| « Back to article | Print this article |

Why you must invest in ELSS funds

Find out why equity linked savings scheme is the best investment option for tax savers, why it is a favourite of tax-savers, what factors you must to consider while investing in ELSS mutual funds and how to choose them.

The purpose of tax exemption under section 80C is to promote the habit of savings and long-term investment. However, we generally don't plan for the ideal investment avenue in advance and take last minute decisions, disregarding all the good advice we get about choosing investment products well.

With this article, we evaluate the ELSS mutual funds category, a Section 80C favourite, and discuss the best way to get the most out of your ELSS investments.

As per Section 80C of Income Tax Act, individuals are allowed to invest up to Rs 100,000 in tax saving instruments, which will be deductible from their gross total income.

Tax-saving mutual funds (or ELSS -- equity linked saving schemes as they are more popularly known), insurance plans, PPF, and NSCs are some of the avenues where an investor can invest and save tax.

When selecting a tax saving product, choose one that can help you meet your financial objectives and matches your saving patterns. Broadly, consider the following points:

1. Liquidity

Investment avenues available under section 80C carry lock in period ranging from three years to 15 years. So select a product which is in line with your investment horizon.

Click here for REdiff Realtime News on ELSS mutual funds

Disclaimer: This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients.

Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Why you must invest in ELSS funds

2. Risk & returns

There is always a tradeoff between risk and returns -- the higher the potential returns, the higher the risk. Select a product which is suitable to your risk appetite.

3. Inflation protection

Inflation eats into the value of your returns. Consider 'real returns' (returns minus inflation) when evaluating whether a particular product can help you meet your financial objectives.

4. Tax implication at redemption

Apart from the tax benefit under section 80C, tax implications on the returns are also an important point to consider while selecting a investment product. The interest earned on fixed deposits or NSC (National Saving Certificate) is taxable and hence that reduces returns on these products. Long-term returns on mutual funds (more than one year) are tax-free.

Why you must invest in ELSS funds

Investing in an ELSS fund

Equity linked saving schemes are equity-oriented mutual funds with tax benefits. They score over other tax saving investment products in some respects.

They have the lowest lock in period, of three 3 years, and being market linked have the potential to generate good returns over long term. Investors with moderate to high risk-appetite should seriously consider investing in these funds.

However, it is difficult to ignore the assured returns and capital protection aspect of other products like PPF, NSC and FDs.

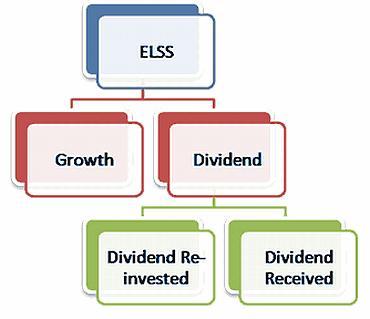

Dividends received from ELSS funds are also exempt from tax. However, when investing in ELSS funds, it is advisable to not go in for the dividend re-investment option, as each re-investment will be treated as a fresh investment and will lock in your re-invested money for another three years.

This loop makes it difficult to exit the fund completely at one point of time. It is therefore wise to select either the growth or dividend payout option in these funds.

The same logic applies if you decide to go in for an SIP mode of investing in ELSS funds. While SIPs are very desirable in terms of allowing disciplined and small investments, each SIP installment is locked in for three years from investment, creating a similar loop.

Lastly, this might be the last year that allows you to take advantage of the tax savings offered by ELSS funds.

If the parliament passes the Direct Tax Code, ELSS funds along with many other investment products may no longer attract tax exemption after April 2012. Any fresh investment in an ELSS fund after April 2012 will be treated as an equity mutual fund investment.

Why you must invest in ELSS funds

Selecting an ELSS mutual fund

All together 48 equity linked saving schemes are available in the market. Of these, 37 funds are open-ended funds, of which 30 funds have a track record of three-years or more. Only 14 funds out of 30 manage to beat the category average in the three-year period.

So selecting a right fund is more important, as the money is going to be locked in for three years.

For selecting an ELSS fund, one can evaluate the following parameters:

- Historical track record of the fund: The historical performance of the fund can be evaluated across various time periods to see how the fund has performed compared to its benchmark or other comparable indices and the peers. That apart, fund performance in falling markets can also be looked at to get better perspective about the fund.

- Consistency of the fund:Consistent performance is an important point to consider when selecting a fund. Some funds give phenomenal performance in one time period and are not able to continue that in future. So prefer to choose a fund that has a history of consistent performance.

- Track record of the fund manager: The fund manager is the main driver behind the investment strategies of the fund. Historical performance of the Fund Manager can be reviewed by evaluating the performance of the funds managed by him.

Why you must invest in ELSS funds

Equity linked saving schemes have a good track record, with performance similar to diversified funds. The category average returns on 3-year, 5-year, 7-year and 10-year are 22.23%, 5.20%, 15.41% and 22.17% CAGR respectively. Even the returns for SIPs (systematic investment plans) are also good.

However, market slumps in recent times have hit the performances of equity oriented funds including ELSS.

Conclusion

Negative news is flowing across the globe every day. Indian economy is slowing down. The profit margins of the Indian corporate sector are under immense pressure due to high borrowing and raw material cost. There has been a downgrade in third quarter GDP and the Indian rupee has depreciated by close to 16% in few months and it is the worst performing currency in Asia.

Equity markets (Sensex) have given negative returns of close to 21% year to date. European debt crisis is spreading to major European economies. US economy is also in bad shape. All this has led to a high level of pessimism in the market.

However, the equity market has already discounted the negative news.

We believe that there may be headwinds on short term, but long term prospects for equity markets are promising and this could be a good time for investors to get equity exposure for long term, via products like ELSS funds.

Here's list of recommended ELSS funds for 2012