| « Back to article | Print this article |

Nine ways to avoid credit card debt

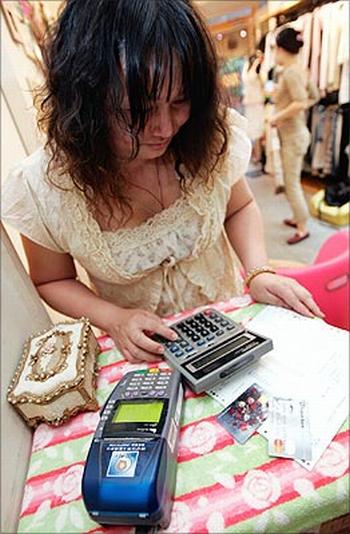

Credit cards have turned into an integral part of modern living as they facilitate purchases and bill payments without carrying cash. They make life easy and help maintain a record of our expenses and help us dispute charges for undelivered and defective things.

In addition they enable us to earn reward points. However credit cards could make you overspend and get into debt. There are nine ways that could help you to be credit card smart.

One can be very smart in playing a game only when s/he knows the rules of the game very well and follows the same diligently. Similarly to be smart with your credit card you need to know the rules of the credit card usage. Let me unbundle the same for you.

NEXT: Nine ways to avoid credit card debt

The author is Ramalingam K, an MBA (Finance) and Certified Financial Planner. He is the Founder and Director of Holistic Investment Planners (www.holisticinvestment.in) a firm that offers Financial Planning and Wealth Management. He can be reached at ramalingam@holisticinvestment.in.

Nine ways to avoid credit card debt

1. Do not have too many credit cards

It is true that credit cards definitely help in emergencies and facilitate payments. But having too many credit cards could tempt you to overspend and get into credit card debt that becomes difficult to recover from.

In addition it is best to avail of reward points on one credit card, so that you could encash the points quickly.

2. Cultivate and maintain an emergency fund

Most of us believe that credit cards can definitely help in medical and unexpected emergencies, but it is unwise to consider it as a general rule.

A much better alternative would be to set aside money regularly as an emergency fund for such unexpected emergencies. This will prevent you from getting into credit card debt.

Nine ways to avoid credit card debt

3. Repayment capacity should determine credit card spending

It is true that using credit cards in place of cash helps. But this applies to purchases that you can afford only and, more importantly, repay immediately. Spending more than what you can repay is highly undesirable and could get you into credit card debt.

4. Avoid cash advance withdrawals

It is best to live within your means and avoid making cash advance withdrawals even in emergencies. This is the worst thing you can do with a credit card. Having a smart spending plan will help you in not falling this trap.

Nine ways to avoid credit card debt

5. Avoid bank transfers without valid reasons

Being credit card smart requires avoiding making balance transfers from one credit card to the other. This will avoid payment of balance transfer fees and getting into further credit card debt that could turn vicious.

However transfer of bank transfers for taking advantage of lower interest rates could prove fruitful.

6. Make full payments in time

Being credit card smart requires you arranging for payment within a month or your next billing date. Delay in repayment and minimum payment could affect your credit standing and make you also liable to pay high rates of interest that you could not afford.

Not carrying any balance forward would relieve you of stress of getting into credit card debt.

Nine ways to avoid credit card debt

7. Understand the credit card agreement fully

Being credit card smart requires understanding fully the agreement and other terms and conditions for use of the credit card.

This includes understanding levy of transaction fees, interest rates, and when increased rates for credit would be charged. This would help take precautions to avoid getting into increased debt on credit cards.

8. Recognise the signs of credit card debt

Many consider the credit card to be a boon and fail to realise that they are getting into credit card debt. It is best to understand and recognise signs like skipping a credit bill to pay another, avoiding credit card payment statements, and charging more than your repayment capacity by purchasing luxuries.

Failing to cultivate and maintain an emergency fund could also be a cause. Once you recognise these signs you can turn credit card smart.

9. Never lend your credit card

Being credit smart requires not trusting others with your credit card even if they promise to pay back in time. It is unwise because you will be responsible for the debt and consequent charges.