Eight months after India's largest car maker, Maruti Suzuki India, announced plans for a Gujarat unit to be set up as a wholly-owned subsidiary of parent Suzuki, opposition to the move continues to simmer.

Eight months after India's largest car maker, Maruti Suzuki India, announced plans for a Gujarat unit to be set up as a wholly-owned subsidiary of parent Suzuki, opposition to the move continues to simmer.

Though Maruti later tweaked the proposal to appease shareholders, domestic mutual funds (MFs) weren't convinced. They say they will oppose a special resolution in this regard, which the company is expected to bring to vote in early November.

Multiple fund managers Business Standard spoke to said the proposal would result in the company changing from a manufacturing to a trading firm. The company has, however, maintained the move will only result in reducing the cost of manufacturing its cars.

Domestic MF managers, who hold half the stake required to successfully oppose the move, could well scuttle the deal if other large shareholders side with them. "Why will I invest in a company that gets into distribution instead of the complete value chain?" asked a senior official at a fund house.

Another said, "The proposal is marginally different but at the core, nothing has changed."

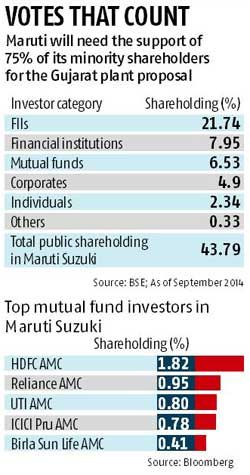

To bring its plan to fruition, Maruti requires the support of three quarters of its minority shareholders. In other words, if more than a quarter of minority shareholders oppose the deal, it cannot go through. As public shareholders hold 43.79 per cent stake, a quarter translates into 10.95 per cent.

MFs hold 6.53 per cent stake. If all MFs vote together and manage to convince stakeholders with another 4.42 per cent to side with them, the resolution will fail.

Foreign institutional investors hold 21.74 per cent stake in the company. Often, these investors go by the recommendations of proxy advisory firms. Two of the three proxy advisors Business Standard spoke to opposed the deal.

"Given Maruti already has the cash to set up the Gujarat plant, is this transaction necessary? The argument of incremental earnings on account of savings might have had some credibility if Maruti was planning to return the cash to shareholders. Given its history of cash-hoarding, investors are better off having the cash invested in the Gujarat plant - the return on investment will be higher by investing the cash in operations, rather than in safe investment avenues," said Hetal Dalal, chief operating officer, Institutional Investor Advisory Services.

Shriram Subramanian, managing director of InGovern Research Services, said, "We are waiting for the proposal. But it appears nothing has changed since the company came to the public domain the last time. I do not think we will change our stance, though Maruti has put in place some checks and balances and there was a call with us about two weeks ago, in which the chairman took pains to explain the rationale."

The company's proposal has some backers. J N Gupta, founder and managing director of Stakeholders Empowerment Services, a corporate governance research and advisory firm, said, "The initial concerns raised by us have been adequately addressed by Maruti, in its clarification and in the draft agreement enclosed with its presentation to investors. Very few concerns remain; these include the need for a minimum exclusivity period on markets which Maruti is developing. Hopefully, this will also be addressed."

Maruti Suzuki's original proposal would have included a mark-up on cars the company sourced from the plant. It later tweaked the proposal to remove the mark-up. The revised plan said in the event the agreement was terminated, the plant would be transferred to Maruti at book value, rather than at 'fair value', as planned earlier. Also, the company agreed to put the proposal to vote. While this was seen as a positive move by fund managers from a governance perspective, those Business Standard spoke to remained opposed to the core plan.

Maruti Suzuki's original proposal would have included a mark-up on cars the company sourced from the plant. It later tweaked the proposal to remove the mark-up. The revised plan said in the event the agreement was terminated, the plant would be transferred to Maruti at book value, rather than at 'fair value', as planned earlier. Also, the company agreed to put the proposal to vote. While this was seen as a positive move by fund managers from a governance perspective, those Business Standard spoke to remained opposed to the core plan.

They added the stand of Life Insurance Corporation of India (LIC) , which held 6.8 per cent (the largest minority shareholder), would be decisive. An LIC official said the company was yet to decide on the matter.

India's fund houses have an investment of about Rs 6,000 crore in the company stock. Since February, the counter has rallied 83 per cent on stock exchanges.

Currently, it is trading at Rs 3,075.9, against Rs 1,675 in mid-February. An email sent to the company did not receive an immediate reply.

© 2025

© 2025