Low demand, coupled with the complexity in logistics, has made India’s largest oil marketing company, IndianOil Corporation Ltd, stop selling its branded diesel, Xtramile, at its fuel retail stations.

Low demand, coupled with the complexity in logistics, has made India’s largest oil marketing company, IndianOil Corporation Ltd, stop selling its branded diesel, Xtramile, at its fuel retail stations.

The ratio of branded fuel to total sales of unbranded fuel (conversion rate) for IOCL has come down to single digits, ranging between five per cent and 10 per cent in various markets.

This is a far cry from the heydays of fuel brands (regular fuels with additives supposed to enhance a vehicle’s performance).

In 2007, the ratio of the sale of branded fuel amounted to 30 per cent to the overall sale of unbranded fuel for IOCL.

Branded diesel scripted a similar downfall -- the conversion rate of 20 per cent in 2007 is now as low as two-four per cent.

What triggered dismal sales were government rulings which led to large price differences.

In the 2009 Union Budget, new duties were introduced on branded fuels which raised the differential between unbranded and branded fuel to Rs 2.50 (of which Rs 1.75 was special duty) a litre for petrol and to Rs 4.95 (Rs 4.20 special duty) a litre for diesel.

Branded fuels started taking a beating.

This weaned away truckers, who largely patronised both regular and branded diesel, away from the latter.

In September, 2012, another blow was dealt, with the government withdrawing the subsidy support for branded fuels (although branded fuels are nothing but regular automotive fuels, blended with special additives).

It further increased branded fuel prices.

Branded petrol was popular with premium and luxury car owners; it, too, began to suffer from waning demand.

With the twin nails wedged in, the downward spiral has been difficult to stem since then.

“With the conversion rate down, the retail network which offered these branded fuels has shrunk.

"The high price difference between regular and branded automotive fuels has forced the latter out of the market,” says Srikumar N, executive director (corporate communications and branding), IOCL.

"Unlike those in industries with branded and unbranded products, the oil marketing companies (which buy, refine and market fuel from others), largely IOCL, HPCL (Hindustan Petroleum Corp Ltd) and BPCL (Bharat Petroleum Corp Ltd), did not have much scope in taking a hit on their own margins to contain the prices.

An official, from one of the companies, who did not wish to be named, says decreasing their own margins on branded fuel to cushion the consumer from the price increase was not considered: “Our

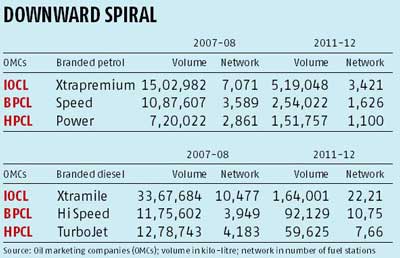

"We can’t sustain losses in both branded and the heavily-subsidised, unbranded fuel segments.” Hence, OMCs have been curtailing production and footprint. In the past five years, volumes for IOCL’s branded petrol, Xtrapremium, has gone down by a little over three times (refer to chart).

The difference between branded and unbranded petrol is Rs 8-10 a litre, depending on the market.

For diesel, it is upwards of Rs 16 a litre.

“This is indeed unfortunate, given the fact that we assiduously built these brands in the last one decade, investing in technology and network expansion, only to ensure we could provide choice for Indian consumers with improved products.

Now, both volumes and network are shrinking, for reasons beyond our control,” adds Srikumar.

Complex logistics such as factoring in state taxes and duties have served as further deterrents to distributing branded fuels widely, in the face of plummeting demand.

The network of fuel stations which offered these branded fuels has also diminished.

For IOCL, the number of outlets selling Xtrapremium has come down to 3,421 from 7,071 in the past five years.

For BPCL, it is down from 3,589 in 2007-08 to 1,626 in 2011-12.

The number of outlets selling branded petrol for HPCL is down from 2,861 in 2008-09 to 1,100 in 2011-12. (For more info, please see chart.)

The concept of branded fuel came in 2002, when the petroleum sector started investing in marketing.

With an influx of new-generation cars, the public sector oil firms decided to offer variants other than regular fuel.

Branded fuels were developed to cater to this need.

The ones launched in India by OMCs were similar to those launched by companies abroad and spiked with special additives which ensure economy in mileage, a smoother ride, quick and better pick-up, engine longevity, and above all, reduced emissions.

The going was good till 2007, when both sales and network expansions peaked.

At that time, the maximum difference between regular and branded was Rs 1.50 a litre for petrol and 25-75 paise a litre for diesel. “All OMCs invested heavily in building these brands.

"We didn’t know that in just over a decade, branded fuels would meet such a fate.

"It is unfortunate to see all the investments in technology go down the drain,” says a senior official from BPCL.

It is still not clear whether all the fuel brands will eventually disappear from the shelves or not.

© 2025

© 2025