We live in an era where the metric, money, used to measure value itself is not constant. What we do know is that central banks continue to drive their respective currencies down in order to inflate away the real value of their debt and stimulate business with low interest rates. So currency valuations drive asset valuations and the link with underlying cash flows is rather tenuous.

The dollar continues to drift downward. Correspondingly, the euro is trending upwards as the EU economies mend quietly beyond the headlines. The EU equity markets are into a phenomenal bull run. There will be corrections in due course but for now the bulls is in full command. Politics bogs down the US markets where the market hangs on the edge of a cliff. For the nonce, the markets have corrected but show no signs of reversal or panic. On the charts the bull run in US markets is intact.

Commodities appear to have made up their mind to test the lows made in May 2012. That means CRB's CCI is headed towards 500. No commodity is an exception. Gold for once is acting like any other commodity and may well offer a buying opportunity that comes along once in three or four years. But investors should be patient. The bottom in commodities could also drag down other risky assets.

Crude is headed for a retest of $78. That has huge implications for India in terms of basic viability, level of subsidies and cost structure of businesses. Crude could stay down for a while. On the other hand, if and when the world markets correct, India will feel the chill.

Private banks in India have had a phenomenal bull run that could see a correction. So there is good news for India in the commodity and currency markets, assuming the RBI does not go back to its old habit of exporting away jobs to appease those who have one.

But until a decisive break above 5950 is printed on the charts [a nick with less than 3 per cent and no confirmation will not do], investors in India shouldn't be chasing stocks. Buying blue chips, especially those already in a correction, and there are many, would however be okay.

Happy investing.

Gold:Gold closed the week just a notch below its 200 DMA at $1660.10 after making a low of $1636. With this close, gold has decisively broken its 200 DMA and confirmed it is traversing a wave 3 down from the top of $1798 on October 5.

Gold:Gold closed the week just a notch below its 200 DMA at $1660.10 after making a low of $1636. With this close, gold has decisively broken its 200 DMA and confirmed it is traversing a wave 3 down from the top of $1798 on October 5.

Unless gold pulls back over its 200 DMA immediately [an unlikely event], the unfolding wave 3 would take the metal to a retest of $1525 eventually some time in April next year.

Meanwhile, over the next few weeks, gold could slip well below $1635 and drift lower towards $1525 region over time.

Silver:The daily Silver chart shows the extent of breakdown in price that has occurred in metal prices. [The Gold chart was weekly in contrast to show the wave structure more clearly.] Silver too is the grip of wave 3 down with a target of $26 eventually.

Silver:The daily Silver chart shows the extent of breakdown in price that has occurred in metal prices. [The Gold chart was weekly in contrast to show the wave structure more clearly.] Silver too is the grip of wave 3 down with a target of $26 eventually.

Silver closed the week at $30.20, after making a low of $29.6350. Being relatively weaker than gold the pullback fell well short of its 200 DMA at $31.70.

Over the ensuing week Silver could try to pull back towards $31.50. However, barring such reactive moves, the trend appears firmly down and the metal will try and drift lower towards the $26 region.

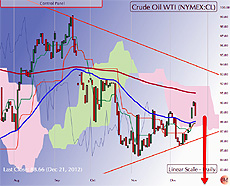

WTI Crude: WTI Crude has been trying to pull back to its 200 DMA since the low of $84 on November 7. The up-move from there was clearly reactive in nature and crude as turned down from first resistance at 90.30, well short of the 200 DMA mark. That betrays price weakness.

WTI Crude: WTI Crude has been trying to pull back to its 200 DMA since the low of $84 on November 7. The up-move from there was clearly reactive in nature and crude as turned down from first resistance at 90.30, well short of the 200 DMA mark. That betrays price weakness.

Crude closed the week at 88.60. From there the first support lies at $84, followed by the floor at $77.30. On a break of 84, crude could head swiftly towards the $78 region.

Going by the wave structure, the floor at $78 may not hold. However there is time for that denouement.

US Dollar: The US dollar has been in a fairly orderly correction from its top of 84.24 on July 24. It closed the week at 79.71 after making a low 79.31.

US Dollar: The US dollar has been in a fairly orderly correction from its top of 84.24 on July 24. It closed the week at 79.71 after making a low 79.31.

The US dollar is clearly in wave C of and A-B-C corrective pattern from its recent top in July. From current levels, first support lies at 78.50. We will know if the correction will go deeper than that by the markets reaction to price at that point. However, given that wave C can extend, one should not lose sight of the deeper floor at 76.50.

Dollar looks pretty bearish from hereon.

EUR/USD: The Euro closed the week at 1.3180 a nick above its breakout point at 1.3120 after making a high of 1.33080. The pullback to retest the breakout from the topside is constructive price action. The Euro remains firmly in an uptrend.

EUR/USD: The Euro closed the week at 1.3180 a nick above its breakout point at 1.3120 after making a high of 1.33080. The pullback to retest the breakout from the topside is constructive price action. The Euro remains firmly in an uptrend.

The next overhead resistance for the Euro lies at 1.3400 followed by a higher resistance at 1.3500.

Over the next few weeks Euro will probably move towards 1.34 level. Expect an orderly move up marked by the usual short corrections.

$-INR: $ closed the weak at 55.06. As expected, the $ continued to drift upwards towards the major overhead resistance of 55.50. That continues to be the target for the current up move and should achieved over the next two weeks.

$-INR: $ closed the weak at 55.06. As expected, the $ continued to drift upwards towards the major overhead resistance of 55.50. That continues to be the target for the current up move and should achieved over the next two weeks.

What the $ does at INR 55.50 is critical. A lot will hinge on the market's reaction to price in that region. I continue to favor my old wave count that puts the $ in an up move to eventually retest the previous top of 57.30.

However, the hurdle at INR 55.50 is very strong and a downturn in the $ from there will completely alter my favored wave count.

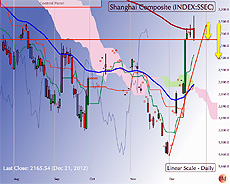

Shanghai Composite: As expected, Shanghai [SSEC] made a bid for its 200 DMA and nicked it repeatedly without closing above it. The SSEC closed the week 2153, a nick below its 200 DMA.

Shanghai Composite: As expected, Shanghai [SSEC] made a bid for its 200 DMA and nicked it repeatedly without closing above it. The SSEC closed the week 2153, a nick below its 200 DMA.

For the bullish case to hold, SSEC needs to pull down in an orderly fashion 2140 or even 2130 to establish the new floor and then take out the 200 DMA. The Index's rise has been fast and furious from the low of 1949. So taking a few days of consolidation before a decisive break over the 200 DMA is entirely in order.

The bullish case falls to pieces if the 200 DMA is not held at the next break. There is still some time for a bottom formation within the existing wave structure. So failure to take the 200 DMA is still possible which in turn implies a retest of 1949.

S&P 500: SPX closed the week at 1430.15 almost exactly at the support but after making a low of 1422.58.

S&P 500: SPX closed the week at 1430.15 almost exactly at the support but after making a low of 1422.58.

A break above 1430 called for retest of the same level from the topside and that's exactly what the SPX has done. There is no breakdown in the wave structure and SPX remains bullish with the next target 1465. Stop loss should be at 1400/1405.

NIFTY: Nifty has been consolidating just below 5950 within the parameters set by the yellow box shown above. It closed the week at 58.47.50.

Will it bust the 5950 overhead ceiling or 5800 floor first is the million-dollar question. So far the correction from the 5950 high point has been constructive and orderly. The range has been contained between 5800 and 5950. The index is on target to retest 5800 over the next week. Most likely the floor will hold and the index will reverse from there to retest the overhead ceiling of 5950.

A violation of 5800 will negate this analysis. Keep stop loss orders just below 5800.

A violation of 5800 will negate this analysis. Keep stop loss orders just below 5800.

It is hard at this point to predict if 5950 will be taken out, nicked, or nicked and reversed from there. In many ways the present A-B-C followed by A-B-C up is a way of gauging where the market should go. Only price-volume action will give us clues to the eventual break out. So watch action carefully. There is room for caution as we are in a very mature bull market in the US and a sudden slide there will have ramifications for Nifty.

NB: These notes are just personal musings on the world market trends as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions.

Sonali Ranade is a trader in the international markets

© 2025

© 2025