As we succeed in life and achieve new milestones, we reward ourselves with better things. Buying a car is one such thing, and most of us look forward to it. However, it is not essential that you must have the entire amount to fund the car in your pocket. Based on certain conditions, banks in India are more than willing to extend a car loan to finance the major share of the car's cost. Getting your dream car is now very easy with a good car loan.

A secured loan

Beginning with the basics, a car loan by nature is a secured loan.

In simple words, the vehicle or car you are buying will be the collateral or security for your loan. Until you complete the loan repayments, your lender will have complete authority over the purchased car. So to avoid any inconvenience, it is essential that you follow the repayment schedule strictly.

Courtesy:

Owning your dream car is now very easy!

Image: Renault DusterThe margin money or down payment

Whenever you go out for a car loan, there is some amount (usually 15 per cent to 30 per cent depending on the car model and bank), which has to be paid up front to the car loan company. This amount is called the margin money or the down payment.

So, if you want to buy a car whose cost is Rs 5,00,000 the bank will ask you to deposit anywhere between Rs 75,000 to Rs 150,000 as the margin money or down payment.

Owning your dream car is now very easy!

Image: Nissan MicraCar loan on ex-showroom or on road prices?

Some banks like State Bank of India provides car loans at on road prices. This means that the loan amount sanctioned for your cars will contain the ex-showroom price of the car plus the insurance, the road tax and any other amount that is required. The car loan amount in case of on road price will be significantly greater than the ex-showroom price of the car.

Let us take an example.

Suppose you want to buy a car which has an ex-showroom price of Rs 5,00,000. To insure this vehicle you have to pay Rs 18,000, and for the road tax you have to pay Rs 4,000. Thus the total cost of ownership of this vehicle is ex-showroom price plus insurance plus road tax, that is Rs 5,22,000.

So, if you get a loan from bank which gives you car loan on ex-showroom prices you will have to pay the insurance and road tax from your pocket. If you get an on road price car loan you won't have to pay this amount, instead it will be clubbed in your car loan.

After deducting the down payment from your car loan, the bank will finance the remaining portion of your car loan. Depending on the rate of interest charged on your car loan, and the tenure of your car loan, the banks will decide an EMI (equated monthly installment) for you to repay for the entire duration of the loan.

Owning your dream car is now very easy!

Image: Maruti Suzuki SwiftProcessing fees and other charges

There are certain fees to be paid to the bank while getting the car loans. Banks charge processing fees for car loans, which is generally 1 per cent to 4 per cent of the loan amount. This fees varies from bank to bank. In addition to this fees, banks also charge stamp duties, origination fees and administrative fees. These factors increase the cost of the car loan.

There are certain things to keep in mind when the loan is sanctioned and the repayment process begins. Whenever you miss on a repayment, the bank slaps a late payment fee/penalty, if your check bounces the bank will penalise you with check bounce charges, similarly if you want to swap a check, check swap charges will be levied by the bank.

In addition to these charges banks will demand money to give you duplicate documents and statements. In a scenario where the banks have to repossess the vehicle due to a severe repayment defaults, the bank will levy legal and repossession fees on the borrower.

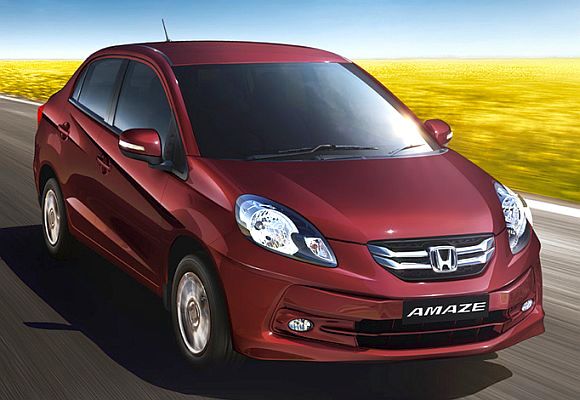

Owning your dream car is now very easy!

Image: Honda AmazeConclusion

A car loan provides the much needed funds to own that dream car. If the borrower follows the repayment schedule like a religion and gets into the good books of bank, he builds up his credit history -- banks will not hesitate to offer him better rates on all future loans.

But if s/he is irregular in repaying the car loan, the interest rates can creep up and this coupled with late payment penalties will make things increasingly difficult.

Comment

article