'From our perspective, it will bring additional customers and from their perspective, it will get them younger customers.'

"Retail health will be one of the strongest growth drivers for the general insurance industry," Sarbvir Singh, CEO, Policybazaar.com, tells Subrata Panda/Business Standard.

How is the business shaping up in Q4, given that it is the best period for insurers sales-wise?

Traditionally, Q4 is a big quarter for insurers. However, on our platform, the impact is not as dramatic as it is in the industry.

This year the seasonality has been a little different because April and May were peak Covid months and we saw a significant increase in demand in health and term business in that period.

Q4 is going well, but Q1, which is not usually a strong quarter for us, was actually quite strong.

After the hike in term premiums by insurance companies, has there been a dip in demand for such products?

The demand for term products is always there. The problem is the supply. The market has gone through a series of price as well as process corrections.

Term insurance continues to be a very affordable area, with or without the price increase.

When the price is increased, the demand goes down but that settles down with time.

The process of buying term insurance has become tougher and that creates its own set of challenges.

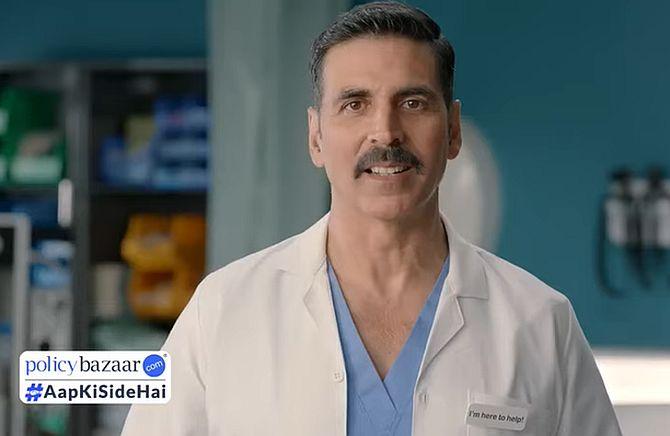

IMAGE: Sarbvir Singh, CEO, Policybazaar.

What is the outlook for guaranteed products and unit-linked insurance plans, given the interest cycle is about to turn and the markets are very volatile?

Interest rate arbitrage still exists to some extent. There is also tax arbitrage.

Sales of guaranteed products continue to be very strong.

Everyone is searching for yields, and guaranteed products provide a good alternative. That is why they are doing well and will continue to do well.

It is not about the cycle, but the steepness of the yield curve. If the yield curve were to flatten significantly, these products will have a problem.

Over a year ago, we started selling ULIPs in combination with guaranteed products called 'capital guaranteed'.

It ensures that whatever the consumers have invested, they will at least get that much at the end of the period and then there is an upside based on how the market does.

So our solution is very suited to the current environment.

How has there been any impact on health insurance demand with the pandemic receding?

Whenever there is a wave, there is a transitory peak in demand for health insurance. But there has been a shift in consumer awareness around health insurance.

Retail health will be one of the strongest growth drivers for the general insurance industry.

How is your partnership with LIC shaping up?

We have started selling offline. As far as online is concerned, tech integration is still being done.

I feel it could be a very significant opportunity for Policybazaar and LIC in creating an alternative channel for them.

From our perspective, it will bring additional customers and from their perspective, it will get them younger customers because the average age of our customers is about 30, which, from an insurance standpoint, is fairly young.

We will distribute their entire range of products over time, but the area in which we will be able to contribute most is ULIPs. Over a period, LIC will be a significant part of our platform.

Is there any plan to revise your commission rates?

Not at all. We are paid fairly by all the insurance companies. We are not trying to optimise commissions; rather, we are trying to optimise products.

For example, annuity products have very low commissions, but we are still keen to sell annuities.

How have you expanded your offline presence?

We are a pull channel, not a push channel. So, the process of buying an insurance product is initiated by the consumer. Historically, when you came to us, you could buy on your own or talk to the advisor.

Now, if the customer wants, we can send a representative to his or her house.

So, we are adding a conversion capability to our platform, which we did not have earlier. Five-10 per cent of our business is coming from this channel.

What will be the focus areas for the company?

For our retail customers, we want to increase our offline capability.

We want to establish the omnichannel multilingual model of distribution over the next one-two years.

Today, of 100 people coming to the Web site, 7-8 are buying and through this offline channel, we can take this number significantly higher.

Second, we want to become a full-service platform, which means customers will also get the entire gamut of service from us.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025