The franchise route has been a boon to international brands before FDI had become a buzzword. KPMG’s report, ‘Collaborating for Growth’ on the industry says that over the last decade, franchising has surfaced as one of the most prolific and feasible ways of expanding businesses in India.

The franchise route has been a boon to international brands before FDI had become a buzzword. KPMG’s report, ‘Collaborating for Growth’ on the industry says that over the last decade, franchising has surfaced as one of the most prolific and feasible ways of expanding businesses in India.

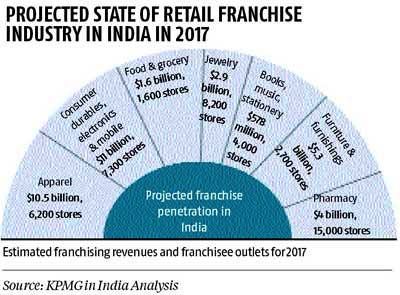

Several industry verticals such as food and beverage, education, fashion and tourism are leveraging their growth by franchising their products under various formats. (Please see chart for future growth).

India is home to more than 3,000 brands that use the franchise model. Bata, was among the first franchisors in India.

Leading global brands such as Yum Brands (KFC and Pizza Hut), Dominos, McDonald’s and Subway too have taken this route to open stores.

However, recent clarifications issued by the Indian Government on foreign direct investment regulations in multi-brand retail that allow foreign retailers to open only company-owned-company-operated outlets could be a dampener for the franchising industry.

But KPMG mentions that franchising is expected to continue to be one of the most popular business formats among organised retailers, especially to reach the tier II and III cities.

The franchisor’s interest will be driven by high disposable income of the consumer, easy talent acquisition, quicker time-to-market, while the franchisee’s interest will be stoked by RoI, less risk than starting its own business and expansion opportunities.

KPMG estimates suggest that the franchising industry was worth $13.4 billion (Rs 8 lakh crore approx) in 2012.

Both franchise revenue and outlet growth is expected to witness a growth of around 30

Food and beverages, health and beauty, education and consumer services have seen the biggest growth through this route.

Some franchisors and their best practices include:-

Subway: Franchisees form the backbone, as all its restaurants are owned and operated by independent franchisees.

Subway plans to open 1,000 outlets by 2017 in India, up from its 260 outlets.

Lakme Salon: Lakme is expanding through franchises, and has 135 franchise salons out of its 175 units; 30 per cent of the total franchisees own multiple salon, reflecting their loyalty to the brand; Hindustan Unilever, the parent, proactively ties up with unbranded players instead of setting up operations from scratch.

Archies: Has more than 350 franchise outlets and supports them with advertising, training, IT support, supply chain.

DTDC: With more than 5,800 units, its USP is the low-cost opportunity.

It focuses on geographical reach through partnerships with small businessmen.

Indian brands have even taken the franchise route to expand overseas.

For example, Saravana Bhavan in food services in the US, Canada, Singapore, West Asia, United Kingdom, China; Gitanjali in jewellery retail in the US, Japan, Dubai and VLCC in health and wellness in the UK, West Asia, Singapore and Malaysia.

© 2025

© 2025