|

|

| Help | |

| You are here: Rediff Home » India » Business » Budget 2008-09 » Pix |

|

The working class people will stand to benefit by up to Rs 44,000 a year in income tax following the changes proposed by the finance minister in the Union Budget for 2008-09, which also provides for a minimum benefit of Rs 4,000.

The working class people will stand to benefit by up to Rs 44,000 a year in income tax following the changes proposed by the finance minister in the Union Budget for 2008-09, which also provides for a minimum benefit of Rs 4,000.

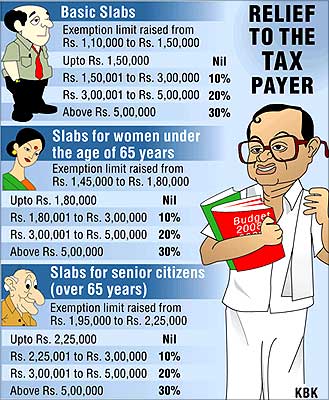

While raising the income tax exemption limit to Rs 150,000 from Rs 110,000, Finance Minister P Chidamabaram also provided for lower tax rates for income up to Rs 50,000.

Earlier, the minimum exemption limit stood at Rs 110,000 for all classes of individuals. For women, the exemption limit has been raised to Rs 180,000 from Rs 145,000 previously, while for senior citizens it has been hiked from Rs 195,000 to Rs 225,000.

For an income of Rs 10 lakh a year, an individual would have to pay a tax of Rs 205,000, as against Rs 249,000 under the previous tax structure. For women assessees, a similar income would attract a tax of Rs 202,000 under the new regime, down from Rs 245,500 previously, while the tax for senior citizens would drop to Rs 197,500 from Rs 236,000 earlier.

The minimum benefit to a person with an annual income of Rs 150,000 at the threshold will be around Rs 4,000, Finance Minister P Chidambaram said, while presenting the Budget 2008-09 in Lok Sabha.

According to the proposals, income between Rs 150,000 and Rs 3 lakh will be taxed at 10 per cent, income from Rs 3 lakh to Rs 5 lakh will be taxed at 20 per cent, while income from Rs 5 lakh to Rs 10 lakh, tax would be at 30 per cent.

The old tax slabs were: |

Up to Rs 1,10,000 -- Nil |

Rs 1,10,001 -- Rs 1,50,000 -- 10% |

Rs 1,50,001 -- Rs 2,50,000 -- 20% |

Above Rs. 2,50,000 -- 30% |

Based on this structure, an individual having an income of Rs 150,000 would pay no tax. Those earning between Rs 150,000 and Rs 3 lakh will pay Rs 15,000 as tax. Rs 40,000 tax will be for those who earn between Rs 3 lakh and Rs 5 lakh, and Rs 150,000 will be tax between Rs 5 lakh and Rs 10 lakh. Previously, the tax amounts for these four slabs were Rs 4,000, Rs 35,000, Rs 60,000 and Rs 150,000 respectively.

The new tax slabs are: |

Up to Rs 1,50,000 - Nil |

Rs 1,50,001 -- Rs 3,00,000 -- 10% |

Rs 3,00,001 -- Rs 5,00,000 -- 20% |

Above Rs 5,00,000 -- 30% |

The tax benefit when compared to the previous regime would be higher for male assessees, as compared to women and senior citizens.

While men with an annual income of Rs 10 lakh stand to gain Rs 44,000, the same for women and senior citizens with similar income is Rs 43,500 and Rs 38,500, respectively.

In case of women assessees with annual income of Rs 10 lakh, the tax amounts for income slab of up to Rs 180,000 would be nil, Rs 12,000 between Rs 180,000 and Rs 300,000; Rs 40,000 between Rs 3 lakh and Rs 5 lakh; and Rs 150,000 between Rs 5 lakh and Rs 10 lakh. Earlier, the tax rates for these slabs stood at Rs 6,500, Rs 29,000, Rs 60,000 and Rs 150,000, respectively.

Income | Old Tax | New Tax |

Rs 2,50,000 (14,000) | Rs 24,000 | Rs 10,000 |

Rs 5,00,000 (45,000) | Rs 1,00,000 | Rs 55,000 |

Rs 7,50,000 (44,000) | Rs 1,74,000 | Rs 1,30,000 |

Rs 10,00,000 (45,000) | Rs 2,49,000 | Rs 2,05,000 |

For senior citizens with similar annual income, the tax for income up to Rs 225,000 would be nil (Rs 6,000 previously), Rs 7,500 (down from Rs 20,000) for Rs 225,000- Rs 3 lakh, Rs 40,000 (down from Rs 60,000) for income between Rs 3 lakh and Rs 5 lakh and Rs 150,000 for income between Rs 5 lakh and Rs 10 lakh (unchanged).

However, those with income in excess of Rs 10 lakh would continue to attract an additional surchange of 10 per cent.

Chidambaram also introduced an additional deduction of Rs 15,000 for taxpayers towards payment of medical insurance for parents. This would be in addition to the Rs 1 lakh limit for savings under Section 80C of the Income Tax Act.

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |