The implication of a slowdown in the financial services sector are very different (eg, likely to affect fewer people directly, and even that affecting those at the top of the income distribution) from that of a slowdown in construction, one of the most employment intensive sectors in the Indian economy (that will affect aggregate demand much more).'

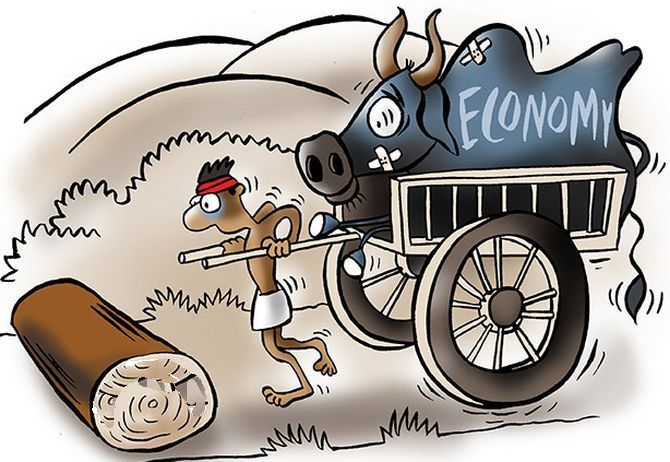

Illustration: Uttam Ghosh/Rediff.com

Talk of economic slowdown is everywhere, and while the government may not openly admit to it, the fact that Finance Minister Nirmala Sitharaman was forced to administer a booster shot on Friday which even included the rollback of unpopular budgetary provisions, is an indicator that everything is not hunky-dory on the economic front.

Reetika Khera, Associate Professor (Economics) at the Indian Institute of Management, Ahmedabad, decodes the slowdown and suggests three ways the government can try to reverse its effects.

"As far as our macroeconomic indicators are concerned, it is very hard to make any sensible judgment given the controversy surrounding each of these. There has been a controversy around the growth rate of the economy, on the fiscal deficit, unemployment, so that we really are blindfolded while analysing the economy," she tells Rediff.com's Prasanna D Zore in an email interview.

How do you read the state of Indian economy in the light of voices -- not only from prominent economists who have been talking about a severe slowdown for some time now but also from prominent Indian Inc leaders who have now begun expressing concern over the economy?

I think the first thing to note with respect to the state of the economy is that most people who are commenting (on the economy) are in the dark, and are commenting on the basis of educated guessing and partial data. This is because India’s statistical infrastructure has been compromised in recent years.

Earlier too there were issues with Indian data put out by the government, but at least there was (grudgingly) some public debate.

Now what we find is that when economists raise questions, instead of debate -- or even denial (the more likely outcome earlier) -- what you get is a finance minister questioning those who raise these concerns as "so-called economists".

How is India's rural/agrarian economy being impacted by the slowdown? Any statistical evidence that can help our readers get the sense of the slowdown in the rural economy?

While the numbers on unemployment have been in the news a lot (and been debated/denied), I think the surest sign of the slowdown in the rural economy is the stagnation in the growth rate of real wages (external link).

Real rural wages (external link) have been growing at less than 5 per cent in the past few years. This is also reflected in the slowdown in the FMCG sector (external link). Recent data from the National Sample Survey (external link) hints at a decline in consumption expenditure (in real terms, ie, adjusting for prices).

How resilient are India's macroeconomic indicators -- fiscal deficit, inflation, interest rates, output, etc -- to fight the general economic slowdown?

Even if one were to believe the worst numbers on the slowdown, say a ~5 per cent GDP growth rate, what matters much more is which sectors of the economy are slowing down or growing. The implication of a slowdown in the financial services sector are very different (eg, likely to affect fewer people directly, and even that affecting those at the top of the income distribution) from that of a slowdown in construction, one of the most employment intensive sectors in the Indian economy (that will affect aggregate demand much more).

As far as our macroeconomic indicators are concerned, as I’ve already said, it is very hard to make any sensible judgment given the controversy surrounding each of these. There has been a controversy around the growth rate of the economy, on the fiscal deficit, unemployment, so that we really are blindfolded while analysing the economy.

Should the government relax its fixation with controlling the fiscal deficit and spend more on rural employment generating schemes like the MNREGA?

I believe that one has to be concerned with the fiscal deficit, but the fiscal deficit is affected by two parameters -- expenditure (on programmes such as NREGA) and revenues (from direct and indirect taxes).

I would be in favour of:

(a) enhancing social spending in India (not just on NREGA, but also other programmes), but

(b) doing so while keeping an eye on the fiscal deficit

(c) by expanding our tax revenues.

The last would require expanding our direct income tax base, and removing or reducing tax exemptions.

The problem is that most commentators think "expenditure" and "fiscal deficit" are synonymous, ignoring a desperately required expansion in tax revenues.

© 2025

© 2025