Home > Business > Interviews

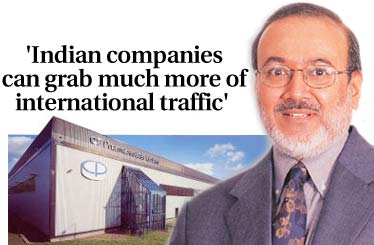

The Rediff Interview/Wockhardt Chairman Habil Khorakiwala

August 07, 2003

On July 8, Habil Khorakiwala, chairman, Wockhardt Limited, announced the largest overseas acquisition by an Indian pharmaceutical company. Wockhardt bought the UK-based CP Pharmaceuticals for £10.85 million.

Under Khorakiwala's leadership, Wockhardt is emerging as the aggressive new star in the Indian pharmaceutical industry.

On Monday, August 4, Wockhardt announced the launch of its recombinant Human Insulin, Wosulin, making the company the first in Asia to develop and manufacture its own recombinant Human Insulin. Wockhardt is the fourth company in the world -- the first outside US and Europe -- to develop, manufacture and market this life-saving drug.

In an interview with Special Correspondent Priya Ganapati, Khorakiwala discusses the importance of Wockhardt's latest acquisition, the importance of the international markets, the company's focus locally and his assessment of the industry post 2005, when the product patent regime will kick in.

How did the decision to buy CP Pharmaceuticals come about?

The acquisition took over a year. We didn't go to CP Pharmaceuticals. It came to us through a merchant banker. The original expectation of the company (CP Pharmaceuticals) was very large. There were other problems too.

The company was also exploring internal management buyout options. When we looked at acquiring CP Pharma we treated it like a normal auction. But we found that part of the management was also trying to buy the company. So, every time we bid they would know how about it and in turn they would know what price to quote themselves. It took us time to get around that. So we finally told the CP management about the valuation we thought was right and asked them to quote a number they would like. They took three months to get back to us and then a team from here went to the UK and negotiations began. Finally, we closed the deal on the same day that we announced it.

How does CP Pharmaceuticals fit into your growth strategy?

CP Pharma strategically fits in very well and is a good value proposition. With the acquisition, we will have a strong presence in the UK. CP Pharma is a generic pharmaceutical company with a strong injectibles facility, which is not very common even among US and UK companies. With this acquisition, Wockhardt's sales will exceed £50 million and we will be among the top 10 generic drug companies in the UK. CP also has a large portfolio of products -- over 200 of them -- for authorization. It gives us good leverage as we can look at introducing some of these in the UK and even globally.

We also got access to customers of CP Pharma. They supply to the NHS (Britain's National Health Service), pharmacies and wholesalers. Forty-five percent of CP's revenues comes from injectibles, which is a good segment to be in as there are less players and so it is more profitable compared to tablets and capsules.

But for us, more importantly, we have a range of biotech products that we intend to get in the US and UK in the next three years. With hospitals, their bio-tech supply is always injectibles. That's where CP Pharma fits in. So that is a medium term approach that we have taken.

You have been very aggressive on acquisitions. What have these acquisitions taught you?

We have had four acquisitions so far. Two in India, two in the UK. I think our core strength is in identifying the right target for acquisition and then creating good value from it for Wockhardt. We have a whole process now in place within the company to handle this. We have 10 people who know what to do when we acquire a company. There is a three phase strategy we have put in place.

First, to understand the new organization quickly, then look at how we can leverage it and use that to plan for growth. We look at what are the cost saving options available to us like in case of the purchases you do, the organization structure and carry out other unifying activities.

Wallis was a loss making company when we acquired them in 1998. But we turned it around and in a way it laid the groundwork for us when we looked at CP as a target. With Merind which we acquired in India we got the experience of acquiring a larger company. In that deal, we had help from McKinsey. So we learned how they do it and the processes they have in place. We put those learnings to use this time around.

