HDFC Bank was penalised R15 lakh in April 2011 for its role in the so-called derivatives scam. By no means is this big money for the bank but such regulatory actions tarnish the image of a bank. In the financial world, they call it reputation risk. HDFC Bank couldn't escape this despite its hatred for risks. What went wrong? Journalist Tamal Bandyopadhyay lifts the veil off the incident, and the bank's response, in this fascinating insight from his forthcoming book

HDFC Bank was penalised R15 lakh in April 2011 for its role in the so-called derivatives scam. By no means is this big money for the bank but such regulatory actions tarnish the image of a bank. In the financial world, they call it reputation risk. HDFC Bank couldn't escape this despite its hatred for risks. What went wrong? Journalist Tamal Bandyopadhyay lifts the veil off the incident, and the bank's response, in this fascinating insight from his forthcoming book

In India, the first time media reported derivatives loss of a company was in 2006 when the Food Corporation of India -- which lends price support to safeguard the interest of farmers, distributes food grains and is responsible for ensuring national food security -- suffered a loss in its swap transaction with a British bank. Being a State-run company, it did not hide its losses, but hundreds of small and medium companies that bought such products from banks were tight-lipped about their transactions till such time the potential loss was enough to wipe out their entire net worth. That was in early 2008.

Lawyers and risk management experts hired by the companies that burnt their fingers in 200708 started accusing banks of 'mis-selling' and enticing companies to 'speculate' instead of hand-holding them to genuine hedging. The banks, in turn, called these lawyers 'ambulance chasers' -- a derogatory phrase that typically refers to attorneys in the United States who solicit business from accident victims or their families.

In March 2008, P Chidambaram, as finance minister, made a statement in Parliament that banks operating in India had R127.86 trillion of derivatives on their books as on 31 December 2007. The 'outstanding notional principal amount' of derivatives, according to him, was 291% higher than the corresponding number on 31 December 2005.

By itself, the amount was not important as it was the notional amount of all derivatives transacted such as overnight indexed swap or dollar/rupee forwards. This number included two legs of transactions that could actually be reversing or closing out any risk that a bank had. Typical products that were permitted by the RBI till that time were forwards, currency swaps, interest rate swaps and foreign currency options.

Banks in India carry a market risk on their foreign exchange contracts but that is largely controlled by the net open position limit that the RBI prescribes for each bank. The larger risk that the banks carry is the credit risk. Since they are not allowed to keep a cross-currency book, they always need to enter into a mirror contract with an overseas bank when they sell cross-currency options to their customers. So, a customer can back out from the second leg of the contract but a bank cannot. Here lay the main problem.

Hundreds of Indian companies that had bought these complex cross-currency options and structured products to seemingly protect themselves from foreign exchange risk started crying foul when significant losses started staring at them. Banks that sold such products geared up for legal battles with clients-turned-adversaries, predominantly small and medium Indian companies, many with unsophisticated internal risk management practices, who were questioning the very legality of such products.

On one side of this battle were new-generation private banks such as HDFC Bank, Yes Bank, Kotak Mahindra Bank Ltd, Axis Bank and ICICI Bank; quite a few foreign banks operating in India such as Barclays, Deutsche Bank, J . Morgan, HSBC, BNP Paribas, Crédit Agricole SA., Citibank, Standard Chartered, Bank of America, Royal Bank of Scotland; and a few public sector banks, including SBI, backed by powerful law firms such as Amarchand & Mangaldas & Suresh A. Shroff & Co, and AZB & Partners.

On the other, was a growing list of small companies, some publicly traded, as well as the well-regarded law firm of J Sagar Associates, a crack team of investigators at auditor KPMG and independent consultants such as A V Rajwade, a leading expert when it comes to derivatives.

At that time, India's accounting laws did not require companies to report notional losses on account of derivatives contracts and hence none had an exact idea of the losses. The numbers floated in media reports were possibly hugely exaggerated.

The banks and their lawyers claimed the derivatives -- a financial term used to describe an instrument whose value is a function of an underlying commodity, bond, stock or currency (also simply called underlying) -- were legal. They are used as a risk management and mitigation tool. But the lawyers and consultants advising the affected companies said the products that were sold violated the country's Foreign Exchange Management Act, which regulates all foreign currency transactions, and the RBI guidelines.

Hedging or Speculation?

Hedging or Speculation?

At the core of the battle was a debate over whether these were sold for hedging or speculation.

