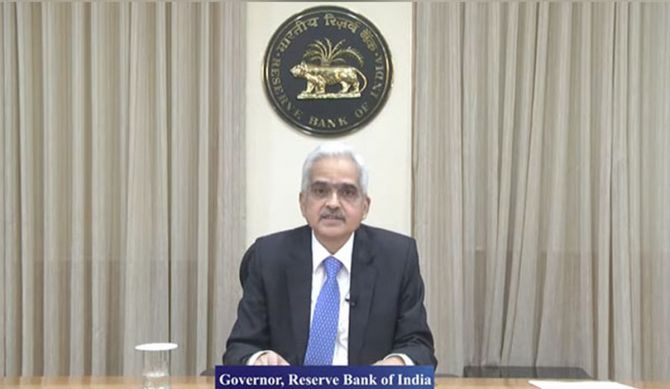

Following are the highlights of the RBI's fourth monetary policy review of fiscal year 2022-23 announced by Governor Shaktikanta Das:

- Key short-term lending rate (repo) raised by 50 basis points (bps) to 5.4 per cent; third consecutive hike

- In all, 140 bps hike in repo since May 2022 to check inflation

- GDP growth projection for 2022-23 retained at 7.2 per cent (pc).

- GDP growth projection: Q1 at 16.2 pc; Q2 at 6.2 pc; Q3 at 4.1 pc; and Q4 at 4 pc

- Real GDP growth for Q1:2023-24 projected at 6.7 per cent

- Domestic economic activity exhibiting signs of broadening

- Retail inflation projection too retained at 6.7 pc for 2022-23

- Inflation projection: Q2 at 7.1 pc; Q3 at 6.4 pc; and Q4 at 5.8 pc; Q1:2023-24 at 5 pc

- India witnessed large portfolio outflows of USD 13.3 billion in FY23 up to August 3

- Financial sector well capitalised and sound

- India's foreign exchange reserves provide insurance against global spillovers

- Monetary Policy Committee decides to remain focused on withdrawal of accommodative stance to check inflation

- Depreciation of rupee more on account of appreciation of US dollar rather than weakness in macroeconomic fundamentals of the Indian economy

- RBI to remain watchful and focused on maintaining stability of rupee

- Rupee depreciated by 4.7 pc against US dollar this fiscal year till August 4

- India's foreign exchange reserves remain fourth largest globally

- Mechanism to be activated to allow NRIs to use Bharat Bill Payment System for payments of utility and education on behalf of their families in India

- Next meeting of rate-setting panel scheduled for September 28-30, 2022.

© 2025

© 2025