. Please note that you can invest only Rs 70,000 into a PPF acount every year.

vrtajne@rediffmail.com asked, i want to surrender icici life time super ? it is good time to surrender or what Please suggest

Sailesh answers, hi, surrender only if you are making gains. Surrendering at a loss would not help.

Sailesh says, We have run completely out of time. I thank you all for participating in this chat session. If you have any questions which were not answered during the chat, you can mail them to me at: sailesh.multani@gmail.com. I would request you to mention your age, investment objectives and willingness to take in the mail. This will help me in understanding your profile and determining the asset allocation for your investments.

Sailesh says, We have run completely out of time. I thank you all for participating in this chat session. If you have any questions which were not answered during the chat, you can mail them to me at: sailesh.multani@gmail.com. I would request you to mention your age, investment objectives and willingness to take risk in the mail. This will help me in understanding your profile and determining the asset allocation for your investments.

© 2025

© 2025