Investmentyogi

The rising inflation in the last few months has been a concern for most of us. Sparing no segments of the society, inflation has had its impact on our spending, savings and investments. InvestmentYogi gives you a peek into this concept of inflation, and its effect on your daily living.

Let us take the case of, Ramanand Sharma, a retired central government employee, who lives on a monthly pension along with his wife. With rising costs of day to day commodities such as vegetables, fruits, pulses, rice etc., retirees like Ramanand, with a fixed source of income, feel the pinch of inflation, as it eats away the value of their income everyday. He just about makes both his ends meet.

So what is inflation?

Technically speaking, inflation is the general rise in price levels of goods and services in the economy. In simple words, it is a phenomenon that reduces the worth of your money.

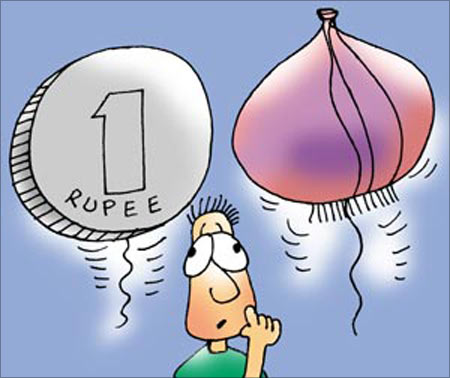

Say, a commodity that would have cost you Rs 100 five years back may now probably cost you Rs 500. This is the effect of inflation. It reduces the purchasing power of your money. With a rising inflation, what a rupee can get you today may get you lesser in the future.

How is inflation measured?

Inflation is measured regularly using the wholesale price index (WPI).

The WPI takes the wholesale prices of select 435 commodities. These selected commodities represent various strata of the economy and give a comprehensive WPI value for the economy for a particular period.

So, if the inflation rate is quoted at 10%, this means that the general level of prices of goods and services has increased by 10% over the previous period.

Thus, purchasing the same amount of goods would now cost you 10% more.

What causes inflation?

- Loose monetary policy of the government

- Increases in production costs

- Tax rises

- Decline in exchange rates

- Decreases in the availability of limited resources such as food or oil

- War or other events causing instability in the economy

Current figures

For the month ending January 2011 food inflation stood at 15.56% compared to 13.55% in December 2010. This high inflationary rate could be attributed primarily to rising vegetable prices.

Onions in particular face exorbitant costs. The primary articles inflation, stood at 17.03%. There has been a sharp rise in prices of essential commodities such as fruits, vegetables, milk, eggs, meat and fish, which carry 10% weightage on the WPI.

What should you do as an investor to beat inflation?

- Inflation sure does bring down the value of your hard earned money. In an inflationary scenario, how do you protect yourself? Here are some quick tips to handle the impact.

Avoid keeping your money stagnant. Invest your money, to increase its worth. - Try choosing investments which earn you a rate of return, higher that the inflation rate, to avoid negative real returns.

- Inflation influences market sentiments. So if you are an equity investor, stay cautious, and keep a watch for negative market reactions.

- With rising inflation, debt instruments may not be an attractive investment option. The real interest rate i.e. interest rate after adjusting inflation may be low or negative. Modify your investment strategy in order to cope with inflation. Commodities such as gold and stocks are considered a good hedge against inflation.

- Wait for interest rates to go up before locking your money into long term fixed deposits.

Can inflation be controlled?

Inflation affects all of us in some way or the other. What is required is a range of policies from the government to keep inflation at bay.

- Appropriate measures to reduce inflation are taken by the Reserve Bank of India and the monetary authorities regularly. Some of the measures are as follows.

- Reducing the central bank interest rates and increasing bank interest rates.

- Regulating fixed exchange rates of the domestic currency.

- Regulatory control on process and wages.

- By tightening the monetary policy, the rising inflation in the economy could be partially controlled.

However there are other factors like supply chain of perishable commodities like food grains which need to be streamlined for an effective solution to this problem.

Comment

article