A new section in the Income-Tax Act should be introduced providing for tax deducted at source for payments made to finfluencers by NREs or social media giants, suggests Harsh Roongta.

A Dubai real estate company's advertisement caught my eye during a flight.

The video showed an individual promising a minimum guaranteed return of 6 per cent, which could go up to 10 per cent.

We have all seen such videos. The task of dealing with the fallout from the expectations created by such unregulated finfluencers (some of whom live abroad) is enormous.

I don't envy the position of the regulators tasked with addressing this issue.

While there is no magic-bullet solution to this problem, here are a few suggestions that may reduce its scope.

One way to deal with finfluencers is to trace the money they make and focus limited regulatory resources on the biggest ones.

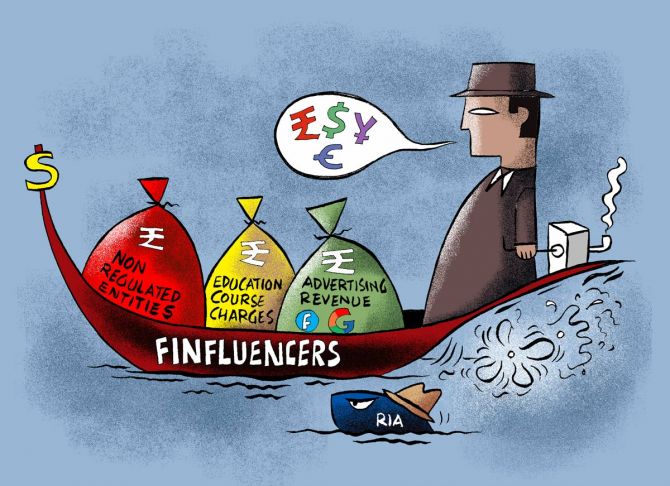

Finfluencers earn money from the following sources: One, they receive payments from stockbrokers and other Sebi-regulated entities.

This will be disallowed, according to a recent Securities and Exchange Board of India consultation paper.

Two, they receive payments from non-regulated entities (NREs).

Three, they earn advertising revenue shared by social media giants like Google and Facebook.

And four, they charge investors directly for services such as 'educational courses' and other non-regulated services.

While the first revenue stream will be plugged, the others will remain unregulated.

A new section in the Income-Tax Act should be introduced providing for tax deducted at source (TDS) at the current rates for payments made to finfluencers by NREs or social media giants.

The information received under this new TDS section must mandatorily be shared by the tax department with the regulators in real-time.

This will facilitate the identification of Finfluencer revenue and enable the regulators to maintain a near real time finfluencer revenue dashboard (FRD).

Additionally, a liability to collect tax collected at source at a token rate of 0.1 per cent should be imposed on finfluencers for fees collected from educational courses or for providing non-regulated services.

This information must also be shared with the regulators to aid the creation of the FRD.

The FRD will help regulators identify and focus their energies on the most problematic finfluencers.

It is easier for the tax department to collect and cross-tally information through its nationwide data network.

The compulsion to follow tax collection procedures will help gather comprehensive data.

The second, and equally crucial, aspect of resolving the finfluencer issue is to ensure that investors have access to an adequate number of Sebi-registered investment advisors (RIAs), who are required by law to offer advice that serves clients' best interests.

Unfortunately, due to restrictive regulations, India has only 918 RIAs.

Sebi is likely to introduce a centralised fee collection mechanism for RIAs, which will enable investors to identify a genuine RIA easily.

The Sebi grievance redressal system will be available to customers for services paid for under the new mechanism.

This proposed mechanism may initially cause disruption for existing RIAs and could further reduce their already limited numbers.

The new mechanism stands a chance of success if three conditions are met.

One, extensive publicity is given to this fee-collection mechanism, encouraging investors to engage only with regulated RIAs.

Two, sufficient time should be allowed to resolve the initial glitches, and implementation should occur in phases.

And three, certain regulations that inhibit the growth of the RIA profession are relaxed, allowing for a larger number of regulated RIAs.

The regulations that need to be relaxed include the need for RIAs to retake the qualifying exam every three years, compulsory corporatisation of the practice on reaching 150 clients, the requirement to hire associates with very high qualifications for client interface, and to take pre-approval for each marketing campaign.

Truth be told, having an adequate number of RIAs is a necessary part of any solution to counter finfluencers.

The regulator needs to perform a delicate balancing act: It must address the issue of missing RIAs while forcing finfluencers to exercise greater caution.

Hopefully, a comprehensive solution will emerge sooner rather than later.

Harsh Roongta heads Fee-Only Investment Advisors LLP, a Sebi-registered investment advisor

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025