The issue first came to light in late November 2007 when software company Hexaware Technology Ltd set aside $2025 million (about R80100 crore at the prevailing exchange rate) to cover exposure from unauthorized deals entered into by an employee which involved derivatives. The company later reported a net loss of R81 crore for the quarter that ended in December 2007, after the actual damage on account of these transactions ended up being R103 crore.

Sundaram Brake Linings Ltd, Rajshree Sugars and Chemicals Ltd and Sundaram Multi Pap Ltd, among others, hired law firms to fight it out with the banks.

According to Berjis Desai, managing director of J Sagar Associates, whose firm advised around a dozen affected companies, such transactions are worse than betting on horse races or playing slot machines in Las Vegas. 'Banks can say that the contracts are fine but, under the Indian Contract Act, wagering is not permitted. Nobody can punt on any currency under RBI norms,' Berjis told me at that time. But Cyril Shroff, managing partner of Amarchand & Mangaldas & Suresh A. Shroff & Co, claimed there is enough jurisprudence on derivatives contracts all over the world and they are not wagering contracts.

Deepankar Sanwalka, head of the forensic wing of audit and consultancy company KPMG India, too, said some of these transactions were in violation of the RBI's derivatives guidelines. 'The issue is not as simple as some of the banks are projecting. The documentation of such contracts is not always watertight and if the firms decide to go to court, the contracts can be null and void,' Deepankar told me while I was writing a report for Mint in 2008.

The derivatives involved include swaps and options -- a sort of insurance that companies with exposure to dollars or other currencies buy as a protection against any adverse movement in these currencies that can hurt their income (for exporters) or increase their liabilities (for companies that have borrowed overseas).

Theoretically, a swap is a financial transaction in which two counter parties agree to exchange a stream of payments over time at an agreed price. An option is an agreement between two parties in which one grants to the other the right to buy or sell an asset under specified conditions.

Thus, in case of a currency swap, both parties have the right and obligation to exchange currencies. In case of options, the buyer has the right but no obligation, and the seller, the obligation but not the right to exchange currencies.

A Black Swan Phenomenon

A Black Swan Phenomenon

Bankers claim there was nothing wrong in such transactions. Both the buyer and the seller understood the products well, but who would have anticipated that the dollar would touch 100 yen? It's a 'black swan phenomenon', they say. A black swan is a large-impact, hard-to-predict and rare event beyond the realm of normal expectations.

There are two sets of RBI guidelines that banks, consultants and lawyers swear by -- comprehensive guidelines for derivatives, a 30-page document, dated 20 April 2007, and a 53-page master circular of risk management and inter-bank dealings, released on 2 July 2007.

The RBI insists that such transactions must be 'suitable' and 'appropriate' for the end users. Besides, every derivatives contract must have an underlying transaction. RBI norms also say that when companies enter into such derivatives contracts to reduce their costs, such transactions must not increase 'risk in any manner' and should not 'result in net receipt of premium by the customer'.

In private, some bankers admit that there could be a few companies that used the same 'underlying' for many derivatives transactions that they have entered into with different banks without their (the banks') knowledge but they vehemently contest allegations of mis-selling. All phone calls made from banks' treasury are normally recorded and one can hear the tape and decide who enticed whom. They also claim all derivatives contracts follow the guidelines of the International Swap Dealer Association; and they proceed only after getting the board resolution from a company and a confirmation that their risk management policy is in place.

Bankers blame the dollar's weakness against global currencies for the turn of events. Between April 2007 and March 2008 when the lit fuse on the derivatives time bomb got shorter, the euro had appreciated 17.8 pc against the dollar, the yen more than 16 pc and the Swiss franc some 21 pc, making most of the bets against currency movement go horribly wrong. Thus, a company that transformed its dollar liability into a yen or Swiss franc liability through complex derivatives faced significant losses.

Typically, these have 'knock-out' and 'knock-in' clauses. While these options protect a company's yen or Swiss franc exposure against dollar depreciation, this is only till a certain level; once the dollar's weakness crosses this, the knock-out clause is triggered, leading to losses.

Similarly, if the dollar rises and touches the knock-in level, the customer makes money. If the dollar continues to depreciate and losses increase, the companies can either terminate the deals midway or wait till they are mature, hoping that by that time the currency movement would have been reversed.

After 2008, most banks have stopped selling such products as companies' appetite for such products has gone down, but risk management consultants say the demand was never there and banks led the companies up the garden path. A few banks settled their disputes with companies by sharing the losses whereas others advised their clients to get into new contracts by shifting currencies or close the contracts to cut losses. Yet a few others are fighting court cases challenging the contention of companies. HDFC Bank is one of them.

