| « Back to article | Print this article |

Why multi-currency cards are better than credit cards

Travellers, here are 8 solid reasons you should prefer to use a multi-currency card than a credit card when you travel abroad

In the times of instant cash and extensive travelling, multi-currency card has become a necessity. While travelling abroad, one of the biggest hassle faced by all the travellers is to get foreign exchange. Mostly, travellers run out of foreign currency and are often fazed by the changing rates of exchange so at such times multi-currency card can be the ticket.

Courtesy:

Why multi-currency cards are better than credit cards

What is a multi-currency card?

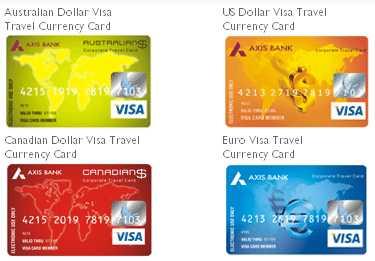

Multi-currency card is a card that works like plastic money, where travellers can make purchases with a quick swipe, just as they would with their credit card. This card can be used at ATMs and recognised VISA enabled points of sale.

It is prepaid in nature and can be loaded with dollars, Euros or pounds and can also be used in the local currency of any country visited by travellers.

Why multi-currency cards are better than credit cards

Who is it for?

Multi-currency travel cards are particularly suited for the corporate segment where employees are posted abroad or are travelling to multiple countries on a regular basis. So, is best suited for business travellers. Many private sector banks such as Axis Bank, ING Vysya and HDFC Bank have launched multi-currency card targetting the high-end business travellers.

Why multi-currency cards are better than credit card

Advantages of the multi-currency card

1. First and foremost, the multiple currency card provides the travellers the convenience of making monetary transactions in the currency with which they are most familiar. This makes the card very comprehensive for the travellers to make payment everywhere.

2. There are no surprises with the multi-currency card. What a cardholder pays for on their travels, is what is reflected in the card statement. Unlike credit cards, there is no transaction fee associated with any transfer, exchange, or purchase. In fact, the annual fee on most international credit cards is very high.

Why multi-currency cards are better than credit cards

3. With credit cards, the rate of exchange applied is the day's rate, which might not be favourable every time. With the multi-currency card, the rate of exchange is fixed the day travellers purchase the multi-currency card.

4. And the security of the cash is stepped up, because the card is protected by a secure PIN (Personal Identification Number) which prevents anyone else from using the card, even if it is lost or stolen. If cardholders misplace their cards, all they have to do is call the respective company's phone banking number for a replacement card to be issued within 48 hours.

Why multi-currency cards are better than credit cards

5. While Travellers' Cheques are accepted only at select locations for purchases or encashment, multi-currency cards are accepted everywhere. Cardholders can use the multi-currency card to withdraw cash in the local currency of the country they are visiting.

6. For retailers, it means an increase in sales, opening up markets where the dollar and the euro don't sway such as small towns and villages for local handicrafts. The retailer also enjoys the added benefit of customer loyalty and building relationships with repeat customers.

Why multi-currency cards are better than credit cards

7. Some multi-currency cards also offer great deals on air tickets, holiday packages and travel insurance (including lost card and lost or delayed baggage). This makes a multi-currency card a sweet proposition all round. The paperwork to buy a multi-currency card is minimum: prospective cardholder needs a copy of their air ticket, a valid passport, an A2 form, and their PAN card details.

8. Multi-currency cardholders also enjoy unsurpassed global acceptance and they can easily pay for hotels, airfare, train fare, car rental, dining, and entertainment and more anywhere in the world. So, no more hassles with finding money exchanges, cashing Travellers' Cheques or carrying wads of cash.