Ten years ago you were a company whose revenues almost completely came from India. Now you are increasingly focusing on the international market. So what place does the domestic market retain in your vision?

Ten years ago, we were just a Rs 90 crore company. Then the domestic market contributed to 98 percent of our revenues. Today we are a Rs 1,100 crore company. Now domestic market is 47 percent of our revenues. So you can see that the domestic business has also grown significantly. It is not that we have taken our eyes away from it.

We have a large field force here. We are a broad-based pharmaceutical company with interests in nutrition and biotech. In biotech, specifically, the domestic market is the starting point for us. We first introduce our products here and then take them to other countries and finally go to the US and UK with it. Our manufacturing base is in India and our research base is 100 percent here.

Domestically, we are strongly focused on the diabetes segment. We are already among the top 11 players in the diabetics segment and in the next three years we hope to be among the top 3. The other focus areas for us is pain management and nutrition. We would like to remain in 4 or 5 therapeutic areas only.

Why has the international market become so important for most Indian pharma companies? Is this due to the threat from multinationals in the domestic market with patent laws set to change in January 2005?

The reality is that in value terms, India contributes just 2 percent of global business. So there are larger opportunities available outside and everyone would like to capture this 98 percent.

When liberalization came in the early nineties, pharmaceuticals along with IT was one of the few industries who saw the global opportunities rather quickly and took a long term view of it.

We have invested significantly in research and took this position to go outside India a few years ago. What you are seeing is you not the results of the last one year but efforts of the last 8 to 10 years.

But few have the capacity and the capability to succeed there. It is highly competitive and requires a deep understanding of the patents, IPR laws. You also have to get approvals from various international bodies like the FDA or MCA. So you have to create that level of competence.

Indian drug companies are often accused on not spending enough on R&D. What percentage of your revenues do you spend on R&D? What is the focus area of your R&D activity?

We spend 7 percent of our sales on R&D. Obviously, we are not a research-based pharmaceutical company which spends about 15 to 18 percent of its sales on research. But then the amount we spend on research is not the only criteria to judge us by.

There are three areas which we focus on in our R&D. First is on chemical technology. We file ANDAs (abbreviated new drug applications) in the US and UK and develop novel drug delivery systems. The second is biotechnology. We started on it more than 10 years ago and we have introduced two products already, a recombinant hepatitis B vaccine, BIOVAC-B & Wepox, Erythropoietin (which is effective in treating severe anaemia caused by kidney failure and cancer).

There is also a new drug discovery. We have a drug WCK 771 which is completing phase 1 human clinical trials and by the end of the year will go into phase 2. It is a life saving drug for infections and sepsis. WCK-1152 which is a broad spectrum oral new chemical entity is effective in treatment of respiratory infections. We hope to file an Investigational New Drug application within the next few months for it.

When India introduces the product patent regime in two years, what kind of changes do you foresee in the industry? How is Wockhardt gearing up to survive in that scenario?

We have 81 patents filed internationally and in India. We are investing in R&D so the knowledge capital we have accumulated will pay us.

But let us accept the realities of patented products. In UK only 65 percent of prescriptions written out are patented, while in the US it is only 51 percent.

Post 2005, the use of off-patented drugs is not going to reduce. The newer drugs are also very expensive. So one wonders how many of them will be used in India.

So off-patented drug usage is not going to go down but the growth of the industry in value terms will be higher.

Will the prices of drugs rise post-2005 in India?

It will increase but the prices of current drugs will go unchanged. Only products patented after 1995 will be introduced in India at international prices, rather than the prices they are currently at in India.

In the post-2005 scenario, how do you think Indian pharmaceutical firms can counter the huge threat posed by MNCs?

We are opening up our borders by allowing the patent regime to come here. But at the same time, Indian companies are increasingly investing in research and looking at ways they can leverage their India advantage. One way of looking at things is that MNCs will take a little of the market share in India but Indian companies can grab much more of international traffic. It is a traffic that goes both ways.

Image: Dominic Xavier