Reputation Risk

Reputation Risk

HDFC Bank was penalised R15 lakh. By no means is this big money for the bank but such regulatory actions tarnish the image of a bank. In the financial world, they call it reputation risk. HDFC Bank couldn't escape this despite its hatred for risks. What went wrong?

Is selling derivatives compatible with the bank? 'Yes, it is, as it meets customers' need to hedge risks,' Paresh replies. Financial markets offer a range of products and no bank can sit in judgement on whether or not products add value to a customer. They can only have policies on which product is appropriate to which type of customer.

Could it have been a little more measured in its approach? Did it avoid some of the most over-leveraged, most complex structures? The bank claims that from a pure risk point of view, it never ran the book. When it comes to non-rupee-related derivatives, Indian banks are allowed to do this only on a back-to-back basis. So, HDFC Bank, like many others, didn't take any market risk on the product; it was taking only credit risk.

None of the customers actually lost big money but they were afraid that they would lose. The rates moved and there was high volatility in cross-currency markets. So, while an actual crystallised loss might have been very little or a modest amount, the companies had a much bigger potential loss staring at them as they were extrapolating volatility. Risk management socialites and lawyers saw an opportunity in this. Once they rushed to seize it, a fear psychosis gripped the companies and that did the banks in.

'We didn't flirt with the worst of the lot, and not even ten out of over a hundred derivatives customers accounting for less than 5 pc of such deals challenged their contracts or sued the bank,' Paresh told me. There have been about eight cases, and a couple of them came as a legacy from Centurion BoP. At least some of the companies that moved the court did a flip-flop. The Bangalore-based home textile manufacturer, retailer and distributor Himatsingka Seide Ltd first filed a case against HDFC Bank for alleged mis-selling. But when the market moved back in its favour, the company asked for the transaction to be unwound and paid off its dues. (I did not reach out to the company for its comments.)

No Out-of-Court Settlements

No Out-of-Court Settlements

GS, country head for internal controls and compliance risk management, said the bank has not gone for any compromise settlement: 'We steadfastly refused to do any out-of-court settlement because we believe we didn't do anything wrong.' HDFC Bank has won an arbitration award in a case filed against Centurion BoP by apparels and garments maker Sportking Group of Ludhiana. The company had challenged the award in the Bombay High Court, which has since been dismissed by the court.

The RBI has taken quite a few steps to ensure that the market doesn't indulge in complex derivatives trades anymore. The change in regulations, which came in 2011, allows transactions in only plain vanilla derivatives and combinations of vanilla derivatives. The banking regulator has also made it necessary for corporate governance in companies to be at a certain level if they want to transact in structured derivatives. A tacit acceptance that such trades were indeed allowed earlier.

GS cites an instance where a customer filed a case against the bank after making a loss but the company had earlier gained. He wouldn't name the customer though. 'They were so happy that after a few months they came and said that they wanted to do one more transaction. They repeated the transaction and when they lost money they sued the bank.

While the case was being filed, currency again moved and when they came back "in the money" they wanted to withdraw the case,' he told me. In the money simply means one's derivatives contract is worth money and not in losses. His point is that a customer understands the transaction as long as he is making money but professes not to when he loses.

GS claims the bank has improved its risk monitoring systems and reworked on its derivatives offerings. Has there been a tightening of the internal norms? 'Yes.' Is there any room for improvement? Here also his answer is 'yes'. That's typical of HDFC Bank. No admission of guilt; no aggression; a measured response to everything related to risks.

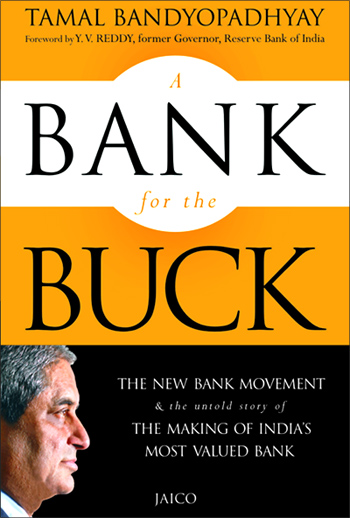

Excerpted from A Bank For The Buck, The New Bank Movement and the Making of India's Most Valued Bank, by Tamal Bandyopadhyay, published by Jaico. Published with permission from Jaico. Finance Minister P Chidambaram will release the book in Mumbai on November 24

© 2025

© 2025