In a part one of a series, Rohit Lamba, Sutirtha Roy and Arvind Subramanian explain why the level of credit in India is consistently lower than the average value of low- and middle-income countries,

There are many problems with India's credit and banking system, but it turns out that size is not one of them.

There are many problems with India's credit and banking system, but it turns out that size is not one of them.

Using existing domestic and international data along five dimensions, we argue that Indian credit and banking are neither too big nor too small -- Goldilocks would think it just right.

However, there may well be a problem of composition and competition especially with respect to private banks.

First, is India credit-addled? We analyse the evolution of credit-gross domestic product (-GDP) ratios in India and select other countries over time (figure 1).

The graph uses the World Bank's domestic credit to private sector, defined as 'financial resources provided to the private sector by financial corporations, such as through loans, purchases of non-equity securities, and trade credits and other accounts receivable, that establish a claim for repayment'.

The level of credit in India is consistently lower than the average value of low- and middle-income countries.

Moreover, the rate of increase of India's credit-GDP ratio is also in line with emerging market standards.

No, India is definitely not drowning in excessive credit.

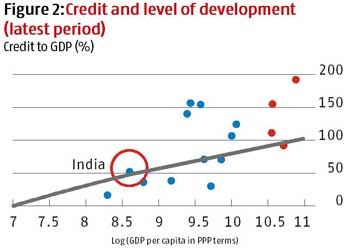

Second, does India's credit match its level of development?

Second, does India's credit match its level of development?

We undertake a cross-country comparison plotting the ratio of credit to GDP against a country's level of development using the log of per capita GDP in purchasing power parity terms as a proxy (figure 2).

As countries become richer, they tend to see a rise in credit, which is reflected in the upward sloping trend line (note that the trend line is drawn for the entire set of 176 countries in the World Bank data set).

India is close to this trend line; for its level of development, credit levels are reasonable.

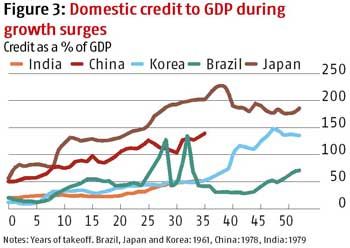

Third, has the Indian banking and financial system been especially irresponsible?

Was it imprudent during and after the recent growth phase?

Was it imprudent during and after the recent growth phase?

We plot the evolution of credit-GDP in 'take-off time' (figure 3).

For each country, the starting point is when its growth started to accelerate.

The graph shows that India's credit bubble was not worse than the experience of countries during comparable times. Countries such as Japan and China saw faster credit growth during 'boom years'.

In this last phase of rapid credit growth during the 2000s, the Indian financial system was no more unduly irresponsible than those around the world.

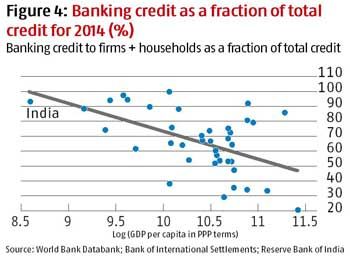

Fourth, is India over-banked? In figure 4, we plot the share of banking in total credit in the economy against a country's level of development.

Fourth, is India over-banked? In figure 4, we plot the share of banking in total credit in the economy against a country's level of development.

As defined by the Bank for International Settlements, this consists of 'credit to non-financial corporations (both private-owned and public-owned), households and non-profit institutions serving households as defined in the System of National Accounts 2008'.

The trend line is downward sloping, which indicates that banking should shrink in size over the course of development relative to other sources of funding (such as capital markets).

Again, India is close to the trend line; for its level of development, it is neither over-banked nor under-capitalised by markets.

Of course, this is no guarantee that the required shift towards greater reliance on capital markets, especially via corporate bonds, will take place.

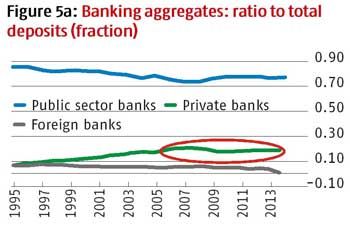

Finally, if size is not a problem, is there a lack of sufficient competition between banks? We explore the rise of private banks in India.

Finally, if size is not a problem, is there a lack of sufficient competition between banks? We explore the rise of private banks in India.

Private banks started cementing their presence in the mid-1990s.

It is important to note that India's approach was not to privatise public sector banks, rather it was based on encouraging entry of private banks.

This strategy worked reasonably well in the telecommunication and civil aviation sectors, but the results in banking have been mixed.

Figures 5A and 5B show that India saw a slow but steady rise in the share of private sector banks until 2007, both in terms of deposit and lending indicators.

Thereafter, the process slowed considerably, and in the aftermath of the Lehman crisis, there was a flight to safety toward the public sector banks.

.jpg?w=670&h=900) The share of the private sector in overall banking aggregates barely increased at a time when the country witnessed its most rapid (and arguably private-sector-driven) growth -- a paradox of recent banking history. Even allowing for the irrational exuberance of public sector banks that financed this growth phase, the reticence of the private sector was striking.

The share of the private sector in overall banking aggregates barely increased at a time when the country witnessed its most rapid (and arguably private-sector-driven) growth -- a paradox of recent banking history. Even allowing for the irrational exuberance of public sector banks that financed this growth phase, the reticence of the private sector was striking.

One of the key messages of this analysis is that size of banking and credit are not the problem in India.

The real problems lie elsewhere: in policies that create financial repression, in ownership structure and in making exit difficult.

While size of credit and banking in India is captured by the Goldilocks metaphor, its composition and the policies therein may not.

Rohit Lamba is a post-doctoral fellow at Cambridge-INET, Faculty of Economics, University of Cambridge; Sutirtha Roy is a Fulbright Scholar at the John Hopkins University; Arvind Subramanian is the Chief Economic Advisor, Ministry of Finance

Part II: Experts list few things that will be different in FY16

Part III: India must learn from China to revive its ailing railways

© 2025

© 2025